EUR/USD Week Ahead Forecast: Helped by ECB's Hardening Resolve

- EUR/USD battling to hold support at 1.0679 on charts

- Aided by hardening ECB resolve but at risk from USD

- After data drives repricing of U.S. interest rate outlook

- S&P PMI surveys, Fed minutes, U.S. PCE data eyed

Image © European Union, reproduced under CC licensing

The Euro to Dollar exchange rate has unwound all of its new year gains over the course of February but drew support on Friday from the hardening resolve of the European Central Bank (ECB), which could cushion the single currency as it navigates a minefield of economic data over the coming days.

Europe's single currency rose against all major counterparts barring a resurgent Dollar last week after receiving a bid on Friday when the continent's current account balance was said to have flipped back into surplus and an ECB policymaker warned of upside risk to market expectations for interest rates.

"Markets are priced for perfection. They assume inflation is going to come down very quickly toward 2% and it is going to stay there, while the economy will do just fine. That would be a very good outcome," executive board member Isabel Schnabel told Bloomberg News.

"But there is a risk that inflation proves to be more persistent than is currently priced by financial markets. As regards the terminal rate, we need to look at the incoming data to see how far we need to go," she added in reference to expectations for the ECB deposit rate to reach 3.5% later this year.

Friday's interview was followed by an uplift in market-implied expectations for the ECB deposit rate, which is now seen approaching 3.7% later in the year, in a repricing of the outlook that helped lift the Euro-Dollar rate back above an important technical support level on the charts ahead of the weekend.

Above: Euro to Dollar rate at daily intervals with Fibonacci retracements of September recovery indicating possible areas of technical support while selected moving averages denote support and resistance. Click image for closer inspection.

"We see early signs of trouble for the doves in Europe, and believe there are reasons why inflation may prove more sticky. This is good news for EUR/USD if it is demand driving inflation higher, as so far it looks to be (unlike the supply-side problems of 2022)," says Jordan Rochester, a strategist at Nomura.

"The problem in the short-term is whether US inflation will also follow suit, and whether Fed terminal pricing will shift higher as it has this past week," he adds in a Friday research briefing tipping EUR/USD to reach 1.11 by late March.

Meanwhile, Dollars were bought widely after U.S. inflation eased by less than was expected for last month while producer prices data suggested costs within supply chains remained stubbornly elevated in January.

That data helped drive expectations for the peak in the Federal Reserve interest rate to new highs, leaving derivative markets pricing-in on Friday a September 2023 peak in the 5.25% to 5.5% range for the Fed Funds rate.

"The US economy is not undergoing a soft or hard landing. There is no landing at all, so far, in our view," writes Joseph Capurso, head of international economics at Commonwealth Bank of Australia, in a Monday research briefing.

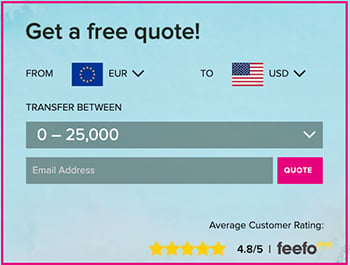

Above: Financial model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

"EUR/USD can ease if the USD lifts as we expect. The next level of downside support is a long way away at 1.0463 (50% Fibbo). Lower energy prices can lift the Eurozone PMIs a little further in February (Tuesday). However, the Eurozone PMIs can re-weaken in the coming months as the impacts of the sharp lift in interest rates fully filter through to the economy," Capurso adds on Monday.

The ECB's hardening resolve and shifting expectations for Eurozone interest rates have helped insulate the Euro from the recovery in Dollar exchange rates thus far but much about price action this week is also likely to be determined by a flurry of European and U.S. economic figures.

Notably, Tuesday marks the release of S&P Global PMI surveys of the manufacturing and services sectors for February while other surveys like the Ifo and ZEW reports are out on Wednesday ahead of the evening publication of minutes from the February Fed policy meeting.

"The repricing of a higher terminal rate and scaling back of rate cut expectations later this year has breathed fresh life into last year’s strong USD trade. The upcoming releases of the latest FOMC minutes and PCE deflator report are unlikely to derail the USD’s rebound in the week ahead," says Derek Halpenny, head of research, global markets EMEA and international securities at MUFG.

"We are recommending a new short EUR/USD trade idea to reflect our view that there is room for the reversal lower to extend further in the near-term. We are expecting the pair to fall back towards support from the 200-day moving average that comes in at around 1.0330. The recent move lower in EUR/USD has been mainly driven by the USD leg," Halpenny writes in a Friday research briefing.

Above: Euro to Dollar rate shown at weekly intervals with Fibonacci retracements of September recovery indicating possible areas of technical support while selected moving averages denote prospective support and resistance levels. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Wednesday's Fed minutes are followed on Thursday by the final estimate of Eurozone inflation for January, which economists expect to be revised higher from 8.5% to 8.6%, and the second estimate of final quarter U.S. GDP.

The latter is seen as likely unchanged at 2.9% but will be followed by Germany's final GDP number on Friday and the February edition of the Core Personal Consumption Expenditures Price Index in the U.S., which is the Fed's preferred and most closely watched measure of inflation.

The consensus among economists suggests the Core PCE inflation rate will fall from 4.4% to 4.3% on Friday but the resilience seen in other measures of inflation means the risk is of an unchanged reading that would potentially provide the U.S. Dollar with a boost ahead of the next weekend.

"We expect the improving global outlook to ultimately lead the Dollar somewhat weaker through the year, but with bouts of strength given the still-difficult road for policymakers trying to slow the economy just enough to bring inflation back to target. We believe we are in the middle of one of those resurgent periods now," says Michael Cahill, a G10 FX strategist at Goldman Sachs.

"We expect the mix of better growth news and a higher terminal rate should continue to be most positive for the Dollar against the Yen. More structurally, we expect that the longer hiking cycle will be beneficial against the “reluctant hikers” like CAD and GBP, with NZD potentially joining that list this week as well," Cahill and colleagues write in a Friday market commentary.