GBP/NZD Week Ahead Forecast: Extending Lower

- GBP/NZD trending lower

- Next target identified

- Watch UK PMI for direction Thursday

- Broader USD pullback can aid NZD

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate (GBP/NZD) is trending lower in the short term and the next target is seen at approximately 2.04; however, a strong UK PMI reading on Thursday could frustrate the move.

Downside momentum in GBP/NZD looks more confident than in the main antipodean Pound-Australian Dollar exchange rate, where we also see the potential for near-term weakness but to a lesser degree.

The GBP/NZD rate's RSI momentum indicator is at 44 and is consistent with a currency pair that is trending lower in the short term, whereas that of GBP/AUD looks more neutral.

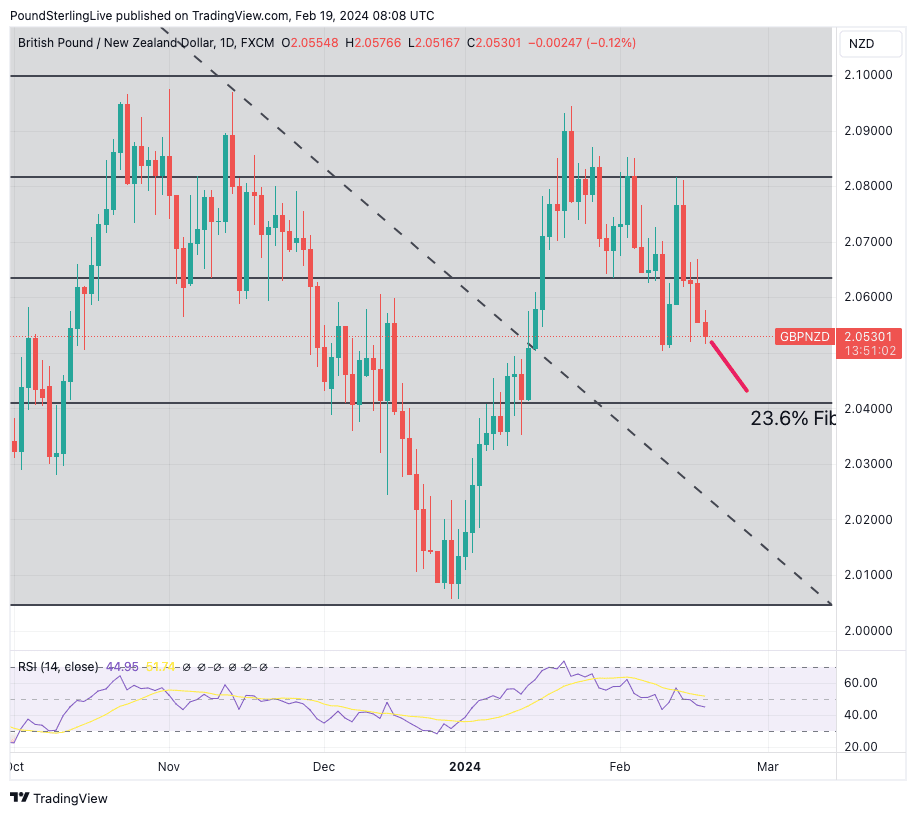

Above: GBP/NZD at daily intervals with Fib retracement and RSI (lower panel).

We note the ADX is also pointing lower in GBP/NZD, whereas it still confirms an uptrend in GBP/AUD, supporting a view that the Pound can fall further against the New Zealand Dollar.

Also of interest are the Fibonacci retracement levels from the H2 pullback in GBP/NZD from last year's highs, which still offer handy levels to identify, as per the above chart.

Given the soft momentum identified, the next target would appear to be the 23.6% Fibonacci retracement line at 2.04103.

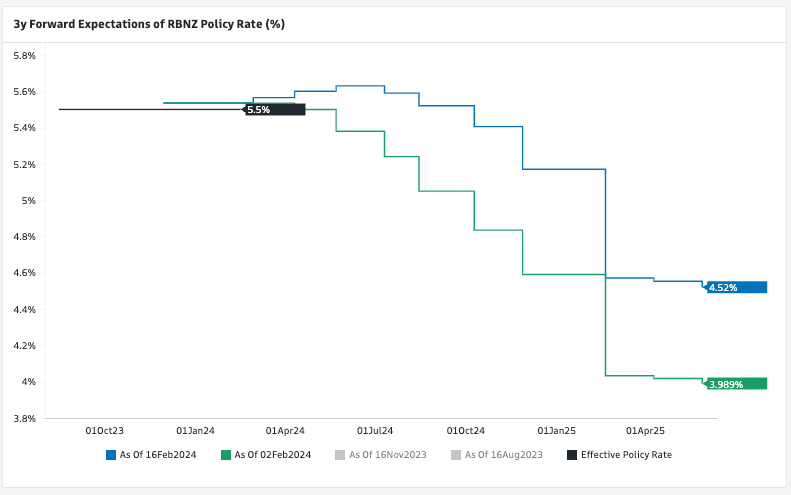

More broadly, the New Zealand Dollar is a near-term outperformer in G10 as markets now see the Reserve Bank of New Zealand (RBNZ) as likely to be one of the last major central banks to cut interest rates.

In fact, chatter of another RBNZ rate hike has risen following New Zealand's most recent jobs data that confirmed the labour market remains tight and capable of generating inflation well above the RBNZ's 2.0% target.

The NZD, therefore, has some positive momentum on the interest rate side, which can continue to play out in the near term in the absence of any major domestic and international economic calendar events this week.

Above: Markets now expect less by way of rate cuts in the future, as evidenced by the lifting in the forwards curve in February. This has assisted NZD outperformance. Image courtest of Goldman Sachs.

The U.S. Dollar will also be important to broader NZD price action this week as its 2024 outperformance looks a little stretched and prone to correction.

Any U.S. Dollar pullback can allow the 'high beta' New Zealand Dollar the space to recover and push GBP/NZD lower. Thus, the global picture will be in the driving seat this week, particularly regarding the U.S. Dollar.

We are also watching Tuesday's People's Bank of China's Tuesday policy decision for hints at further stimulus as authorities try to stimulate the stuttering economy of New Zealand's most important trading partner.

"China continues to cast a shadow on the global economic outlook. Long the key source of global demand, the economy has progressively slowed in recent years," says Taimur Baig, Chief Economist at DBS Bank. "The authorities have announced a slew of measures. Interest rates have gone in the opposite direction from the rest of the world, progressively shifting down over the past four years."

A big driver of GBP/NZD weakness was last week's UK data, which ultimately disappointed and led to a sharp turn lower in the exchange rate as markets boosted bets for Bank of England rate cuts.

This week's UK calendar is quieter, but there is the release of February PMIs to look forward to on Thursday.

Markets look for the manufacturing PMI to have recovered slightly to 47.1, services to have edged up to 54.4 and the composite to have eased to 52.7.

The lesson of the immediate past is that the British Pound is now proving more reactive to negative data surprises, which leads us to expect that any gains that follow positive surprises in the data will be limited.

Instead, the biggest moves are likely to follow downside misses in the data, which suggests risks are pointed lower heading into Thursday.

A case in point is the significant selloff in Sterling following December's retail sales miss, which contrasts with the almost indifferent market reaction to the arguably larger upside surprise that came a month later with the release of January's figures.