EUR/USD Recovery Seen Hampered by Profit-Taking On Approach of 1.10

"Interest rate differentials are supporting these currency pairs with financial markets expecting more tightening from the ECB and the Bank of England (BoE), compared with the FOMC" - Commonwealth Bank of Australia.

Above: Commerzbank HQ looms over the Frankfurt skyline. Image © Andre Douque, reproduced under CC licensing conditionsImage © Adobe Images

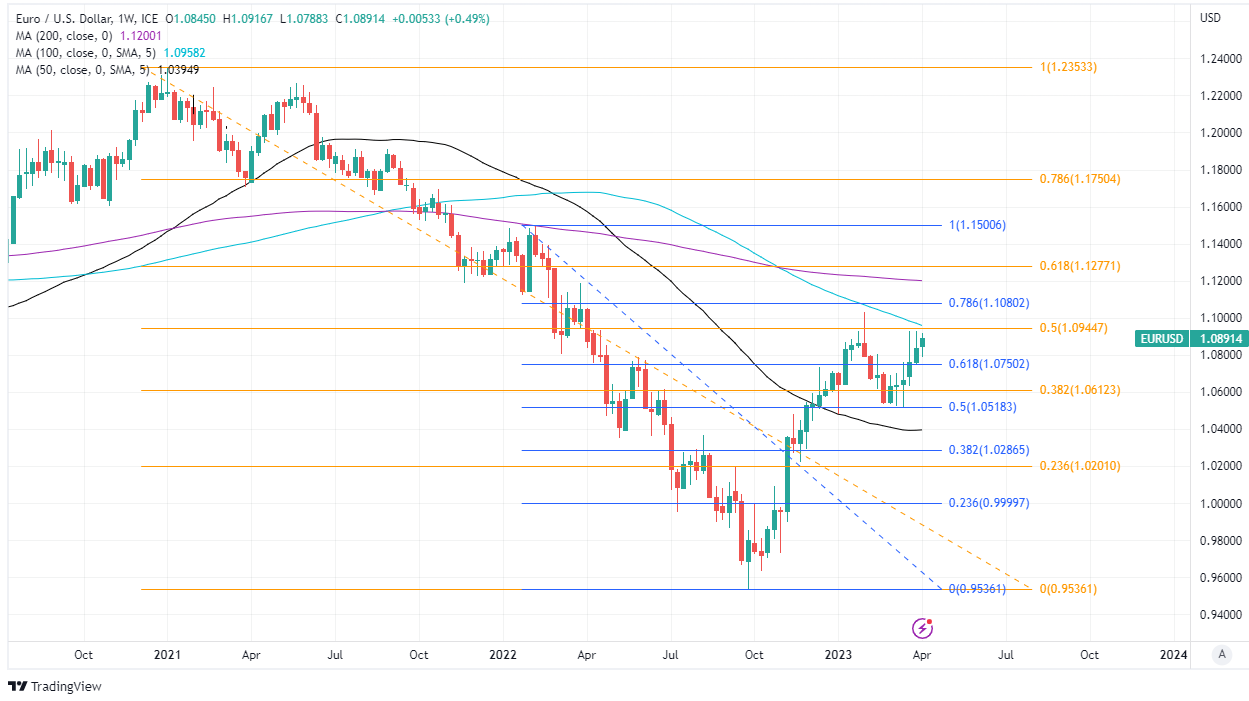

The Euro to Dollar exchange rate set itself on course for a sixth week of gains to open the new month but its recovery could be hampered by profit-taking above the nearby 1.09 level up ahead where a double-barreled layer of technical resistance also impedes the path higher from the charts.

Europe's single currency made a fresh attempt at regaining 1.09 against the Dollar on Tuesday after being frustrated by sellers four times over the recent week in what is potentially indicative of the speculative market taking profits on earlier bets in favour of EUR/USD.

"The adjustment in the net EURUSD position is curious. In the week to March 28, the value of longs fell from $8.3bln to $7.9bln while shorts increased to $7.5bln from $6.5bln," says Stephen Gallo, an FX strategist at BMO Capital Markets.

"Barring clearer recession signals from the US economy, these adjustments point to the 1.08-1.10 range in EURUSD being a near-term struggle in terms of topside," he adds.

The Euro's rally dates back to the mid-March failure of Silicon Valley Bank but has since been further fueled by softer U.S. economic figures, a less hawkish outlook for Federal Reserve (Fed) interest rate policy and the contrast with the European Central Bank's (ECB) policy stance.

Above: Euro to Dollar rate shown at daily intervals with selected moving averages and Fibonacci retracements of March rally indicating possible areas of technical support for the Euro. Click image for closer inspection.

Governing Council members including Robert Holzmann, Gediminas Simkus, Francois Villeroy and President Christine Lagarde all indicated at the weekend or on Monday that further increases in Euro Area interest rates are still possible, if not likely for the months ahead.

This contrasts with the current position of the Federal Reserve, which said last month that an expected tightening of bank lending standards is likely to dampen U.S. economic activity and inflation enough to necessitate a more cautious interest rate policy over the coming months.

"EUR/USD and GBP/USD both lifted as the USD fell. Interest rate differentials are supporting these currency pairs with financial markets expecting more tightening from the ECB and the Bank of England (BoE), compared with the FOMC," writes Christina Clifton, a senior economist and currency strategist at Commonwealth Bank of Australia.

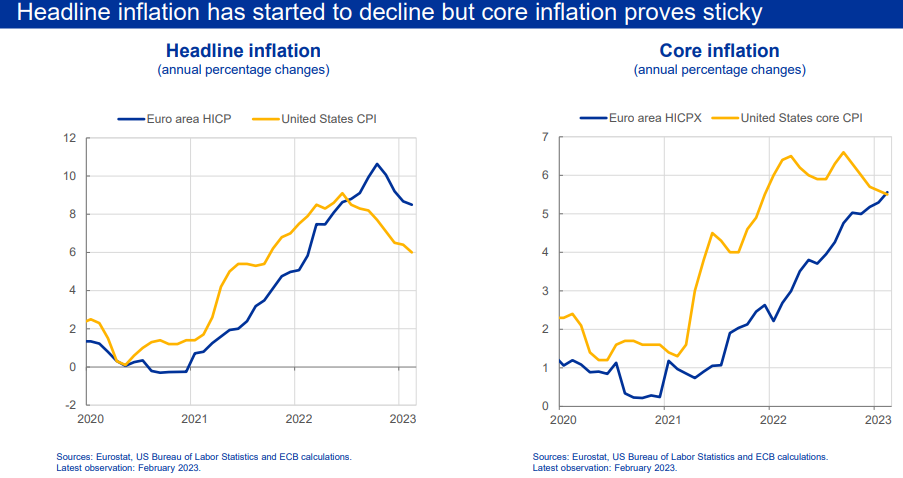

Differing inflation circumstances have also recently been suggestive of greater upside for European interest rates than those in the U.S. and a more supportive outlook for the Euro after the Fed's preferred measures of inflation fell below the Eurozone rates monitored and targeted by the ECB last month.

Since then market-implied measures of investor expectations have shifted in recent weeks to imply that Euro Area interest rates are likely to rise by another half a percentage point in the months ahead but that barely one further increase in U.S. borrowing costs is likely, if that.

Source: ECB. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Source: ECB. To optimise the timing of international payments you could consider setting a free FX rate alert here.

"Signs of core prices remaining elevated, while growth assumptions are not yet at risk of being materially compromised, suggest that EUR/USD dips remain attractive. Only a material breach of 1.0750 would test a constructive EUR bias," says Jeremy Stretch, head of FX strategy at CIBC Capital Markets.

The risk for the Euro-Dollar rate, however, is of the U.S. economy proving more resilient than investors have given credit for and eventually forcing the markets to abandon recently popular bets suggesting the Fed is likely to cut its interest rate before year-end.

This is part of why Wednesday's release of the Institute for Supply Management Services PMI survey and Friday's non-farm payrolls report for March will be scrutinised closely for signs of any economic impact from last month's turbulence in the banking sector.

"EUR gains have lost some technical momentum on the short-term charts but the underlying trend higher remains intact," says Shaun Osborne, chief FX strategist at Scotiabank.

"Firm gains from the overnight low suggest the undertone remains relatively constructive but new cycle highs (above 1.0930) are needed to give the EUR a bit more lift in the short run and drive gains on through 1.10+. Support is 1.0800/25. Key support is 1.0700," he adds in Monday market commentary.

Above: Euro to Dollar rate shown at weekly intervals with Fibonacci retracements of May 2021 and February 2022 downtrends indicating possible areas of technical resistance for the Euro. Click image for closer inspection.