Sunken Rand Keeps from New Lows in GBP/ZAR as "Restrictive" SARB Weighs

"Given upside inflation risks, larger domestic and external financing needs, and load-shedding, further currency weakness appears likely" South African Reserve Bank.

Image © SARB

The South African Rand narrowly avoided a new record low against the Pound on Thursday after sinking in response to a South African Reserve Bank (SARB) decision to adopt a "restrictive" interest rate policy as part of its effort to return inflation to within the target band.

Rand exchange rates fell widely with losses of more than two percent in some cases after the South African central bank raised its cash rate by half a percentage point to 8.25% in a May monetary policy decision that over delivered against the economist consensus.

The consensus among economists had suggested an increase to 8% but the SARB cited "elevated inflation and risks" for going further in adopting what it called a "restrictive" level of interest rates, which "tightens" financial conditions.

"Tighter global financial conditions raise the risk profiles of economies needing foreign capital, leading generally to weaker currencies," Governor Lesetja Kganyago said in a statement announcing the decision.

"Given upside inflation risks, larger domestic and external financing needs, and load-shedding, further currency weakness appears likely," he added.

Above: Pound to South African Rand exchange rate shown at 15-minute intervals alongside USD/ZAR. Click image for closer inspection.

Above: Pound to South African Rand exchange rate shown at 15-minute intervals alongside USD/ZAR. Click image for closer inspection.

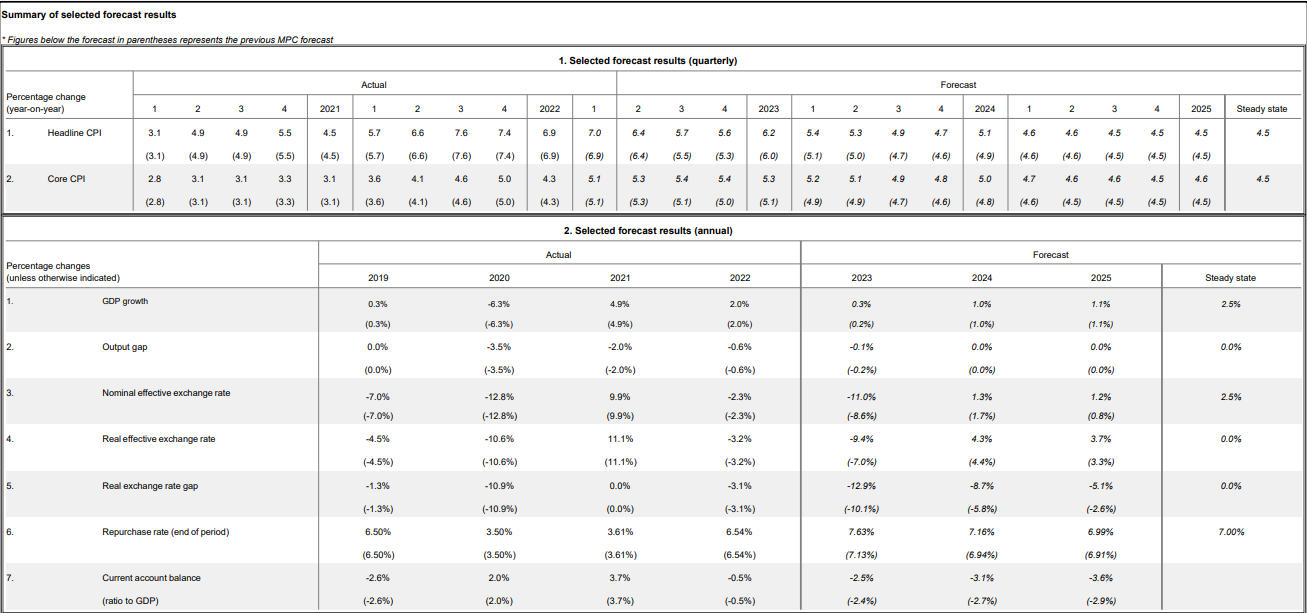

New forecasts suggested economic growth will be slightly higher than previously assumed at 0.3% for this year, up from 0.2% previously, though projections for 2024 and 2025 were unchanged at 1% and 1.1% respectively.

These follow upgrades to International Monetary Fund projections for the global economy over the same period.

"Energy and logistical constraints remain binding on South Africa’s growth outlook, limiting economic activity and increase costs. We estimate load-shedding alone to deduct 2 percentage points from growth this year," the governor said of the new projections.

Projections for inflation suggest it's still likely to peak in the second quarter before falling more slowly than was previously expected, with the main inflation rate falling from an average of 6.4% to 5.6% by year-end.

But the core inflation rate, which overlooks changes in prices for some volatile items, was seen edging higher from 5.3% to 5.4% over that time, taking it further away from the 4.5% midpoint of the three-to-six percent target band.

Above: South African Reserve Bank forecasts from May. Click for closer inspection. Full forecast sheet accessible here.

Above: South African Reserve Bank forecasts from May. Click for closer inspection. Full forecast sheet accessible here.

"We expect global financial markets to remain volatile and policy rates elevated," the governor said on Wednesday.

"Household spending is expected to grow very modestly in real terms, in line with a positive but weak rise in real disposable income," he added.

Statistics South Africa said Wednesday inflation had fallen from 7.1% to 6.8% in April, and that core inflation rose from 5.2% to 5.3%.

Lower fuel prices were a prominent driver of the decline in the main inflation rate, though prices also reportedly declined across other categories too.

"Investment by the private sector remains positive, in part reflecting efforts to overcome constraints in energy and transport supply," the governor also said.

Above: Pound to South African Rand exchange rate shown at monthly intervals alongside USD/ZAR. Click image for closer inspection.

Above: Pound to South African Rand exchange rate shown at monthly intervals alongside USD/ZAR. Click image for closer inspection.