GBP/CAD Week Ahead Forecast: Supported Near 1.7660

Image © Pound Sterling Live

The Pound to Canadian dollar exchange rate receded further from recent multi-year highs last week but the author’s model suggests it should remain well supported above 1.7660 over the coming days, and that it could have scope to retest the 1.78 handle in some circumstances.

GBP/CAD receded from July’s multi-year highs around 1.7850 last week but appeared to find support around 1.7625 on Thursday, Friday and on Monday, which is the 23.8% Fibonacci retracement of the April uptrend and a level that should continue to underpin the pair over the coming days.

The pullback in GBP/CAD has been modest despite widespread losses for Sterling pairs connected with last Thursday’s interest rate cut from the Bank of England. This is because the Canadian dollar has also weakened broadly over recent days in apparent sympathy with a softening of the US dollar.

“GBPCAD gains are slowing, around the highest point seen for the GBP since 2021. While longer term technical pointers remain bullish, the GBP’s run higher is looking overextended in the short run,” said Shaun Osbourne, chief FX strategist at Scotiabank, in a review of the Canadian dollar charts last Wednesday.

Above: Pound to Canadian dollar rate shown at daily intervals with selected moving averages and Fibonacci retracements of the April uptrend indicating possible areas of technical support for the pair.

While Sterling has fallen with the onset of the Bank of England easing cycle, GBP/CAD has been supported by losses for the Canadian and US dollars as the market has moved to price in as many as four interest rate cuts from the Federal Reserve for this year following a spate of soft economic numbers from the US.

Last Wednesday’s statement from Fed Chairman Jerome Powell suggesting a September rate cut is possible has been an important source of support for GBP/CAD, alongside the softer ISM Manufacturing PMI for July out last Thursday, and weaker than expected July jobs report announced in the US last Friday.

However, the easing cycle underway at the Bank of Canada is also supportive of the outlook for GBP/CAD, which reached its highest level since February 2021 in July, and could provide an extra lift to the pair as soon as this Friday if Canada’s jobs data for July comes in soft for a second month running.

“The BoC has clearly telegraphed that with unemployment rising and inflation at target they have no qualms easing further/more than the Fed,” Barclays strategists wrote in a Sunday note to clients. “Accordingly, we expect further pressure on CAD. This week the highlight will be jobs data on Friday.”

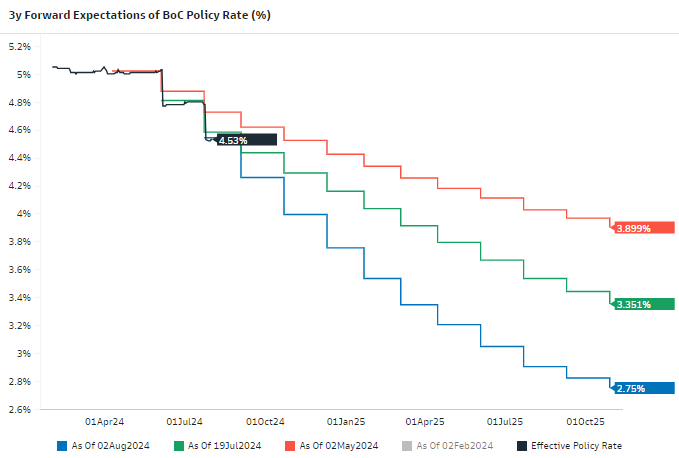

Above: Change in market-implied expectations for BoC cash rate over time. Source: Goldman Sachs Marquee.

Friday’s July jobs data from Canada is the highlight of an otherwise quiet week for economic calendars on both sides of the GBP/CAD equation, though the trajectory of the US dollar will also be an important influence.

Canada’s dollar often follows the US dollar in trade-weighted terms so would likely weaken, lifting GBP/CAD from Monday’s levels, if the US dollar weakens afresh as it did over the second half of July.

One big risk for GBP/CAD, however, is that Federal Reserve officials push back against the expectation of a deeper easing cycle while out on the speaking circuit this week, lifting both the US and Canadian dollars.

Another risk is of geopolitical tensions between Iran and Israel, and worries about the global economy, driving a continued sell-off in risky assets and positively correlated currencies like sterling over the coming days.

GBP/CAD could test the 23.8% Fibonacci retracement of the April uptrend at 1.7625 in those circumstances, where it should remain supported, pending another attempt on the 1.78 handle over subsequent weeks.

Above: Pound to Canadian dollar rate shown at weekly intervals with selected moving averages.