GBP/CAD Rate Retreads Harder Yards of Recovery Road

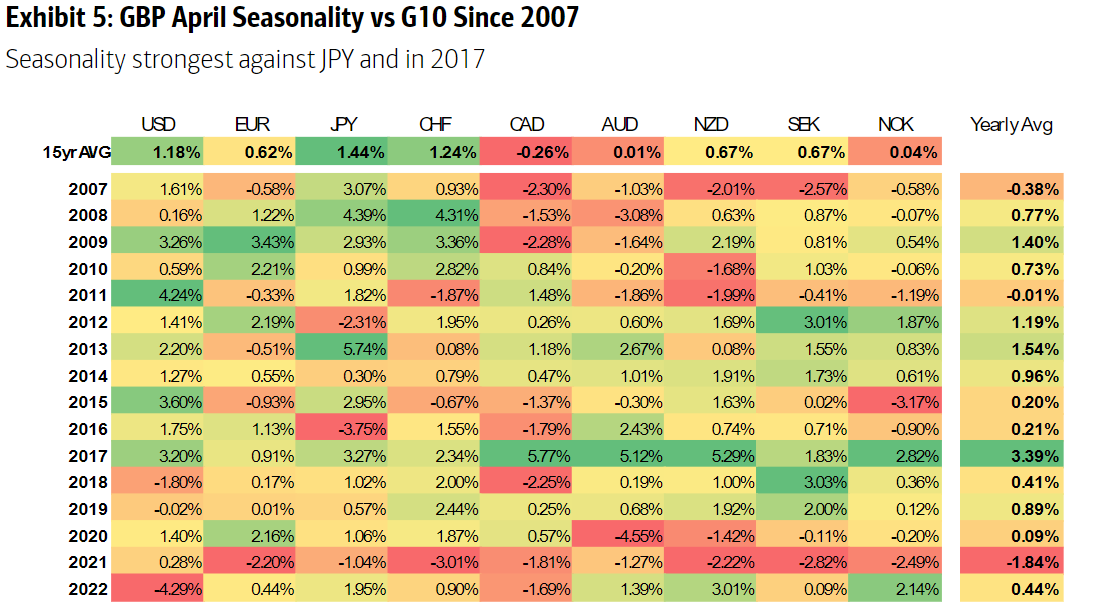

"GBP performance is strongest versus JPY and CHF and weakest versus CAD since 2007" - BofA Global Research.

Image © Adobe Stock

Canada's Dollar remained the best-performing major currency of the week to Tuesday but faced stiff competition from a rallying Pound that appeared to have placed GBP/CAD on course for another test of a formidable technical resistance at 1.6849.

This has already stalled GBP/CAD's multi-month recovery from last year's lows multiple times so far including just last week when repeated failures to overcome it led the CIBC Capital Markets team to tip GBP/CAD as a sell in anticipation of a fall to 1.61 over the coming months.

"We’re constructive on the CAD – and remain short USD/CAD (via the 1.30 strike) and GBP/CAD and are happy to maintain those for now," writes Bipan Rai, head of North American FX strategy at CIBC Capital Markets, in Monday market commentary.

"The trade setup looks relatively appealing as price action for the cross appears to be rolling over just below a key resistance area at 1.6840/50," Rai and colleagues said previously.

Above: GBP/CAD at weekly intervals with Fibonacci retracements of September 2021 downtrend indicating possible technical resistances for Sterling. Selected moving averages denote support or resistance. (To optimise the timing of international payments you could consider setting a free FX rate alert here.)

Tuesday's climb in GBP/CAD came amid a broad rally by the Pound, which rose against all counterparts in the G20 basket with the sole exception of the Swedish Krona, and at the opening of a calendar month in which Sterling has an uncanny or otherwise a seasonal habit of outperformance.

"Assuming there is no quick reversal of the breakout, the move implies upside potential in Cable towards 1.30 over the next 3-6 months," says Shaun Osborne, chief FX strategist at Scotiabank, in a reference to Tuesday's price action in GBP/USD.

"Solid-looking bull trend signals on the short, medium and long-term DMI oscillators lend a lot of credence to the idea that a major bull move in the pound is developing here," he adds.

Sterling has rallied against the U.S. Dollar and many other currencies during April in eight of the 10 years up to the end of 2022 but the potential rub for GBP/CAD is that Canada's Dollar also features as a seasonal outperformer around the same time and has a lengthy record of outperforming the Pound.

"GBP performance is strongest versus JPY and CHF and weakest versus CAD since 2007. Some of these trends tend to suggest that the risk backdrop may also be playing a role in April seasonality," says Kamal Sharma, an FX strategist at BofA Global Research.

"The most observable dynamic to account for GBP outperformance is dividend payment season: the international nature of the FTSE, multinational companies listed in the UK repatriate overseas earnings (buy GBP) to pay dividends," Sharma adds.

Source: BofA Global Research. Click image for closer inspection. (To optimise the timing of any international payments you could consider setting a free FX rate alert here.)