EUR/USD Rate Tipped as Buy Ahead of ECB Decision and Forecast Update

"But expectations for a March rate hike are already relatively elevated, and there is much more to price for the ECB terminal rate in our view too" - Nomura.

Image © European Central Bank

The Euro to Dollar exchange rate neared the top of the major currency board for the week and has been tipped as a buy at Nomura ahead of the European Central Bank (ECB) interest rate decision and forecast update for March.

Europe's single currency had risen against a solid majority of its counterparts in the G20 grouping by Friday but with the Swiss Franc, Japanese Yen, U.S. Dollar and Pound Sterling not far behind after maany were helped by falling U.S. government bond yields.

U.S. yields fell while futures market expectations for Federal Reserve (Fed) interest rates eased late in the week but these factors and others could yet lift the Euro further against the greenback in the days ahead.

"Next week’s ECB meeting is likely to strike a hawkish tone after recent strong core euro area CPI prints. In addition, the euro area’s terms of trade have continued to climb, ETF inflows from foreign investors are accelerating and US energy prices are in decline," says Jordan Rochester, a strategist at Nomura.

"This is likely to keep the US disinflation trend intact and US rates pricing has been a drag on EUR of late," he adds.

Above: Euro to Dollar rate at hourly intervals alongside 02-year U.S. government bond yield. Click image for closer inspection.

Above: Euro to Dollar rate at hourly intervals alongside 02-year U.S. government bond yield. Click image for closer inspection.

Market-implied expectations for the Fed Funds rate were raised sharply to imply an increase to 6% later this year after congressional testimony from Chairman Jerome Powell suggested the Federal Open Market Committee could respond aggressively to any fresh upturn for U.S. inflation.

Nomura's U.S. economists are forecasting a half percentage point increase in the benchmark interest rate for March but say that by the second quarter of the year, inflation is likely to be in a clear enough downtrend for the Fed to call an end to its interest rate cycle.

"The good news is that US energy prices declined in February, reducing some risks of a strong headline number at least," Rochester says in a Friday reference to U.S. inflation figures out next Tuesday, which are a risk for EUR/USD.

"But expectations for a March rate hike are already relatively elevated, and there is much more to price for the ECB terminal rate in our view too," he adds.

Fortunately for the Euro to Dollar rate, perhaps, Nomura economists have also recently lifted their endpoint forecast for the ECB deposit rate to 4.25%, which is above the latest market-implied expectation.

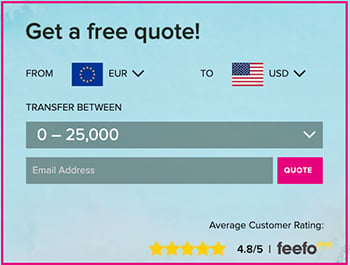

Above: Euro to Dollar rate shown at daily intervals alongside 02-year U.S. government bond yield. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: Euro to Dollar rate shown at daily intervals alongside 02-year U.S. government bond yield. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

That would potentially help the Euro next week if the latest European Central Bank inflation forecasts suggest such a policy prescription is merited.

"To reach that level, we expect the ECB to raise rates by 50bp at each of the March, May, and June meetings, followed by a final hike of 25bp in July. This is not priced in by the markets, which are pricing in a terminal rate of 3.77% in July and 3.80% in October," Rochester says.

"For July that is significantly below our euro area economics team’s view of 4.25% (one that we back with confidence)," he adds.

Europe's economy stalled in the final quarter of last year but data released more recently told of a modest revival in the new year while last week Eurostat figures indicated that inflation remained stubborn in February.

Euro area inflation dipped to 8.5% in February but from an upwardly-revised level of 8.6% while the more important core inflation rate rose from an upwardly-revised 5.3% to 5.6% in a second consecutive defiance of ECB expectations for price growth moderate in January and February.

The Nomura team is targeting a EUR/USD recovery to 1.11 for the end of June.