GBP/NZD Week Ahead Forecast: Rallies Fade Above 2.14

Image © Adobe Images

The Pound to New Zealand Dollar exchange rate has unraveled much of its July rally in recent trade but the author's model suggests it's likely to stabilise above 2.11 in the week ahead, with any rallies fading once near or above 2.14.

GBP/NZD fell sharply from late July highs above 2.18 last week as stock markets rebounded from early August losses amid an improvement in global market risk appetite that has helped the Kiwi back onto its front foot.

The pair has tested the 61.8% Fibonacci retracement of its recent rally around 2.1105, which is underpinned by the 50-day moving average at 2.1090, and could be likely to steady above here in the days ahead.

“The RBNZ takes centre stage this week, and it’s set to be a big one,” Kiwi Bank economists said in a Monday note to clients. “The RBNZ teased a softer tone at the July policy review. This week, we expect a more formal dovish pivot, backed by a downgrade to the RBNZ’s economic outlook.”

Above: Pound to New Zealand Dollar rate shown at daily intervals with Fibonacci retracements of June rally and selected moving averages indicating possible areas of technical support for Sterling.

There is a deluge of UK economic data out this week that could offer support to Sterling but the upside risk for GBP/NZD stems mainly from Wednesday’s Reserve Bank of New Zealand interest rate decision.

Overnight index swap rates imply around a 50% probability of the cash rate being cut to 5.25%, from 5.5%, as soon as this week and most economists expect the bank to at least signal that a cut is imminent.

The market reaction to the August 01 interest rate cut from the Bank of England suggests a dovish pivot from the RBNZ might also be followed by a weakening of the Kiwi Dollar, although Kiwi Bank economists see things differently.

“Looking at current market pricing, anything less than cutting in August will cause a large spike in wholesale rates. So even if they hold in August and signal cuts from October, the market already has much more than that priced. A “hold” of any description would cause a big back up in interest rates,” they said.

Kiwi Bank economists note that while a rate cut is not nearly in the price for Wednesday, there are more than 200 basis points worth of interest rates baked into current interest rates and exchange rates for the period out until August next year, and they say these expectations are apt to be disappointed.

The risk on Wednesday, in other words, is that the RBNZ signals imminent rate cuts but pushes back against expectations for as much easing as the market envisages, triggering a rally by the New Zealand Dollar that would be likely push GBP/NZD below the nearby technical support at 2.1105.

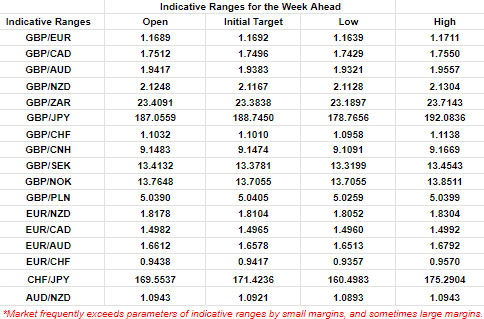

The author’s model suggests a range of 2.1108 to 2.1304 is likely for this week but the Kiwi Bank outlook indicates risk is on the downside, and any break lower from here would act as a catalyst for GBP/NZD to begin closing the gap with fair value, which is estimated to be down around 2.0435.

This estimate is derived from the author’s fair value model, which uses inflation, interest rates and the cross-currency differentials between both to estimate where currencies should trade as inflation rises and falls.

Above: Quantitative model estimates of possible ranges for the week. Source: Pound Sterling Live.