GBP/CAD Week Ahead Forecast: 1.6768 to 1.6849 Range

- Scope for GBP/CAD to attempt a seventh weekly gain

- But technical resistance obstructs path higher on chart

- Narrow 1.6768-1.6849 range could confine short-term

- BoE speeches in focus for GBP with GDP key for CAD

Image © Adobe Stock

The Pound to Canadian Dollar exchange rate remains close to one-year highs but with resistance immediately overhead on the charts the risk is of it being confined to roughly a 1.6768 to 1.6849 range over the coming days.

Canada's Dollar notched up gains over most major counterparts on Monday as a recovery for banking shares enabled German, French, Swiss and Swedish stock indices to lead a broader rebound of global markets.

Sterling outperformed the Loonie, however, helping GBP/CAD to remain buoyant above 1.68 and near to some of its best levels since March 2022.

"We were short GBP/CAD last week – expecting (wrongly) that 2y US yields end the week higher and drag CAD up on the crosses as a mini-USD proxy," writes Elsa Lignos, global head of FX strategy at RBC Capital Markets.

"We thought short GBP may be a hedge for broadening bank tensions, with GBP traditionally acting as a bank stock proxy. We were wrong on both counts, and we run pretty tight stops on our weekly trades (~0.9%) and yet we weren’t stopped out," she adds in Monday market commentary.

Above: Pound to Canadian Dollar rate shown at daily intervals with Fibonacci retracements of September 2021 downtrend indicating possible areas of technical resistance for Sterling while selected moving averages denote prospective technical supports. To optimise the timing of international payments you could consider setting a free FX rate alert here.

GBP/CAD was entering what would potentially be its seventh week of gains on Monday but the author's model indicates that it would be most likely to remain within roughly a 1.6768 to 1.6849 range, implying scope for technical resistance at 1.6849 to continue frustrating Sterling's recovery over the coming days.

A narrow range trade between 1.6768 and 1.6849 might be especially likely this week unless appearances by Bank of England (BoE) Governor Andrew Bailey provide the market with incentive on Monday and Tuesday.

"The only data print out of the UK today was the just-released CBI retail survey data reports which reflected slightly better activity in the sector this month. Sterling remains well-supported on dips but investors will be sensitive to the messaging from policy makers on the rate outlook," writes Shaun Osborne, chief FX strategist at Scotiabank, in a Monday research briefing.

"Market pricing continues to reflect the expectation that the BoE will raise rates once more in the next few weeks amid high inflation. BoE Gov. Bailey may provide more insight into the outlook today," Osborne adds. .

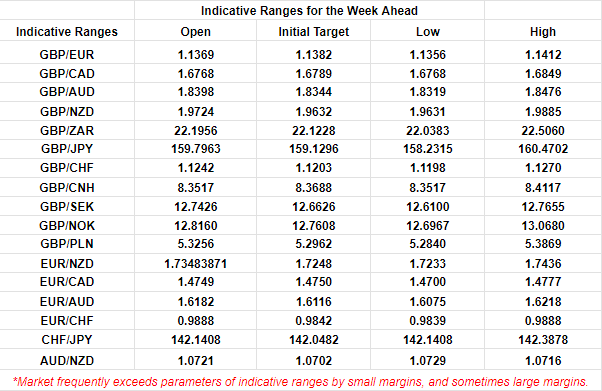

Above: Quantitative model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

The BoE raised Bank Rate to 4.25% last week, citing economic outcomes that have been less bleak than expected of late and inflation that surprised on the strong side of expectations last week, although it said future decisions will depend on the data emerging from the UK up ahead.

Last Thursday's increase took Bank Rate to its highest since shortly after the collapse of Lehman Brothers in September 2008 and leaves it sitting close to the midpoint of the three-to-six percent range in which it has spent roughly 96% of the time since the Bank of England's incorporation in 1694.

This is something of a victory for policymakers and other stewards of the monetary system, given how many had once surmised that central banks would struggle to reverse or leave behind the near-zero interest rates and quantitative easing policies that were widely used in the years after the 2008 financial crisis.

"Ahead of BoE Governor Bailey testifying on the collapse of SVB in front of the Treasury Select Committee tomorrow, the market faces the Governor speaking at the London School of Economics, from 13:00ET," says Jeremy Stretch, head of FX strategy at CIBC Capital Markets.

"This will be a busy week with the Federal budget out tomorrow afternoon (little passthrough to FX expected), as well as a speech from BoC Deputy Governor Gravelle on Wed and Jan GDP on Friday. USD/CAD likely to remain within 1.36-1.3850 for now," Stretch and colleagues said in Monday commentary.

With little in the calendar to influence Sterling this week, much about how GBP/CAD ends the period might well depend on Tuesday's Canadian government budget and the Loonie's response to Friday's GDP data.

The consensus suggests Canada more than reversed a -0.1% December contraction with a 0.4% increase in GDP during January but the market will likely be more interested in the advance estimate for February.

Statistics Canada said last that "advance information" indicates a 0.3% rebound for January GDP on Friday but the markets will be most interested to see how much of the recent strength in employment shows up in GDP.

"I’m not so sure that the labour market is as tight as perceived. The wage mechanism is not telling you that, especially in Canada. We know that there is a clear negative correlation between wages and vacancy rates in Canada," says Benjamin Tal, deputy chief economist at CIBC, in the above podcast.

Above: GBP/CAD at weekly intervals with Fibonacci retracements of September 2021 downtrend indicating possible areas of technical resistance for Sterling while selected moving averages denote prospective technical supports and resistances.