New Zealand Dollar Recovery, Rates Repricing Ahead, ANZ Says

Image © Adobe Images

The New Zealand Dollar struggled for traction against the US Dollar and Pound on Thursday but could perform better in the week ahead as the market rethinks the outlook for Kiwi interest rates, according to ANZ Research.

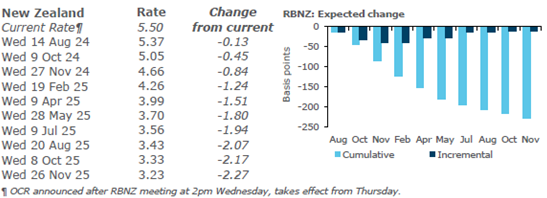

“Interest rates are rising globally again as markets regain composure, but they arguably have more scope to rise in New Zealand over coming weeks, presuming no change in the OCR next week. We don’t think recent data justifies a cut just yet,” ANZ Research strategists wrote in a Thursday research briefing.

The New Zealand Dollar struggled for traction against a mixed US dollar and broadly stronger British Pound on Thursday after an influential Reserve Bank of New Zealand survey suggested businesses’ two-year inflation expectations fell to 2.03% and their lowest level since the early months of 2021 in the third quarter.

However, the Kiwi was up against both counterpart currencies for the week after rising broadly on Wednesday when New Zealand’s second quarter employment figures were better-than-expected owing to a surprise increase in employment, and lower than expected uplift in the unemployment rate.

Above: NZD/USD shown at daily intervals alongside GBP/NZD.

“We suspect the Q2 labour market data will give anyone calling for August cuts cause for pause, especially with around 50/50 odds of a cut still priced in. We remain wary of how low rates are here. Cuts are coming, but we think August is too soon, and we could be in for a re-rating of expectations,” ANZ economists said on Thursday.

They say the resilience of the labour market means the Reserve Bank of New Zealand is unlikely to cut its interest rate next Wednesday, and that the Kiwi Dollar should benefit from a boost relative to the US Dollar as a result. Overnight index swap rates imply a 50/50 probability of a cut taking the cash rate down to 5.25%.

Any further recovery in NZD/USD would be likely to weigh further on the negatively-correlated GBP/NZD pair, which has already fallen heavily from 2.17, to 2.12 in recent days. However, the softening of inflation expectations means there is still some prospect of a rate cut next Wednesday, and a possible boost for GBP/NZD.

The idea of an August interest rate cut has gained traction after the RBNZ indicated in July that it could ease policy soon, and after data showed inflation surprising on the downside of expectations for the second quarter late last month. Kiwi inflation fell to 3.3% last quarter, from 4%, which was below the expected 3.5%.

Above: Market-implied expectations for changes in RBNZ cash rate. Source: ANZ Research.