EUR/USD Week Ahead Forecast: Risking Setback Below Support at 1.0679

- EUR/USD tests technical support at 1.0679 on charts

- Risks deeper corrective setback to 1.0535 short-term

- May struggle once past 1.08 in big week for U.S. data

- U.S. inflation, retail sales & Fed policy chatter in focus

- Eurozone jobs, GDP data & ECB speeches also eyed

Image © Adobe Images

The Euro to Dollar exchange rate has relinquished much of its January gain in recent trade and would potentially risk falling back toward the 1.05 handle this week if a nearby level of technical support around 1.0679 gives out in what is a busy period for European and U.S. economic data.

Europe's single currency underperformed all major counterparts in the week to Monday including a generally softer U.S. Dollar after economic figures and other developments in third-party markets lifted non-Euro counterparts at the expense of the single currency.

Notably, the Swedish Krona, Norwegian Krone and Pound Sterling all found reasons for cheer in some of the latest economic data and monetary policy developments while profit-taking on once-popular Euro 'long' positions appeared to weigh heavily on the Euro-Dollar rate.

"We have been highlighting recently the fact that the EUR has become overbought and overvalued and this has contributed to its underperformance, especially vs the GBP, NOK and SEK," says Valentin Marinov, head of FX strategy at Credit Agricole CIB.

"On the day, focus will on the updated EU economic projections from the European Commission as well as a speech by the ECB’s Mario Centeno. We think that evidence that the European official forecasts remain quite subdued in part because of the continuing tightening of the financial conditions could keep the EUR on the defensive across the board," Marinov and colleagues write in Monday market commentary.

Euro-Dollar entered the new week testing a Fibonacci support level at 1.0679 and would risk further losses taking it below there this week if Tuesday's data casts the Eurozone economy as softer than expected, of if U.S. data calls into question the notion of a disinflation process being underway.

Above: Euro to Dollar rate shown at daily intervals with selected moving averages and Fibonacci retracements of January and November microtrends indicating possible areas of technical support. Click image for closer inspection.

"EUR/USD is opening NY around 1.0698 and is still hung up on the 50dma but I think that will give way soon enough, and we'll be down around 1.0500 before you know it," writes Brad Bechtel, global head of FX at Jefferies, in Friday market commentary.

"The BBDXY {Bloomberg Dollar Index] held a key pivot yesterday as well to confirm that underlying strength in the USD and many other pairs are setting up for a USD run higher as well. USD/ZAR most notably but also EUR/USD, GBP/USD and a host of others," he adds.

Tuesday's U.S. inflation figures are the highlight of the week ahead for global markets but are preceded by the release of Eurostat's initial estimate for Eurozone GDP growth and employment in the final quarter, and followed by a series of other important data points from the U.S.

Consensus or the average of professional forecaster estimates suggests Eurozone GDP edged higher by 0.1% in the final quarter and that this was accompanied by a matching increase in employment, while the Euro would potentially be vulnerable to any negative surprises.

"Several ECB officials are scheduled to speak. We expect their messages to be hawkish, on balance, in line with recent communication. The next level of upside resistance is a fair way away at 1.1033 (76.4% Fibbo)," says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

"The main risk to the USD this week is the US CPI for January (Wednesday Australian time). Underlying CPI measures have tentatively trended down in the past few months. But there are limits to how far they will trend lower while US employment costs are growing strongly," he adds in a Monday research briefing.

Above: Financial model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live.

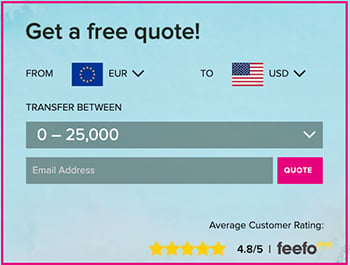

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Weaker than expected employment growth in the Eurozone would potentially call into question and weaken the hawkish consensus on the European Central Bank (ECB) Governing Council to the detriment of the Euro, although much also likely depends on the outcome and implications of the U.S. data.

U.S. inflation has eased in recent months, leading Federal Reserve (Fed) Chairman Jerome Powell and other Federal Open Market Committee members to suggest that begun to acknowledge with cautious optimism that a disinflation process may now be underway.

It would take time for such a process to lead inflation back to the 2% target, however, there is a risk of setbacks along the way that could lead to a less supportive environment for currencies like the Euro and Pound.

"Our medium-term view is still one of EUR/USD appreciation over the course of 2023, but we don’t see clear drivers for a EUR/USD rebound this week, especially from the eurozone side," writes Francesco Pesole, an FX strategist at ING, in Monday market commentary.

"It would probably require a rather low US CPI figure to send the pair sustainably back above 1.0800-1.0850. We see a greater chance of the pair coming under some additional pressure, and a strong US CPI read could mean the 1.0500 support (1.0490 is the 2023 low) is tested," he adds.

Above: Euro to Dollar rate shown at weekly intervals with Fibonacci retracements of 2022 decline indicating possible arease of technical resistance. Selected moving averages denote possible resistance. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.