GBP/CAD Week Ahead Forecast: Risking Sharp Corrective Losses

- GBP/CAD buoyant near 2022 highs & supported short-term

- If softer CA inflation weighs on pricing of BoC's rate outlook

- But UK data also inflation poses downside risk for GBP/CAD

- If inflation leads BoE Bank Rate expectations to moderation

Image © Adobe Stock

The Pound to Canadian Dollar exchange rate entered the new week at more than one-year highs but could be susceptible to a sharp corrective setback if UK inflation rolls over on Wednesday though the prospect of further declines in Canadian inflation beforehand could support GBP/CAD ahead of the midweek session.

Canada's Dollar outperformed most other major currencies while pushing GBP/CAD lower from its highest level since February 2022 and the onset of the Russian invasion of Ukraine on Monday amid widespread signs of risk aversion in global financial markets.

Stock and commodity prices weakened while government bonds rose in what appeared to be a global market response to official figures suggesting economist expectations for China's second-quarter economic recovery had been too ambitious.

"It’s the q/q number that markets are taking their cue from and it’s below the average pace seen in the past," says Bipan Rai, North American head of FX strategy at CIBC Capital Markets, in reference to quarterly GDP numbers out in China overnight.

"What’s more is the weakness in consumer spending (reflected in soft retail sales), and further declines in property investment – both of which look set to continue into Q3. Industrial production numbers were a bit stronger than expected which offset some of the disappointment," he adds.

Above: Pound to Canadian Dollar exchange rate shown at weekly intervals with Fibonacci retracements of January 2021 downtrend indicating possible areas of technical resistance for Sterling while selected moving averages denote prospective areas of technical support. Click image for closer inspection.

Last quarter's acceleration of the world's second-largest economy was softer than indicated as likely by the average of economist forecasts with the annual measure rising from 4.5% to 6.3% while stopping short of the 7.3% projected by the consensus.

Monday's data was better than expected if the quarter-on-quarter decline from 2.2% to 0.8% is measured against forecasts for a 0.5% expansion over the quarter, while retail sales growth slowed to 3.1% rather than 3.2%, and from 12.7% previously.

Retail sales growth remained in the high single digits across some categories of spending but not by enough to cheer financial markets that might still have been hungover on Monday from the rally inspired by last Wednesday's decline in U.S. inflation though it's Canadian inflation figures now looming largest for GBP/CAD.

"Canadian inflation data may help shape the outlook for the CAD as investors consider whether the BoC will have to follow up on this week’s rate hike. July survey data for the US may pressure the USD if there is more evidence of slowing growth momentum," says Shaun Osborne, chief FX strategist at Scotiabank.

"The influence of spreads, stocks and commodity prices on the CAD are strengthening but remain low; this trend should extend if markets remain persuaded that the Fed is unlikely to tighten further after July and will add some tailwinds to the CAD," he writes in a Friday market commentary.

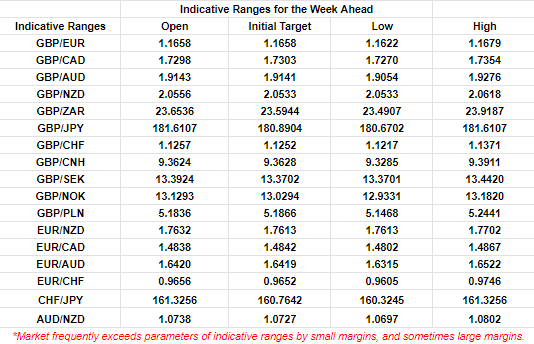

Above: Quantitative model estimates of ranges for this week. Source Pound Sterling Live.

Economists widely expect Canadian inflation to have fallen further in June with the consensus suggesting annual price growth likely decelerated from 3.9% to 3.7% while also tipping each of the more refined Bank of Canada (BoC) measures of inflation to fall further for last month.

There is either a risk or chance of this or otherwise any weaker-than-expected inflation outcome leading to losses for the Canadian Dollar on Tuesday and helping to support GBP/CAD if the result prompts financial markets to abandon wagers on the BoC raising its interest rate again later in the year.

"10 rates hikes and a 5% overnight target rate; that’s where things stand after the Bank of Canada’s latest policy rate tightening. This rates as an exceptional policy response any way you slice it," says Taylor Schleich, a director of economics and financial market strategy at National Bank of Canada Financial Markets.

"And if it wasn’t obvious, it’s our relatively anemic growth assessment—and the marginal economic slack it would thus generate—that leads us to argue that at 5%, the Bank of Canada has gone far enough," Schleich writes in a research briefing following last Wednesday's interest rate decision.

Derivative markets have continued to imply around a 50% probability of the BoC raising its cash rate again later this year after the bank lifted its benchmark for borrowing costs from 4.75% to 5% last Wednesday, taking it from 4.75% to 5% while citing the risk of "more persistent excess demand" in some parts of the local economy.

Above: Pound to Canadian Dollar exchange rate shown at weekly intervals with Fibonacci retracements of January 2021 downtrend indicating possible areas of technical resistance for Sterling while selected moving averages denote prospective areas of technical support. Click image for closer inspection.

Excess demand has caused concern at the BoC about how much longer it might take inflation to return to the 2% target, something the bank now projects will take up until the middle of 2025, but Tuesday's inflation figures could change all of that if they surprise on the downside of expectations in the same way as last week's U.S. data.

This would likely support GBP/CAD on Tuesday but there is a risk or chance of any buoyant performance from sterling then coming undone following Wednesday's release of UK inflation figures for June, which are widely expected to herald their first significant fall since April this year.

The consensus sees inflation falling from 8.7% to 8.2% for the month of June, bringing it close to the Bank of England (BoE) forecast of May in which annual price growth was tipped to decelerate to around 7% by July, though this or any larger-than-expected decline would likely have potentially significant implications for Sterling.

This is in light of financial market expectations currently implying that many investors see Bank Rate as likely to be raised from 5% to 6.25% by year-end, any reduction of which on Wednesday would potentially lead to heavy selling of the Pound including GBP/CAD.

"Expectations for GBP's policy rate to rise above CAD's have only been partly responsible for the resilience of GBPCAD — though the interest rate factor has become more important," says Stephen Gallo, a global FX strategist at BMO Capital Markets.