EUR/USD Week Ahead Forecast: Dip Buyers Drawn Near 1.08 and Below

- EUR/USD repelled from one-year high but downside limited

- Dip buyers could be tempted on any losses to 1.08 or below

- S&P Global PMI surveys, CPI data & ECB speakers in focus

Commerzbank HQ looms over the Frankfurt skyline. Image © Andre Douque, reproduced under CC licensing conditions

Commerzbank HQ looms over the Frankfurt skyline. Image © Andre Douque, reproduced under CC licensing conditions

The Euro to Dollar exchange rate has run aground following a month-long rally and might now consolidate its recent gains this week but with prospective dip buyers already queueing in the wings, the single currency could also find itself well supported when near and below the 1.08 handle up ahead.

Europe's single currency gave way to almost all counterparts in the G20 basket on Monday after being repelled from more than one-year highs around 1.1080 on Friday when an influential policymaker reminded the market that Federal Reserve (Fed) interest rates could still rise further this year.

But the burden of proof rests with U.S. data that will be in short supply during the days ahead and which has warned almost uniformly over recent weeks of a broadening slowdown in the economy that could yet preclude any prospect of further increases in interest rates.

"The market is pretty well dead set on one more hike for the Fed and then done from there with rate cuts in the Fall. The ECB also going to be important with the market a little less euphoric for a 50bps hike there," writes Brad Bechtel, global head of FX at Jefferies, in Monday market commentary.

"It is still a good environment for the EUR/USD, and it is trending well. We could pull back into the 1.0750 area around the 50dma/100dma there if the US rates / DXY story illustrated above plays out, but I would be a buyer there. I don't expect we'll get those levels and I think we hold 1.0850," he adds.

Above: Euro to Dollar rate shown at daily intervals with selected moving averages and Fibonacci retracements of March rally indicating possible areas of technical support for the single currency. (To optimise the timing of international payments you could consider setting a free FX rate alert here.)

Above: Euro to Dollar rate shown at daily intervals with selected moving averages and Fibonacci retracements of March rally indicating possible areas of technical support for the single currency. (To optimise the timing of international payments you could consider setting a free FX rate alert here.)

There is little by way of data in the calendar to influence expectations for U.S. interest rates this week in advance of Friday's S&P Global surveys of the manufacturing and services sectors on both sides of the Atlantic but policymakers from the Fed and European Central Bank (ECB) will speak publicly.

"A lighter data calendar this week suggests the focus will be on central bankers jostling for position on the need for and size of some final monetary tightening in May," says Chris Turner, global head of markets and regional head of research for UK & CEE at ING.

"The hawks argue that a 50bp hike should still be on the table, while the doves - most recently Mario Centeno - argue that the slowdown in headline inflation could even make the case for a pause. Currently the market prices in 32bp of tightening on 4 May," he adds.

Surveys containing "managers' views of economic conditions" in April were among the indicators cited on Friday as likely to influence Federal Reserve Governor Christopher Waller's interest rate decision in May, making Friday's PMI surveys a calendar highlight for the Dollar.

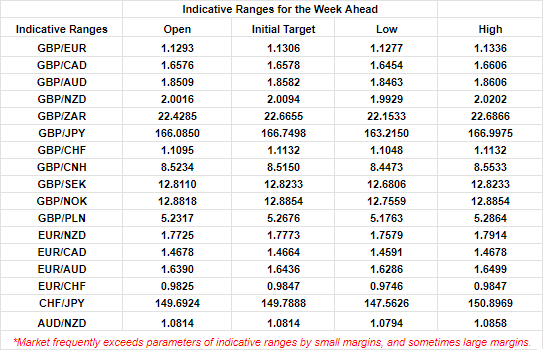

Above: Quantitative model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

ECB officials, European business surveys and Eurostat's final estimate of inflation for last month are likely to capture the lion's share of market attention in the interim, however, and could help the Euro to recover its footing if they keep alive the prospect of another increase in interest rates for next month.

"EUR/USD is being driven by 5yr rate spreads (both nominal and real) and its path is more likely to be determined by the ECB and Fed decisions than in 2022 (when stagflation concerns and terms of trade mattered more)," writes Jordan Rochester, a strategist at Nomura, in a Monday research briefing.

"Surprisingly, healthy China credit data suggest the direction for the credit impulse has bounced back. If China credit data remain strong could German PMI new orders continue to climb? If so the ECB would be looking at a healthier growth picture," he adds while tipping EUR/USD for 1.14 by the end of June.

The ECB said in March that its next policy decisions would be decided by the data emerging in the months ahead and since then business surveys have suggested a thawing of the Eurozone economy while offering signs that inflation may turn out to be more persistent than once expected.

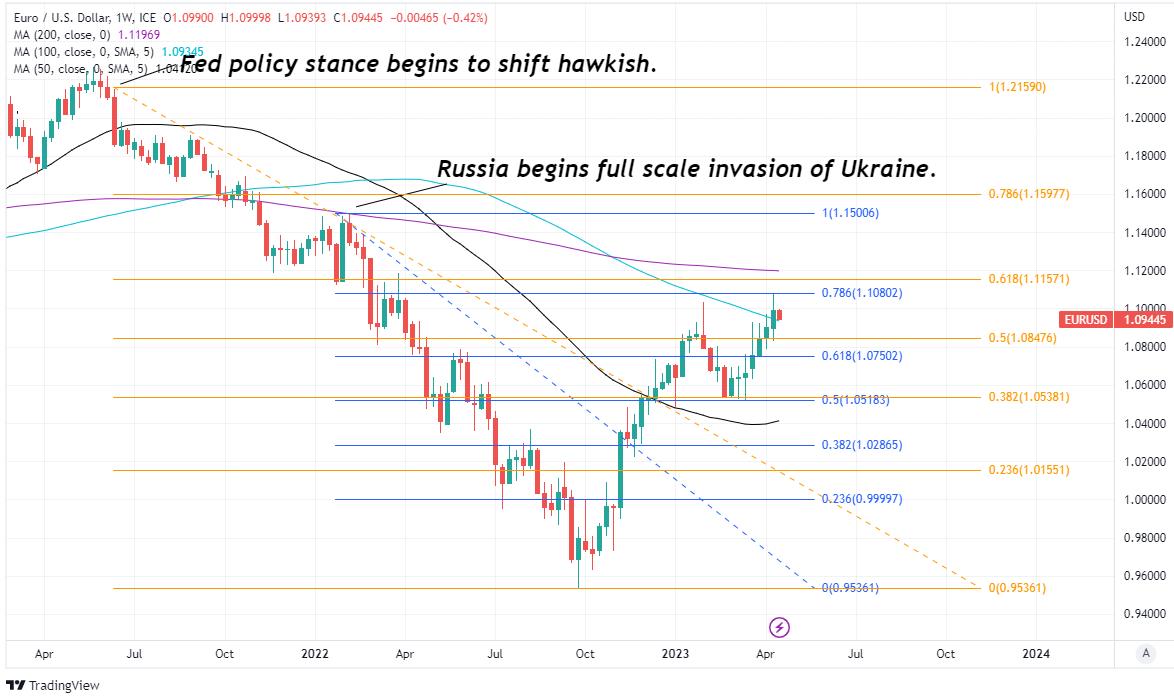

Above: Euro to Dollar rate shown at weekly intervals with Fibonacci retracements of June 2021 and February 2022 downtrends indicating possible areas of technical resistance for the Euro, and including selected moving averages. (To optimise the timing of international payments you could consider setting a free FX rate alert here.)

Above: Euro to Dollar rate shown at weekly intervals with Fibonacci retracements of June 2021 and February 2022 downtrends indicating possible areas of technical resistance for the Euro, and including selected moving averages. (To optimise the timing of international payments you could consider setting a free FX rate alert here.)

Europe's core inflation rate is thought to have ticked higher from 5.6% to 5.7% in March even as the overall measure of inflation fell back from 8.5% to 6.9%, which would all but assure a further increase in interest rates from the ECB next month if Eurostat confirms that increase in core inflation this Thursday.

Market-implied measures of expectations suggest there is uncertainty among investors about whether the ECB will lift its interest rate to 3.25% next month, or by a larger half a percentage point increment to 3.5%, although minutes of the March meeting might also shed some light on that this Thursday.

Thursday's final inflation figures and minutes from the March meeting of the ECB Governing Council are the highlight of the European calendar ahead of Friday's S&P Global PMI surveys and will be important determinants of sentiment toward the Euro.

" The tone remains bullish on this pair and the options market also indicates more EUR strength," says Roberto Mialich, an FX strategist at UniCredit Bank.

"A further EUR-USD rally up to above the new YTD high of 1.1075 thus looks in the offing, in our view, with 1.12 as the following target on charts and risks being tilted to the upside at least in the near term," Mialich adds in a Monday research briefing.