New Zealand Dollar Weakness to Resume, GBP/NZD Can Go to 2.20 Show HSBC Predictions

Image © Adobe Stock

The New Zealand Dollar faces a "longer and tougher fight" according to the most recent analysis of the currency from the global banking giant HSBC.

In a monthly currency research update HSBC says New Zealand Dollar headwinds come as a result of "a convergence of the rate cut outlook, a notably slow recovery in China, and our view of further USD strength".

The same analysis also finds the Aussie and New Zealand Dollars look set to weaken further before finding stabilisation in the second quarter of 2024, by which time the U.S. Dollar and Pound will have printed new highs.

The analysis is made in the same month the New Zealand Dollar staged a comeback against a host of currencies, such as the Pound and Euro, leading to expectations in some quarters that the worst has come to pass for the antipodean currencies.

The improvement over the August-September period has, in large part, come due to the improved sentiment towards China.

But as mentioned in Pound Sterling Live's week ahead forecast, the recent pullback in GBP/NZD still looks corrective and the broader uptrend in the exchange rate remains valid.

This is an assessment HSBC's forecasts would appear to corroborate.

Analysis from HSBC finds New Zealand's growth outlook to be poor relative to other major economies and this poses "risks of faster disinflation and larger adjustments in rate cut pricing."

"New Zealand is also more prone to stalling external funding amid risk aversion, despite strong foreign appetite for domestic debt instruments so far," adds the analysis.

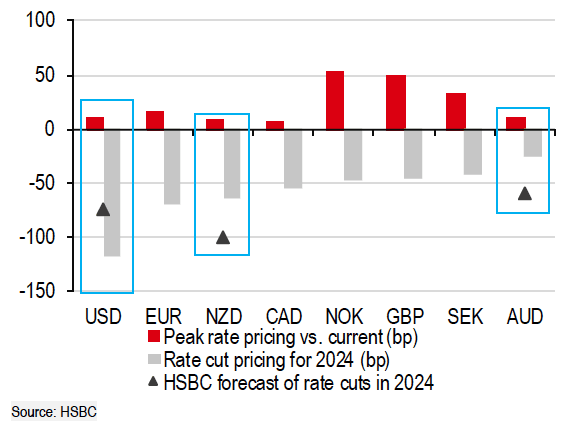

Above: Potential rate cut convergence. Image courtesy of HSBC.

Foreign exchange markets are moving to a regime whereby valuation is determined by the market's expectations for rate cuts in 2024, whereas 2022 and 2023 were all about rate hikes and assessing the peak in interest rates at the various central banks.

Currencies are now seen to be at risk of losing value if they belong to central banks that are expected to cut further and quicker than those belonging to peers that are likely to hold rates.

In this regard, HSBC finds the New Zealand Dollar vulnerable,

"With the Fed and the Antipodean central banks nearly done hiking, the relative rate cut outlook should be an increasingly important driver for FX," says HSBC.

"We expect a convergence in the rate cut outlook between the RBNZ and the Fed to become a headwind for the NZD over 4Q23 and 1Q24, too, when HSBC economics expects a more meaningful disinflation progress versus the RBNZ’s forecasts and market consensus."

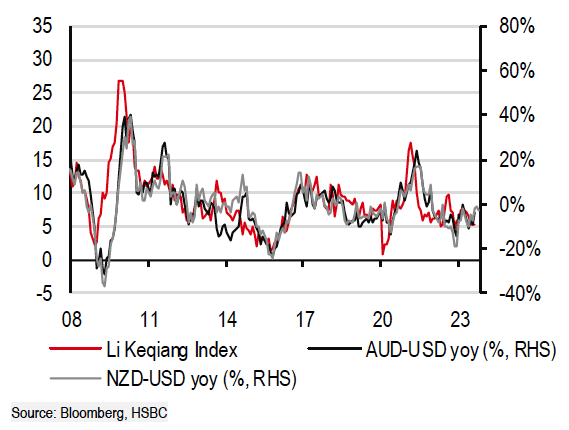

Above: The recovery in China has been "notably slow" says HSBC.

HSBC meanwhile finds the Australian and New Zealand Dollars have not benefited from the post-Covid rebound in global growth, largely because this rebound has been triggered by an improvement in the availability of commodities.

This implies lower commodity prices which are in turn unhelpful for Australian and New Zealand terms of trade, a key driver of AUD and NZD value.

For the AUD and NZD to find meaningful support, improvements in the demand outlook for Australia and New Zealand's key commodity exports, iron ore and dairy products respectively, are required.

"However, a markedly slow recovery in China remains the key constraint, with limited improvement in sight," says HSBC.

For New Zealand in particular, "both demand and supply elements indicate no immediate recovery in dairy prices, having seen very steep declines. Just as markets go into peak supply season in the Southern Hemisphere, China’s dairy demand growth remains historically low," says HSBC.

Reasons for the lacklustre Chinese demand for New Zealand dairy include large inventory levels built previously, accelerated domestic production, and a strong intention to save rather than spend for Chinese consumers.

"This means policy measures from China targeting consumption recovery are unlikely to boost its dairy-related imports in any meaningful way, if at all," says HSBC.

HSBC cuts its New Zealand Dollar forecast against the Dollar to 0.56 (NZD/USD) from 0.66 previously, the end-Q1 2024 forecast is moved to 0.55 from 0.66 previously, and end-Q2 2024 to 0.55 from 0.66.

The Pound to New Zealand Dollar forecast profile is 2.20, 2.18 and 2.15 for these same points in the future.

The Euro to New Zealand Dollar profile for these points are 1.84, 1.88 and 1.87.