Pound to South African Rand Rebound Potentially Ahead

Image © Adobe Images

The Pound to Rand exchange rate fell heavily in the opening half of the week but could be in line for a minor rebound from Wednesday if inflation falls further in South Africa and the South African Reserve Bank (SARB) leaves its cash rate unchanged.

South Africa's Rand outperformed much of the G20 basket in the opening half of the week, leading GBP/ZAR back below a notable support level on the charts Tuesday but it could be volatile with some prospect of a modest rebound ahead if inflation falls back to within the three-to-six percent target band in South Africa.

A further fall for June would match the market consensus and enable the South African Reserve Bank (SARB) to pause or otherwise end its interest rate cycle from Thursday, potentially calling a halt to the recent rally by the Rand and enabling GBP/ZAR to recover some of its recent losses.

"Considering the global economic environment, not hiking rates may result in further weakness," says Sebastian Steyne, an FX risk and hedging specialist at Sable International.

"Therefore, there is a chance that the SARB might take this into account and implement a 25 basis-point hike," he warns.

Above: Pound to Rand rate shown at daily intervals alongside USD/ZAR.

The economist consensus tips South Africa's inflation rate to fall from 6.3% to 5.6% on Tuesday, placing it comfortably within the South African Reserve Bank (SARB) target band while once energy and food prices are removed from the goods basket, the core inflation rate is seen falling from 5.2% to 5.1%.

Wednesday's data comes ahead of Thursday's interest rate decision from the SARB, which is widely expected to see the cash rate left unchanged at 8.25% and might be supportive of the Rand as well as a further weight on GBP/ZAR if the market response to last month's inflation figures is anything to go by.

But much also depends for GBP/ZAR on the financial market response to inflation data out previously in the UK on Wednesday, and whether the latter shows any sign of the Bank of England (BoE) interest rate beginning to have an effect on UK price pressures.

"While inflation has rolled over globally, and to a modest extent in the UK, British inflation figures have been wearing anti-gravity boots even as the rest of the world sails in for a smooth landing," says Brent Donnelly, CEO at Spectra Markets and a veteran trader with a career spent between hedge funds and global banks including HSBC and Nomura.

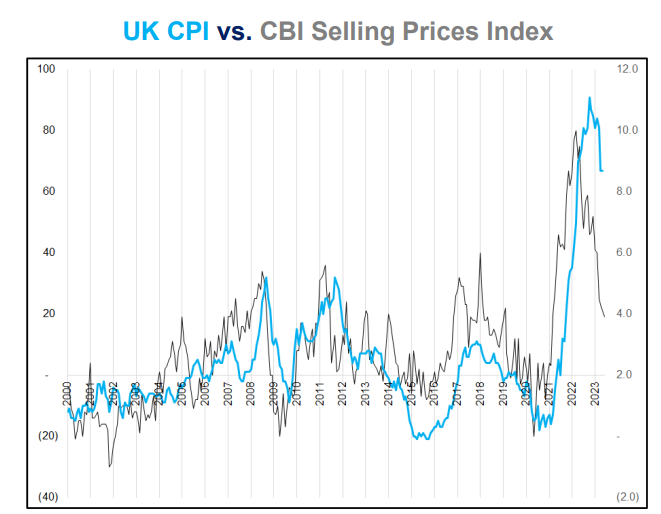

"If you have been following the UK story, you know that almost every forward-looking indicator has been pointing to much lower UK CPI for a while," he adds.

UK inflation had been widely expected to fall much further than it has over recent months only to be propped up by fresh increases in the core inflation rate, which reached a new high of 7.2% in May, leading financial markets to raise implied expectations for the BoE Bank Rate aggressively in that time.

Source: Spectra Markets.

"Much as has been the case with US nonfarm payrolls, economist forecasting models for UK CPI are completely broken," Donnelly says.

Interest rate derivative markets have moved to suggest a high risk of Bank Rate rising from 5% in July to 6.25% by the early months of next year since April, though the Pound has fallen against the South African Rand over the period and struggled to keep its head above water in relation to many other currencies.

This potentially owes itself to the likely economic and financial implications of market pricing for the BoE Bank Rate but is also potentially connected to weakness in the Dollar, which has fallen widely in recent months but particularly since inflation was reported to have fallen back to 3% in the U.S. for June.

"Stock markets have gained on the recent better than (market consensus) expectations of US inflation data, with global financial market’s risk aversion waning on hopes to an end to the US interest rate hike cycle," says Annabel Bishop, chief economist at Investec.

"The world's largest economy sees its next interest rate (FOMC) meeting close to the end of the month, 26th July, around a week after SA’s MPC meeting. A flat US interest rate outcome would be supportive of the rand, underpinning further strengthening," she adds.

Above: Pound to Rand rate shown at weekly intervals alongside USD/ZAR.

Above: Pound to Rand rate shown at weekly intervals alongside USD/ZAR.