EUR/USD Week Ahead: European Statistics Vs Chinese Characteristics

- EUR/USD support near 200-day average at 1.0796 on charts

- Yuan losses & index management potentially offering support

- EUR losses limited until RMB, KRW, MYR et al stage recovery

- Setback could coincide with USD, GBP, CHF, CAD, MXN loss

- Losses on dour European data could be shallow & short-lived

Image © European Union - European Parliament, Reproduced Under CC Licensing.

The Euro to Dollar exchange rate found support above its July lows early in the new week but the interplay between European economic data and China’s currency policy could be as important an influence on EUR/USD as the words of the world’s central bankers spoken from Jackson Hole, Wyoming over the coming days.

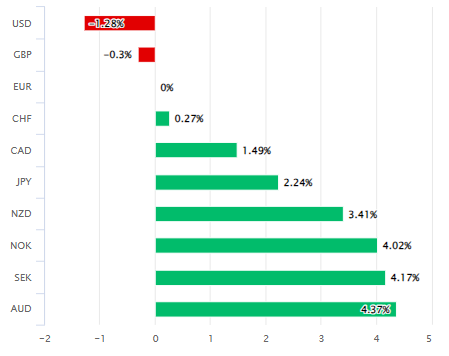

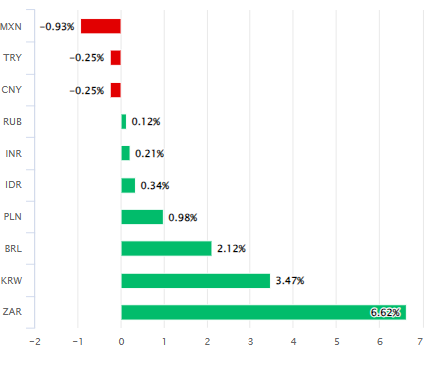

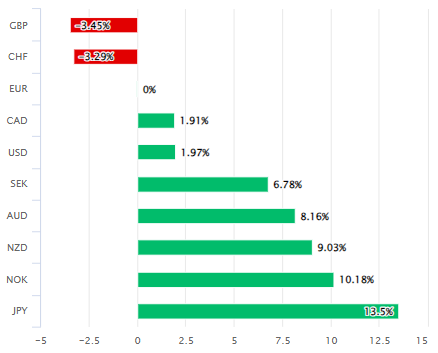

Europe’s single currency was the third best performer in the G10 basket of major currencies for the week to Tuesday while featuring prominently in the upper half of the G20 ranking following a tame set of July inflation figures out on Friday and Eurostat report suggesting earlier last week that Europe’s economy stabilised in the second quarter.

July’s final reading of European inflation was unchanged at 5.5% last week while Eurostat data indicated a 0.3% Euro Area expansion followed in the second quarter from a 0.2% growth previously, placing the continental economy ahead of its UK counterpart and potentially standing the Euro in good stead for the weeks ahead.

But a far more important influence on price action has been developments in the Chinese economy with their knock-on implications for foreign exchange policy and government bond markets elsewhere including in the U.S. where rising long-term bond yields have been cited for undermining investor risk appetite in recent days.

“While the USD has recently found support from the ‘higher for longer’ rate theme, it has also found buyers on the back as safe-haven flows as the news from China becomes more worrying,” says Jane Foley, head of FX strategy at Rabobank.

Above: Euro to Dollar rate shown at daily intervals with selected moving averages denoting possible areas of technical support and resistance for the single currency.

“We maintain our 3-month EUR/USD forecast of 1.08 and see risk of EUR/USD moving back to 1.06 on a 6 month view before Fed rate cuts make way for a softer outlook for the greenback,” she adds in a Monday forecast review.

With Wednesday’s S&P Global PMI surveys and Friday’s smattering German economic figures aside, the week ahead is a quiet one for economic data on both sides of the Atlantic until Thursday when the Federal Reserve’s annual Jackson Hole Symposium for economists and central bankers gets underway.

One of the important themes concerns structural shifts in the global economy but the event’s coincidence with a summit organised by the BRICS group of countries means it could garner more attention than usual, given the latter group’s ambition to create an international financial architecture to compete with that overseen by the U.S.

“Fed Chair Powell’s Jackson Hole address is likely to again push back against the rate cuts priced into the forward curve over the next year and services PMIs in Europe could follow the weakness in manufacturing that came through in last month’s manufacturing surveys,” says Adam Cole, chief FX strategist at RBC Capital Markets.

“Perhaps the more significant upside risk for USD, however, is the asymmetry of risk from bonds and equities. UST 10s are close to testing October’s yield high of 4.33% and if that level breaks convincingly, the sell-off could take equities lower via valuation concerns,” he adds while tipping EUR/USD as a sell on Monday.

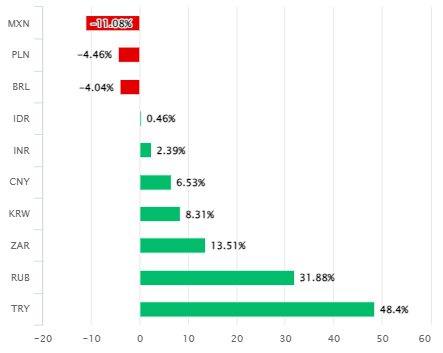

Above: Euro relative to G10 and G20 in month to Tuesday. Source: Pound Sterling Live.

Many analysts are bearish on the outlook for the Euro to Dollar rate for the coming week and months but it’s possible, if not somewhat likely that losses for the single currency will be shallow and short-lived unless and until the managed-floating Renminbi is either able or willing to recover against the U.S. Dollar.

“Rising financial stress and weaker economic performance over the summer has lowered growth expectations,” says Bjørn Tangaa Sillemann, a director at Danske Bank.

“We see a rising risk (25% probability) of a deeper financial and economic crisis but still believe that China has the tools to avert such an outcome and will use them to the extent needed. We have revised higher our USD/CNH forecast to 7.70 in 12M from 7.40 in response to the weaker outlook and rising risks,” he adds.

China’s Renminbi is managed loosely in relation to a basket of developed and emerging market currencies, each having a different weighting and with the objective of keeping it “basically stable” at an adaptive equilibrium level, which has implications for other currencies when the Dollar-Renminbi pair is trading at its highest since October 2022.

A strong USD/CNH pair tends to weigh, by necessity almost, on the currencies of trade partners and competitors in the Asia Pacific and emerging market areas but the latter currencies’ responses exert a significant upward influence on the Renminbi index.

Above: Euro relative to G10 and G20 in 2023. Source: Pound Sterling Live.

The upward influence exerted by losses in the Renminbi-Dollar rate and other pairs like KRW/USD, AUD/USD, NZD/USD, JPY/USD and MYR/USD while in turn necessitating an offsetting calibration of other currencies in order for the monetary authority to meet the policy objective of keeping the overall index “basically stable”.

This offsetting constellation or calibration of other currencies is effectively what is illustrated in the above images depicting the pecking order of performances from Euro exchange rates for the recent month and year-to-date, and is something that becomes more difficult to achieve without a buoyant EUR/USD.

In short, counterbalancing any depreciation of the Renminbi and other regional currencies so as to keep the Renminbi Index stable can only be achieved with significant efforts to lift or otherwise support currencies like the Dollar, Euro, Pound, Swiss Franc, Canadian Dollar, Mexican Peso, Thai Baht and Russian Rouble.

Such efforts would be enabled by the world’s largest chest of foreign exchange reserves and might be likely to mean that financial market speculators, and even European economic data, will have a hard time holding the Euro down until the Renminbi is able or willing to stage a recovery from recent losses.

Conversely, any successful effort in Beijing to bring down USD/CNH might be likely to coincide with losses for currencies like the Dollar, Euro, Pound, Swiss Franc, Canadian Dollar, Mexican Peso, Thai Baht and Russian Rouble, though the likely timing of any such action is uncertain in light increasingly adverse economic news from China.

Above: China Foreign Exchange Trade System Renminbi Index. Source: China Money.