Undervalued South African Rand Flirts with SARB Forecast Near Record Lows

"The ongoing infrastructure challenges, especially for electricity, continue to impose a hard constraint on growth...fighting inflation is much harder when the economy is already underperforming" - South African Reserve Bank Governor Lesetja Kganyago.

Image © Adobe Images#

The Rand neared record lows against the Pound, Dollar, Euro, and some others this week but recent losses have merely brought it into line with the South African Reserve Bank (SARB) forecasts of April while the risk of a policy response and other factors might soon help the currency back onto its feet.

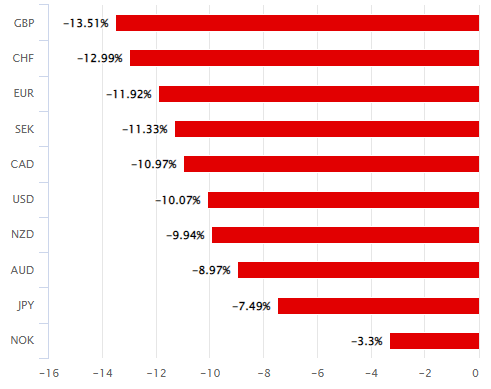

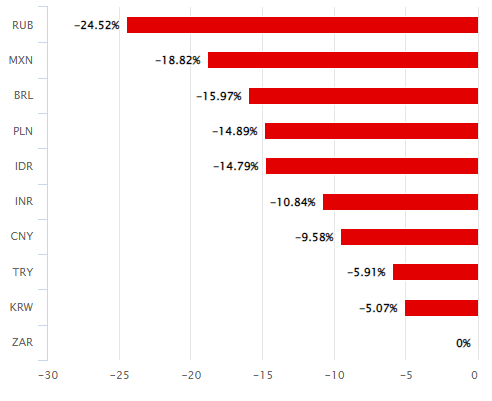

South Africa's Rand edged higher against almost half its most comparable peers during European hours on Thursday but remained underwater against all barring the Russian Rouble when measured for the week and month while also featuring as the biggest faller of the year.

Its latest losses have come against a deteriorating economic backdrop at both the domestic and international levels with analysts, economists, and policymakers attributing exchange rate weakness and economic travails to a range of factors.

"Idiosyncratic factors such as persistent load-shedding and the recent greylisting of the country by the Financial Action Task Force have kept investors wary," South African Reserve Bank Governor Lesetja Kganyago told an audience at the University of Johannesburg on Wednesday.

"And, by extension the rand depreciation has negated the impact of lower global energy and food costs on domestic inflation," he added in a speech titled "Challenges facing the global economy: a South African perspective."

Above: South African Rand relative to G10 and G20 counterparts this year. Data covering different timeframes can be accessed here. Source: Pound Sterling Live.

These exchange rate losses above look heavy and are heavy but when they're viewed in the trade-weighted or overall context the result is roughly an -8.7% depreciation of the Nominal Effective Exchange Rate (NEER) that comes close to matching the forecast made by the SARB last month.

The SARB had previously projected the NEER would fall by -3.6% for the year but then raised the expected loss to -8.6% in April while also lifting forecasts for inflation and moderating its outlook for economic growth in light of the risks and challenges posed by load-shedding at energy provider Eskom.

"The ongoing infrastructure challenges, especially for electricity, continue to impose a hard constraint on growth. The SARB estimates that load-shedding alone will reduce GDP growth by 2% this year, after knocking off 0.7 percentage from growth in the previous year," Governor Kganyago said on Wednesday.

"The repo rate has been raised by a cumulative 425 basis points, and now sits at 7.75%. Still, the real policy rate remains somewhat accommodative, being slightly below its estimated neutral rate of 2.5%," he added.

Above: Pound to Rand rate shown at weekly intervals alongside USD/ZAR and EUR/ZAR.

Above: Pound to Rand rate shown at weekly intervals alongside USD/ZAR and EUR/ZAR.

The governor also said "prevailing conditions, more than ever before, have brought the monetary policy conundrum to the fore," and in part because "fighting inflation is much harder when the economy is already underperforming."

But he also warned that the job would become more difficult the longer that inflation risks are allowed to build, and acknowledged that "the real repo rate is still below its estimated neutral level of 2.5%," which might mean there is some scope for interest rates to rise further in the near future.

"Recent commentary from the Reserve Bank on higher inflation and rand depreciation shows these are front of mind for the SARB, which is widely expected to hike the repo rate again this month," says Annabel Bishop, chief economist at Investec.

"The rand has also become much more vulnerable to weakness over the past year as SA has eroded the risk premium offered by the differential between SA and US interest rates, as SA has failed to match the quantum of US interest rate hike," she adds in a Tuesday research briefing.

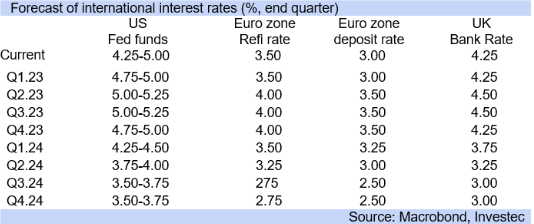

Above: Changes in selected global interest rates. Click for closer inspection. Source: Investec.

While the "real policy rate" has remained below its estimated neutral level and led the gap or spread between local and international interest rates to narrow, South African inflation has also not overshot the SARB's three-to-six percent target band to the same extent as inflation has elsewhere.

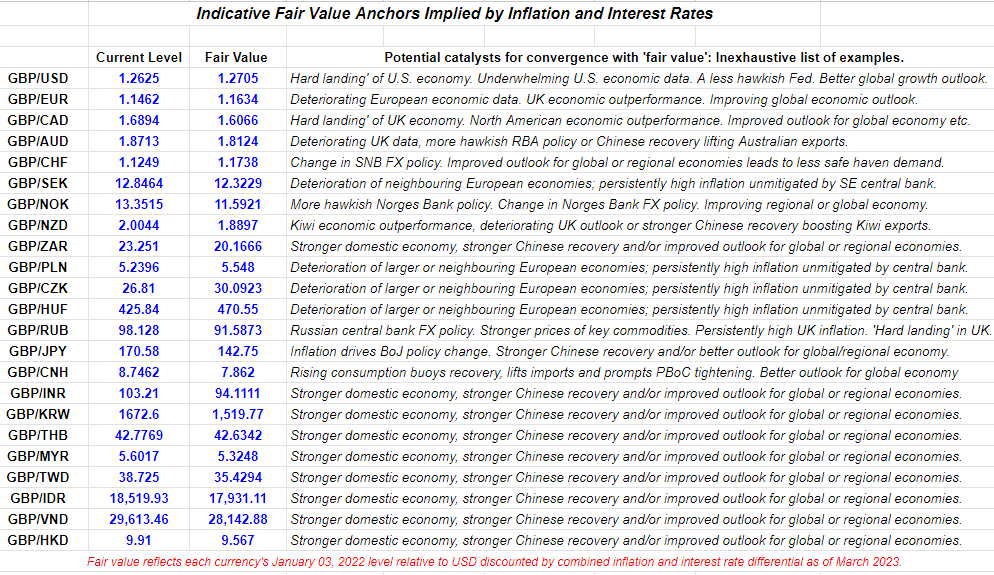

On this admittedly simplistic basis, it's possible to argue the South African Rand is significantly undervalued at its current levels, along with many other currencies.

Conversely, it would appear that Dollars have become exorbitantly overvalued with the Pound and Euro eating free lunch in relation to third-party currencies: The table at the bottom highlights how this might be true of Sterling.

"The currency has been swayed by global factors such as the banking crisis in the US, interest rate hikes globally and then, locally, the never-ending threat of load-shedding and a possible grid collapse which would cripple the economy," says Sebastian Steyne, an FX risk and hedging specialist at Sable International.

"There will again be minimal data from South Africa this week, so we will keep an eye on the currency to see if the weakness persists or if it manages to claw back some gains," Steyne writes in a Tuesday research briefing.

Above: Pound Sterling Live estimates of 'fair value.' Click the image for closer inspection.