EUR/USD and European Central Bank Outlook: Analyst and Economist Views

"The Governing Council is monitoring current market tensions closely and stands ready to respond as necessary to preserve price stability and financial stability in the euro area. The euro area banking sector is resilient," - European Central Bank.

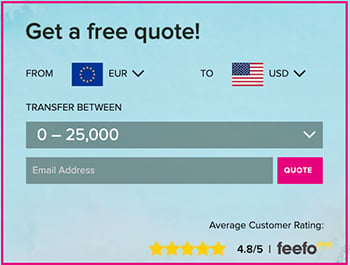

Image © European Central Bank

The Euro to Dollar exchange rate stalled before remaining buoyant near intraday highs after the European Central Bank (ECB) raised all of its interest rates but said little about how it would proceed through the months ahead, leading to a variety of responses from analysts and economists.

Europe's single currency traded heavily in the initial moments after the ECB raised the rates charged or paid on its main refinancing operations, marginal lending facility and commercial bank deposit facility while offering only ambiguous words about the outlook for borrowing costs up ahead.

The benchmarks were lifted to 3.5%, 3.75% and 3% respectively but the Euro was quick in regaining its composure against the Dollar and other currencies as the market parsed an updated set of economic forecasts including new projections for inflation.

Eurozone inflation is now seen averaging 5.3% this year before falling to 2.9% in 2024 and 2.1% in 2025, reflecting downward adjustments from earlier projections of 8.4%, to 6.3% and 3.4% while potentially suggesting something about how the Governing Council sees the outlook for interest rates.

Forecast downgrades combined with a lesser overshoot of the 2% target in 2025 could mean Governing Council members now view the ECB as close to having done enough with interest rates to ensure a timely return to their inflation target, although that is is by no means assured.

Above: Euro to Dollar rate shown at 15-minute intervals alongside EUR/GBP. Click image for closer inspection.

Above: Euro to Dollar rate shown at 15-minute intervals alongside EUR/GBP. Click image for closer inspection.

The latter is in part because central bank inflation forecasts are typically based upon market-implied expectations for the future level of interest rates, and European interest rate markets have continued to indicate that further increases are widely expected among investors and traders.

In addition, the new forecasts for core inflation suggest that domestically generated price pressures on the continent are now expected to be stronger this year than they were at the time of the December forecast update, largely due to recent declines in wholesale energy prices.

The core inflation rate is now forecast to average 4.6% over the current year, higher than previously, before falling to 2.5% in 2024 and 2.2% in 2025.

Those projections suggest the Governing Council might now be more concerned with domestic inflation than that coming from elsewhere, which is one indication that further increases in borrowing costs may still be likely.

With the outlook turning somewhat ambiguous, there is a selection whole or partial views from a range of analysts and economists below.

Simon Harvey, head of FX analysis, Monex Europe

"While there had been some speculation that the recent concerns over financial stability stemming from Silicon Valley Bank and then Credit Suisse would induce either a more conservative 25bp hike or even a decision to hold rates, we believed the adverse signalling effect this would have on confidence that financial stability risks are well-contained would mean such a decision would actually be counterproductive at this juncture."

"Financial stresses weigh on the credit channel and effectively induce tighter monetary conditions. President Lagarde struggled to navigate questions around this topic, but the underlying message from her was clear, the ECB will not be deterred in its battle to get inflation under control and, at present, the Governing Council sees the risks of financial stability as limited. This helped retain confidence in European banking stocks."

"The main takeaway from today’s press conference was that unless future vulnerabilities result in significantly tighter credit standards or inflation deviates from the ECB’s projections, further rate hikes will be necessary. This naturally makes pricing the ECB’s next steps incredibly difficult as it is no longer contingent on economic fundamentals but also credit conditions. For this reason, we expect market pricing of the ECB’s next steps to remain highly conservative."

"The outcome of today’s ECB meeting acts to increase our conviction that the Fed will hike by 25bps next week."

Carsten Brzeski, global head of macro, ING

"The big caveat when looking at the ECB’s newest round of macro forecasts is that the cut-off date was two weeks ago. So, the latest market turmoil has not been factored in. Still, these forecasts reveal some interesting insights. Both headline and core inflation are expected to come down significantly over the next years, reaching 2.1% for headline and 2.2% for core in 2025. Still, the ECB calls inflation too high for too long."

"The ECB remains in our view slightly too optimistic with an upward revision of its growth forecast for this year to 1% and further strengthening to 1.6% in 2024 and 2025. Even though the ECB mentions the tightening of monetary policy as a reason for a slight downward revision of growth in 2024 and 2025."

"However, we think that the latest market developments are another reminder of the fact that the most aggressive monetary policy tightening since the start of the monetary union will have only marginal effects on the eurozone economy. The ECB's view that eurozone growth will return to a trend of 0.4% quarter-on-quarter from 2024 onward looks optimistic."

Richard Carter, head of fixed interest research, Quilter Cheviot

"Credit Suisse appears to be teetering on the edge, and the ramifications its collapse could have on the European banking sector are profound, but the ECB continues to see inflation as the bigger risk to tackle. And this could perhaps be a good sign as it is hoped that the likes of Credit Suisse and Silicon Valley Bank are isolated incidents with their own set of circumstances."

"If inflation fails to come down swiftly this year, the bank could find itself with two competing forces – a struggling financial system that will impact on economic growth versus sticky inflation that shows no sign of returning to target. This is a tense period and one that will require central banks to be agile and swift in their decision making. For now, though they are deciding to stay the course on fighting inflation."

Bipan Rai, North American head of FX strategy, CIBC Capital Markets

"A few important messages were sent by Lagarde today.

a.) The first is that “if the baseline persists, then we have a lot of ground to cover”. Put in a different way, the ECB is monitoring the degree to which hitherto tightening has impacted the situation. If it isn’t a thing, then they’ll will move forward with aggressive tightening.

b.) Second, Lagarde’s comment that there’s no trade-off between price stability and financial stability is important because it tells us that the base case should still be for a hike in May.

If there’s a concern with financial stability, there are other tools to deploy liquidity. New ones need not be created given that the ECB’s staff has a decade of experience in prescribing the right tools/facilities, and extant tools are already far more expansive than the Fed’s.

"Given the above, we’re still expecting a rate hike at May....Given the shift in ECB messaging here, we’re revising our terminal call lower from 375bps to 350bps. We now expect the ECB to hike by 25bps in May and June."

"Even with that change, we still expect the EUR/USD profile to remain higher given that the market is still pricing a much lower terminal. We have EUR/USD ending 2023 at 1.13."

Mazen Issa, senior FX strategist, TD Securities

"The ECB remains focused on fighting inflation, hiking 50bps at today's meeting and committing to more hikes going forward, should the data warrant it."However, in this environment, we can't see the ECB hiking 50bps in May as we did previously."

"We now expect 25bps hikes in May and June, taking the deposit rate to a terminal of 3.50%."

"No major implication for the EUR from this meeting. Lagarde did a good job in her communication. 1.05-1.07 is beginning to look like more of a solid range. EURGBP and EURJPY may have seen the lows for now, should the Fed deliver a hawkish dot-plot."

"We think EURJPY will be the key risk barometer for EU banking stresses as the cross is very much sensitive to front-end rates repricing and longer dated US 10y real rates. 138 looks to be major support for now."

"If the financial system pressures abate, we may see more consolidation unless the Fed delivers a hawkish dot plot next week. Finally, EURGBP should be supported around 0.8700/50 and if the aforementioned pressures play out, the cross is likely to rebound from here."

Jan von Gerich, chief analyst, Nordea Markets

"The ECB’s cautious stance obviously raises downside risks to our baseline ECB forecast of another 50bp rate hike in May and a further 25bp step in June. However, especially amidst the current uncertain market conditions, it is natural for the ECB to refrain from signalling what the future steps will look like. Nevertheless, the likelihood of moving to 25bp rate hikes after today has clearly increased."

"We continue to think the ECB will deliver several further rate hikes in the upcoming meetings."

"Such expectations are naturally subject to recent banking worries not growing into larger and more-longer lasting turmoil and the development of especially the inflation data. Longer-lasting volatility would hit economic confidence and lead to more permanent tightening in financing conditions, which would in itself be a clear headwind to economic growth, likely lead to weaker labour markets and thus remove the need for the ECB to actively tighten policy further."

Nerijus Maciulis, economist, Swedbank

"The ECB Governing Council pushed back against recent markets expectations and increased all three key interest rates by 50 basis points (bps). After turbulent week in financial markets were expecting only a 25 bps increase. However, forward guidance was dropped (again) and the Governing Council’s policy rate decisions are expected to be data dependent. That should be perceived as a dovish shift."

"We change our forecast (again) and now expect two more 25 bps hikes in May and June, bringing terminal deposit rate to 3.5%."

"Admittedly, uncertainty remains very high – continued financial market volatility could mean that this hiking cycle is over, while stickier inflation and calmer markets would encourage the ECB to continue hiking rates closer to 4 percent. We think that the latter scenario is less likely and maintain our forecast that the inflation will drop to ECB’s target by the end of this year and the ECB will start cutting interest rates in February of 2024."