GBP/CAD Week Ahead Forecast: Eyeing Key Level on Chart

- GBP/CAD risking retest of major technical supports

- With Sterling beginning to wilt & Loonie outperforms

- CA's GDP & inflation data key for short-term outlook

Image © Pound Sterling Live

The Pound to Canadian Dollar exchange rate headed for its June lows early in the new week where it would be retesting the technical support underpinning the recovery from last year's historic trough but whether the 1.6673 holds up through the week ahead hinges as much on the Loonie as it does the underperforming Pound.

Canada's Dollar outperformed all major currencies over the week to Monday to reach its strongest level against the U.S. Dollar since September last year while pulling GBP/CAD lower from close to June highs near 1.70 toward the month's lows just above the round number of 1.66.

Gains for the Loonie gathered steam after Statistics Canada reported robust retail sales growth for April and when a summary of this month's Bank of Canada Governing Council deliberations suggested the BoC could yet raise its cash rate further if the economy remains in rude health up ahead.

"This will be an important week in terms of calibrating expectations for the July BoC. The fun starts on Tuesday with May CPI. There’s a massive base effect due to gas prices that will bring downside to the y/y print," says Bipan Rai, North American head of FX strategy at CIBC Capital Markets

"Markets are currently pricing in 19bps for the July BoC, and 15bps for September. We have some reservations on the latter– which introduces upside risk for USD/CAD this week and should see terminal spreads (Fed-BoC) widen in forward OIS," Rai says in Monday market commentary.

Above: GBP/CAD at daily intervals with technical indicators and analysis. Click image for closer inspection.

The BoC raised its cash rate to 4.75% early in June while the summary of deliberations released last week made clear that future policy decisions would made in response to subsequent economic data, which makes Tuesday's May inflation figures and Friday's April GDP data all the more important for the Loonie.

Advance information published by Statistics Canada in the March GDP report already suggested economic growth of 0.2% would be likely for April, which is already reflected in the economist consensus but could yet have implications for how the BoC views outlook.

At least as important as the GDP data, however, is likely whether or not the April uptick in Canada's inflation rate extended further in May as this would be highly likely to see economists and financial markets become more confident about betting on additional increases in the BoC cash rate for this year.

"A softer than expected core inflation reading on Tuesday may reduce rate hike expectations from the BoC via OIS, but I think that carries less weight if you're looking for reasons to short CAD — because ultimately benign inflation is a good thing for real growth and a currency," writes Stephen Gallo, a global FX strategist at BMO Capital Markets, in a Monday research briefing.

"On the other hand, if core CPI inflation accelerates materially, leveraged funds may feel more emboldened to sell rallies in CAD on economic hard landing risk," he adds.

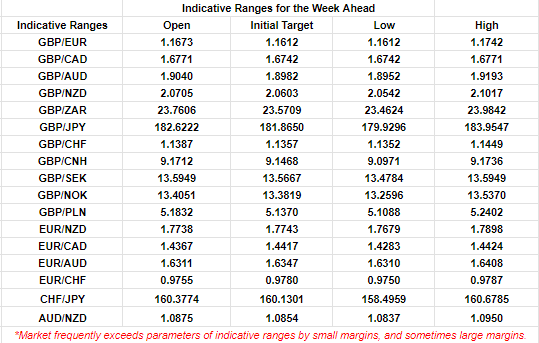

Above: Quantitative model estimates of ranges for this week. Source Pound Sterling Live.

Analysts and economists look for statistical base effects to have pushed the annual inflation rate lower from 4.4% to 3.4% in May while the core inflation rate, which overlooks food and energy prices, is also seen falling from 4.1% to 3.9% and it's this measure which markets will pay most attention to.

Any increase of core inflation could lead to solidifying expectations of further increases to come for the cash rate but there is uncertainty over whether the Canadian Dollar would rise much further as a result of this and how long any gains would last.

"Background fundamentals are supportive and data this week—CPI, GDP and the Bank of Canada’s Business Outlook survey—may reinforce the impression of sticky core price inflation, resilient demand and elevated inflation expectations respectively," says Shaun Osborne, chief UK economist at Scotiabank.

"That will keep the risk of a July BoC hike clearly on the radar and limit losses beyond the 1.32 zone for now," Osborne adds, in reference to USD/CAD.

Further increases in Canadian interest rates would exacerbate concerns about the outlook for the local economy, which is one reason why GBP/CAD could find support around its 100-day moving average at 1.6673 over the coming days, though homegrown risks might also mean that upside is limited for Sterling.

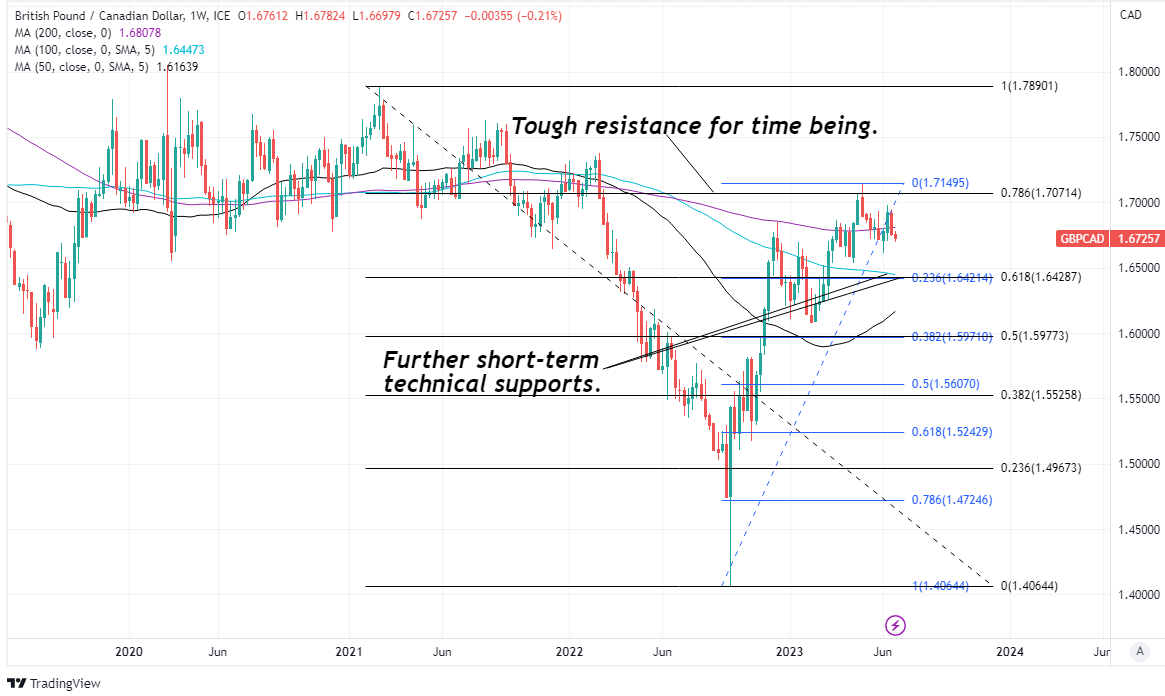

Above: Pound to Canadian Dollar rate shown at weekly intervals with technical indicators and analysis. Click image for closer inspection.

Sterling has, meanwhile, underperformed since last week's disastrous UK inflation figures led the Bank of England to raise Bank Rate from 4.5% to 5% and was followed by a sharp uplift in market-implied measures of expectations for the months ahead.

"The 2s10s UK Gilt curve has inverted sharply of late and this is the strongest indication that investors now, for the first time in this tightening cycle, believe the BoE are acting aggressively enough to hit growth and potentially bring inflation lower," says Derek Halpenny, head of research, global markets EMEA and international securities at MUFG.

"Our US recession indicator identifies a 78.1% probability of the US entering a recession in the next 12 months. While our preliminary UK and Eurozone recession models give a rough estimate of 93.3% and 59.9% respectively," Halpenny says.

Swap prices now suggest a high probability of Bank Rate rising to 6.25% by year-end.

This would take the total increase since December 2021 to 6.15% and make for the second-largest monetary tightening cycle since the establishment of the BoE in 1694 with the only other to surpass it being the one between 1978 and 1979.