GBP/CAD Week Ahead Forecast: Correlation and BoE in Focus

- GBP/CAD in retreat from 15-month high ahead of BoE decision

- Divergence between CAD & USD making for uncertain outlook

- Recent CAD outperformance warns of possible downside risks

- U.S. CPI in focus as looming BoE rate decision also poses risk

Above: King Charles III coronation procession travels along The Mall, London on Saturday, 06, May 2023. Image © John-Parnell-Flickr,

The Pound to Canadian Dollar exchange rate has receded from 15-month highs in recent trade and while it could yet find its feet again ahead of Thursday's Bank of England (BoE) decision, GBP/CAD's shifting correlation with USD/CAD and related factors make for a more uncertain outlook than usual.

Canada's Dollar outperformed most of its major counterparts in the week to Tuesday with the exceptions limited to the New Zealand Dollar, Norwegian Krone and Russian Rouble in G20 terms amid price action that helped to push GBP/CAD back below 1.69 early in the new week.

Losses pulled GBP/CAD lower from 1.70 last Thursday after official data suggested resilience in U.S. and Canadian labour markets while revealing the first meaningful sign of cooling in Canada where a roughly 100k increase in unemployment has offset around a third of the new jobs created this year.

The Loonie's recent outperformance has come against a backdrop of underperformance in U.S. Dollar rates and makes for a divergence between North America's two largest currencies following a lengthy period of high correlation.

"Stronger aggregate demand in the US typically leads to stronger demand for Canadian exports, boosting Canada’s domestic output, which is why the BoC puts a lot of emphasis on foreign (mostly US) developments," says Isabella Rosenberg, an FX strategist at Goldman Sachs.

Above: Pound to Canadian Dollar rate shown at 4-hour intervals with Fibonacci retracements of March rally indicating possible areas of technical support for Sterling, and shown alongside USD/CAD. Click image for closer inspection.

Above: Pound to Canadian Dollar rate shown at 4-hour intervals with Fibonacci retracements of March rally indicating possible areas of technical support for Sterling, and shown alongside USD/CAD. Click image for closer inspection.

"As a result, trends in the Canadian Dollar tend to be closely tied to the broad USD. It is rare, but not impossible as we show below, for CAD to go against the general Dollar trend," Rosenberg writes in a Monday research briefing.

The small increase in the number of unemployed revealed in last Friday's data came alongside a fall in full-time employment growth, which left all of last month's overall increase in employment to be accounted for by growth in part-time work.

This comes after the Bank of Canada (BoC) became the first major central bank to formally "pause" its interest rate cycle and could mark a turning point for the Loonie if the data represents an inflection point for the overall labour market, though much also depends on the U.S. Dollar.

"The influence of the Bank of Canada’s “pause” on the currency is likely to be overwhelmed by spillovers from developments in the US banking system and their implications for growth (and policy) in the region," Rosenberg says.

"If these risks are ultimately more benign as we expect, it should allow some space for the market to eventually lift front-end yields in both Canada and the US, which would support CAD outperformance on crosses [lower GBP/CAD for instance]. However, this would require the market to get more comfortable with the economic outlook, or uncomfortable with the inflation picture, and neither appears particularly imminent," she adds.

Above: Quantitative model estimates of ranges for selected pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

With the week ahead being a quiet one in the Canadian calendar, it's possible the Loonie would rise and fall in tandem with the greenback and its response to Wednesday's inflation figures for April and other U.S.-centric developments.

But last week's divergence shows this is by no means assured and acts as a reminder of how at times the Canadian Dollar can outperform or underperform others irrespectively of what the U.S. Dollar is or isn't doing.

"Meanwhile, bank sector stress and the debt ceiling issue might both contribute to a more uncertain outlook for the US in the next few weeks and months," says Shaun Osborne, chief FX strategist at Scotiabank.

"Our week ahead model anticipates flattish trading in spot around a 1.3340-1.3630 USD/CAD range. The downside of that projection looks more vulnerable," he adds in a Friday research briefing.

For Sterling, however, Thursday's Bank of England forecast update and interest rate decision is likely to be instrumental in determining how it trades over the coming weeks, which could also have implications for GBP/CAD up ahead.

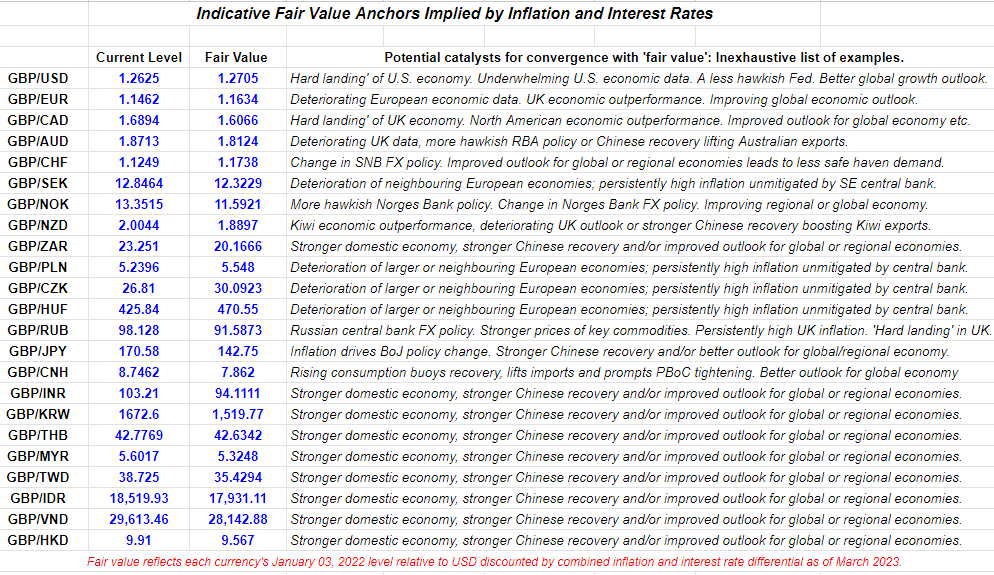

Above: Pound Sterling Live estimates of 'fair value.' Click the image for closer inspection.

"In addition to the Q1 inflation surprise, broad measures of economic activity look likely remain more positive than the BoE had anticipated," says Kallum Pickering, an economist at Berenberg.

"Whether the BoE is fully prepared to abandon its highly pessimistic view of medium-term prospects on the back of recent upside surprises is an open question," Pickering adds.

Economists and financial markets expect the BoE to raise Bank Rate from 4.25% to 4.5% on Thursday but also see a high risk of it rising as far as 5% later in the year and what, if anything, the bank says or otherwise implies about these assumptions will be an important influence on GBP/CAD this week.

Any decision to leave Bank Rate unchanged or suggest that it has peaked would be likely to weigh heavily on Sterling this week but in light of the related economic risks, the same might also be true if the BoE indicates that it's likely to continue lifting interest rates in the months ahead.

"It likely will continue to hint with its medium-term inflation forecast that it does not expect to raise Bank Rate to the near-5.0% level currently priced-in by investors," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics, who looks for Bank Rate to be raised to 4.5% on Thursday.