EUR/USD Rate Outlook Brightens On Sign of Inflation Win for ECB

"When removing the German transport subsidy, services inflation was actually very strong" - TD Securities

Image © European Commission Audiovisual Services

The Euro to Dollar exchange rate climbed back toward 1.07 after Eurostat figures suggested continental inflation fell further than was expected in a May outcome that could mean the single currency has scope for a rebound toward 1.11 and its earlier highs in the weeks ahead.

Europe's single currency climbed after Eurostat said inflation likely fell to 6.1% in May, from 7% previously, following a broad moderation that left the annual pace of price growth running below the 6.3% economist consensus.

Meanwhile, the more important core inflation rate fell from 5.6% to 5.3% when the average of economists' forecasts was that it would fall only as far as 5.5%.

"Regarding the negative surprise in core inflation, the German cheap transport ticket probably played a role which implies that the negative surprise was partly temporary," says Tuuli Koivu, an economist at Nordea Markets.

"Indeed, according to the preliminary data, price pressures in many German service sectors continued to be robust and the small decline in Italy’s annual service price inflation (from 4.8% to 4.6%) was due to a base effect," Koivu says following a review of the data.

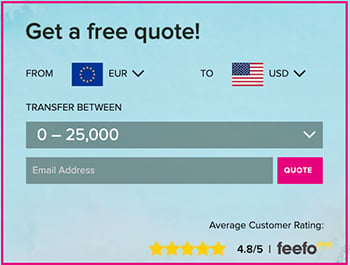

Above: Euro to Dollar rate shown at 15-minute intervals. Click image for closer inspection.

Thursday's data is preliminary and subject to revision but tentatively suggests a European disinflation process being firmly underway with moderation in price growth clear across all categories measured, and in contrast to the picture painted by data released in the UK last week.

"When removing the German transport subsidy, services inflation was actually very strong," says James Rossiter, head of macro strategy at TD Securities.

In the UK inflation fell almost two percentage points for the month of April last week but not without a large increase in core inflation suggesting escalating price growth in the services sector and ultimately leading to a sharp uplift in expectations for the Bank of England Bank Rate.

But for now Europe's inflation numbers are likely to be welcomed by the European Central Bank (ECB), and are good news for the single currency, which has fallen heavily against the Dollar and others since inflation first became a problem around the middle of 2021.

"We spent much of 2022 explaining why rising inflation in Europe would not be positive for the EUR. Now European inflation is falling, at a faster rate than most expected, and we find ourselves having the same conversations in reverse," says Dominic Bunning, European head of FX research at HSBC.

Above: Euro to Dollar rate shown at daily intervals alongside spread or gap between 02-year German and U.S. bond yields. Click image for closer inspection.

"While the EUR has suffered from rate divergence back in favour of the USD in recent weeks, lower headline inflation in Europe should ultimately, in our view, be positive for the EUR. This all boils down to the nature of inflation," he adds while tipping EUR/USD to rise toward 1.15 by year-end.

Many analysts and economists described the Euro's recent two-year depreciation as the effect of movements in interest rate differentials and the 'terms of trade shock' that followed the Russian invasion of Ukraine, although both of those are in some ways merely different reflections of inflation.

Inflation erodes the theoretical value of currencies wherever not compensated for by sufficiently high-interest rates, while in recent years the Euro has demonstrated a negative correlation with continental inflation rates.

This has been true except in relation to the directional twists and turns of EUR/USD and inflation, which have matched each other closely.

For instance, EUR/USD rallied through much of 2020 as inflation fell in the early part of the pandemic and it peaked at a high of 1.2350 in January 2021 just as the inflation bottomed at -0.3% following five months of subzero readings.

Above: Euro to Dollar rate shown at weekly intervals with spread or gap between 02-year German and U.S. bond yields and Fibonacci retracements of January 2021 downtrend indicating possible areas of technical resistance for the single currency.

But the Euro unraveled steadily from January 2021 as inflation rose to its reported peak of 10.7% in September 2022, which was also when EUR/USD reached its low of 0.95.

The Euro-Dollar rate has recovered steadily since then to reach highs of around 1.1092 at the beginning of last month and was quoted higher on Thursday.

These would be important insights as far as they mean that inflation dictates something like a 'fair value,' or equilibrium anchor around which exchange rates tend to trade, and not least because of what the current levels of European inflation imply for the current 'fair value' of EUR/USD.

This fair value would be roughly 1.1080 if Thursday's inflation data is anything to go by and the exchange rate is discounted from the point at which inflation first rose above the two percent target of the ECB.

But that 'fair value' level would rise if current interest rate differentials are taken into account, and more so if Euro Area interest rates rise further up ahead.