Pound to South African Rand Week Ahead Forecast: Gaining Toehold Near 22.40

- GBP/ZAR gains toehold near 22.40 but upside uncertain

- USD trend drives amid quiet SA, UK economy calendars

- U.S. GDP & PCE eyed ahead of April Fed policy decison

Image © Adobe Images

The Pound to Rand exchange rate has held onto the bulk of its April gains in recent trade and may be in the process of establishing a foothold near the 22.40 level but the upside is likely hinged on Dollar factors and South Africa's producer prices figures out on Wednesday.

South Africa's Rand was an outperformer in the week to Monday with losses coming in relation to only the Polish Zloty and Swiss Franc, although gains over the Swedish Krona and Pound were limited in comparison with those seen against the Canadian Dollar and Brazilian Real.

Rands were bought broadly including after March retail sales underwhelmed economist forecasts and in the wake of inflation figures suggesting an uptick in the overall pace of price growth for last month, which ticked higher from 7% to 7.1% while the core inflation rate remained unchanged at 5.2%.

It's not clear what if anything that would mean for South African Reserve Bank (SARB) monetary policy but the outlook for inflation in South Africa could become clearer with Wednesday's release of producer price figures for March.

"The country continues to struggle with crippling loadshedding, reducing productivity and placing the country on wobbly ground from a global investment perspective," says Sebastian Steyne, an FX hedging specialist at Sable International.

Above: Pound to Rand exchange rate shown at daily intervals with selected moving averages and Fibonacci retracements of January rally indicating possible areas of technical support for Sterling.

Above: Pound to Rand exchange rate shown at daily intervals with selected moving averages and Fibonacci retracements of January rally indicating possible areas of technical support for Sterling.

The consensus among economists is that producer price inflation, an influence on consumer price inflation in the goods sector, likely edged lower from 12.2% to 11.05% last month in an outcome that might enable the SARB to remain comfortable with its late March forecasts for inflation and interest rates.

If so it could be the case that the outlook for the Rand will be more a function of offshore factors like the trajectory of the Dollar pairs than anything else, which would bring Thursday's U.S. GDP data and Friday's measures of U.S. inflation and labour costs into focus.

"We remain medium-term USD bears, increasing our conviction that it should drop once we get through this next round of event risk. The USD remains highly correlated to data (hard and soft equally) so another string of weak data is needed," says Mark McCormick, global head of FX strategy at TD Securities.

"We keep faith in the ability of EM FX to withstand higher US yields, but there are signs that some EM high yielders are looking a little vulnerable amid hints of lower rates (HUF) and fiscal concerns (BRL)," McCormick and colleagues write in a Monday research briefing.

Economists widely expect to see the U.S. economy having slowed further in the opening quarter when the data is released on Thursday and for the Federal Reserve's preferred measure of U.S. inflation - the Core Personal Consumption Expenditures Price Index - to have eased from 4.6% to 4.5%.

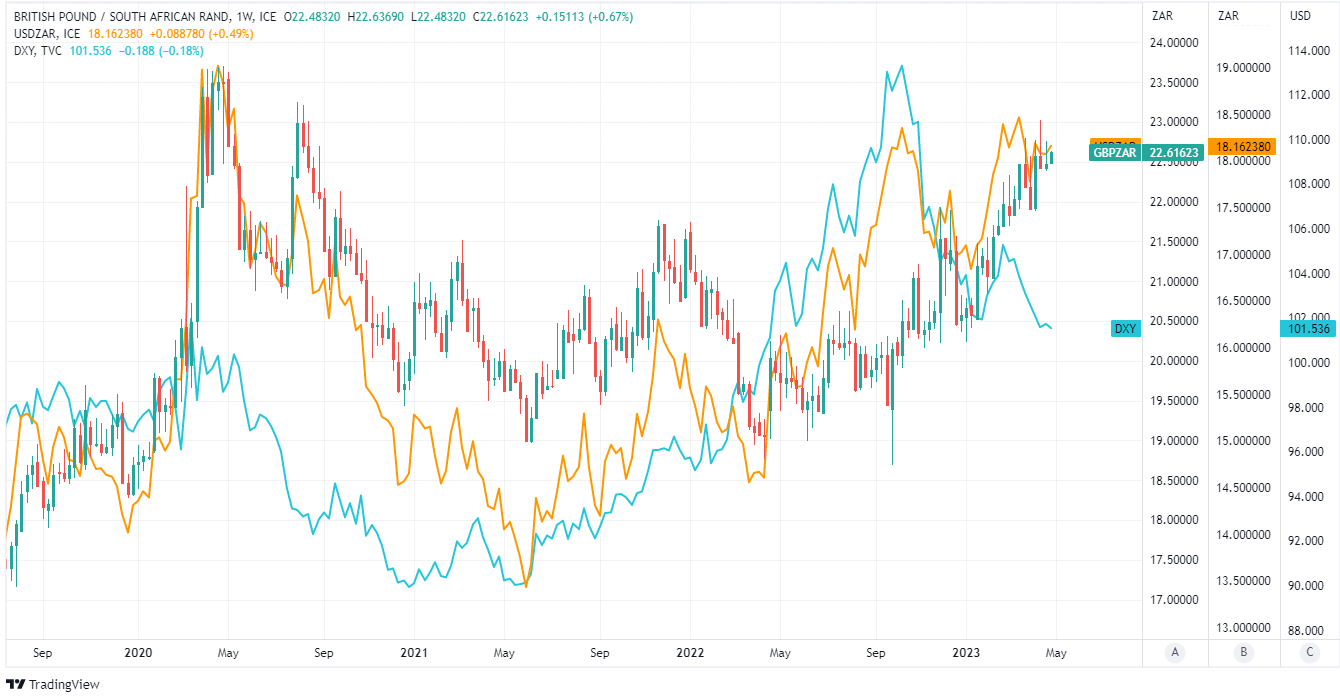

Above: Pound to South African Rand exchange rate shown at weekly intervals alongside USD/ZAR and U.S. Dollar Index. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Above: Pound to South African Rand exchange rate shown at weekly intervals alongside USD/ZAR and U.S. Dollar Index. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

"Markets continue to worry that the US will fall into recession in H2.23, as its interest rate hike cycle overshoots. With at least a two to three quarter lag between interest rate changes and the impact on the economy, further hikes entrench these concerns," says Annabel Bishop, chief economist at Investec.

"Financial markets are factoring in almost a 100% change of a 25bp hike in the US next week, while expectations of a recession are a lot lower, at 44% according to NABE (National Association of Business Economics). Uncertainty is elevated," she adds in a Monday research briefing.

It's possible, if not likely that should GDP and inflation continue to decline this week then Federal Reserve policymakers might elect to leave U.S. interest rates unchanged next Wednesday, posing risk to the Dollar while weighing on the USD/ZAR exchange rate.

There is uncertainty over the trajectory of GBP/ZAR in those circumstances, however, given South Africa's domestic economic vulnerabilities.

These - most notably loadshedding from the power grid by Eskom - have already rendered the Rand an underperformer among G20 currencies for the year-to-date and could be likely to see the South African unit underperform other non-Dollar currencies in any environment where greenback renews its recent losses.

Above: Quantitative model estimates for selected pairs this week. Source Pound Sterling Live.