New Zealand Dollar Week Ahead: Gains Forecast

- NZD in strong start to the week

- As Chinese markets head higher

- Benign global backdrop to benefit NZD

Image © Adobe Stock

The New Zealand Dollar sees a solid start for the new week in sympathy with rising Chinese equity markets, and with little on the U.S., Chinese or New Zealand calendars, further gains can remain possible.

Chinese stock markets rallied, the U.S Dollar fell, and the New Zealand Dollar was at the top of the G10 leaderboard on a familiar theme: the Federal Reserve has completed its rate hiking cycle, allowing for tax cuts in 2024, which boosts global growth expectations.

"USD fell against all of the major currencies that we track in the Asian trading session," says Kristina Clifton, an analyst at Commonwealth Bank. "Market pricing for a 'soft landing' in the U.S. is likely to remain unchanged this week.

The New Zealand Dollar's rise at the start of the week confirms the linkage between NZD and Chinese/global factors remains strong and should continue to determine direction over the coming days.

"Low implied volatility, tight credit spreads, elevated equity markets, and pricing for only 100bp of rate cuts by the FOMC provide an environment for the USD to weaken further for now," says Clifton.

These conditions also provide an environment for the 'risk on' NZ Dollar to strengthen.

The New Zealand Dollar to U.S. Dollar exchange rate is up 0.55% at 0.6027 at the time of writing, the Pound to New Zealand Dollar is trading half a per cent lower on the day at 2.0700 and the Euro to NZ Dollar is down by a similar margin at 1.8105.

Track NZD with your own custom rate alerts. Set Up Here.

Imre Speizer, a strategist at Westpac in New Zealand, says to stay constructive on the NZD against the USD over the short term.

Watch the October peak in NZD/USD, where last week's rebound failed, as it suggests an element of technical resistance.

"A correction during the week ahead to the low-mid 0.59s, if seen, would present an opportunity to enter a long position targeting 0.61+ in anticipation of further bouts of USD weakness (the outsized reaction to US CPI this week suggests positioning is more sensitive to negative than positive data surprises)," says Speizer.

Westpac's bullish NZD/USD view is largely USD-driven, "whereas NZD crosses look less compelling, given recent NZ data outturns," adds the analyst.

A look at the Pound to New Zealand Dollar cross reveals further weakness can be anticipated in the already-mentioned benign global backdrop.

However, the charts confirm this pair is trending in a broad sideways direction with notable support levels that can keep NZD strength contained:

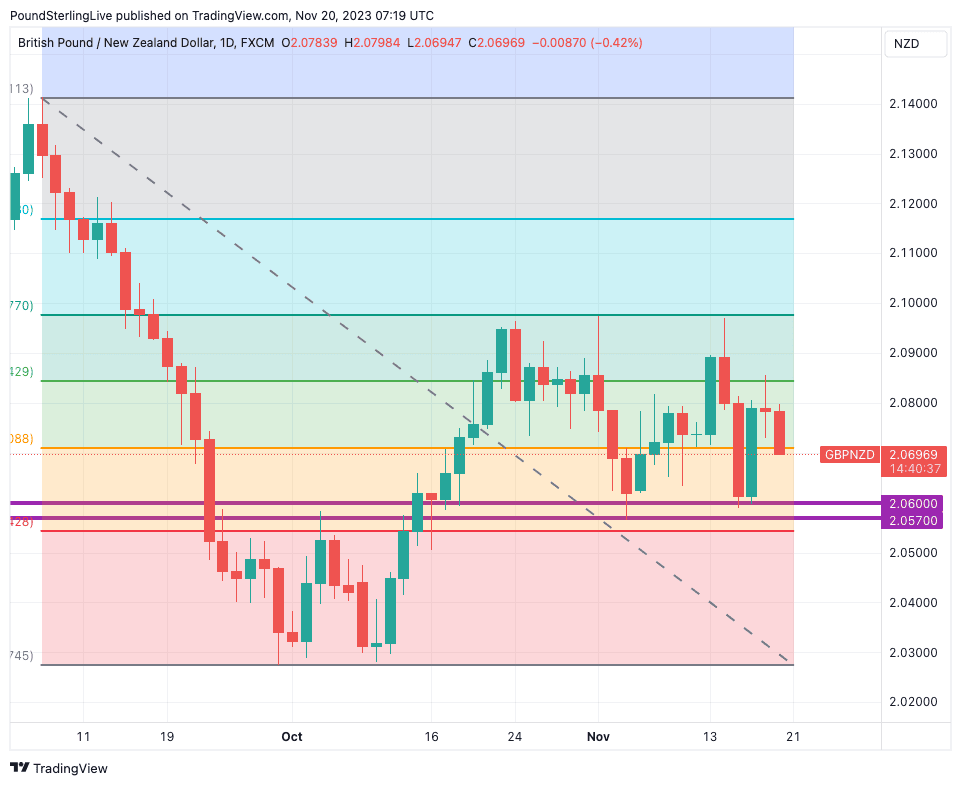

Above: GBPNZD at daily intervals.

GBPNZD is below its 100-day moving average, which suggests that, on balance, the downside is preferred with targets at 2.06 and then 2.05700 forecast for the coming week.

The 23.6% Fibonacci level at 2.0536 forms the next downside target, and we don't anticipate a break below this trio of support levels over the coming days.

Any GBPNZD rebounds are likely to be limited to the 61.8% Fibonacci level at 2.0971, which has stymied rebounds since October.