New Zealand Dollar Drops after RBNZ Signals Rate Hikes are Done

"We'd call today's decision a conditional 'one and done' outcome, in that the RBNZ is now at its signaled peak, but what happens next depends on both the incoming data and global events" - ANZ.

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate soared in midweek trade and its largest intraday rally for more than seven months after the Reserve Bank of New Zealand (RBNZ) largely stayed the course it set out in April but indicated cuts to the cash rate could materialise sooner than markets imagined.

Kiwi exchange rates fell universally on Wednesday after the global godparent of inflation targeting, the RBNZ, raised its cash rate from 5.25% to 5.5% but left unchanged the projection and assumption that this newly increased level would mark the peak for borrowing costs in this cycle.

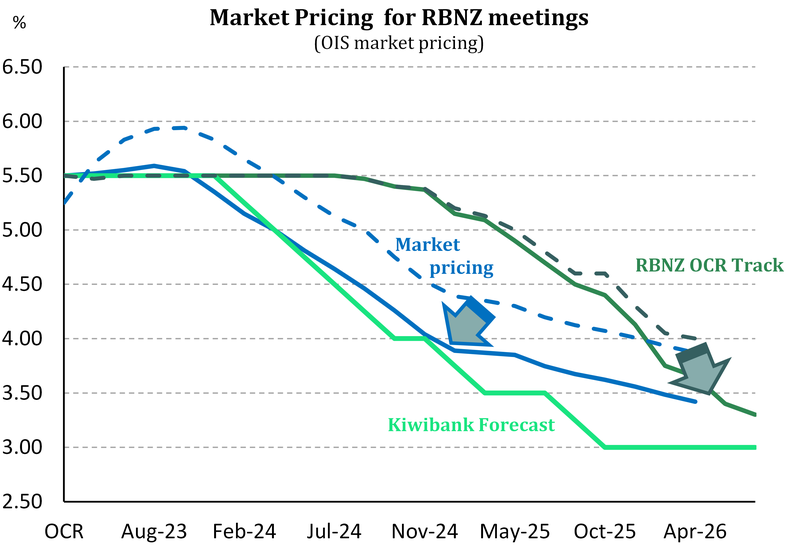

"When the market is mispriced, it moves rapidly. And we saw some brutal readjustments in pricing. Wholesale interest rates had factored in a terminal rate of close to 6%," says Jarrod Kerr, chief economist at Kiwibank.

Source: Kiwibank.

"Most of that move in rates occurred over the last week. Because most economists changed their view, arguing net migration and fiscal largesse would require more tightening. The RBNZ countered this argument," Kerr and colleague Mary Jo Vergara write in summary.

GBP/NZD rose 1.70% to 2.0200, EUR/NZD rose by a similar amount to 1.7564 and NZD/USD retreated 1.80% to 0.6135.

"In New Zealand, the local currency tanked following the Reserve Bank’s decision. Even though the RBNZ raised rates, the vote was split with some members favouring no action, and the overarching message was that this is probably the peak for rates. Zooming out, the growing signs of a slowdown in China are also detrimental for commodity-linked currencies like the kiwi," says Marios Hadjikyriacos, Senior Investment Analyst at XM.com.

Governor Adrian Orr told a press conference following the Monetary Policy Statement that interest rates would need to remain at their current restrictive level for the foreseeable future if a return of inflation to within the one-to-three per cent target band is to be assured.

"I do have to say it's very pleasing to be talking you through these statistics after a long battle," he told reporters before warning that Kiwi companies now cite "a lack of demand" from consumers as their foremost concern where before they had been preoccupied with "labour shortages."

Uncertainties about the outlook for consumer demand are high for their interlinking with other uncertainties relating to inbound migration and tourist spending, although the economy is expected to benefit meaningfully from increased investment spending over the coming years.

There was an increase in government investment baked into the budget announced last week but this was counterbalanced, from an inflation perspective, by reductions in planned government consumption suggesting that overall government spending is still likely to fall over the forecast period.

"The forward guidance today was more dovish than expected. The RBNZ kept a fairly neutral guidance rather than our expectation of guiding towards further hikes," writes Andrew Boak, chief economist for Australia & New Zealand at Goldman Sachs, in a Wednesday research summary.

Above: GBP/NZD at hourly intervals alongside NZD/USD. Click image for closer inspection.

Above: GBP/NZD at hourly intervals alongside NZD/USD. Click image for closer inspection.

Updated RBNZ forecasts RBNZ warned that a short and shallow technical recession in the middle quarters could be accompanied by a bumpy descent of the quarterly inflation rate, before being followed in the second half by a slight increase in the unemployment rate and a decline in the annual inflation rate.

"We'd call today's decision a conditional 'one and done' outcome, in that the RBNZ is now at its signaled peak, but what happens next depends on both the incoming data and global events," says Sharon Zollner, chief economist for New Zealand at ANZ.

"It wouldn't take much for markets to price out hikes altogether. But equally, if we were to see mortgage rates fall, markets might worry about that bringing the RBNZ back to the table, so to speak. In other words, expect more volatility," Zollner and colleague David Croy write in a Wednesday briefing.

Above: GBP/NZD at daily intervals alongside NZD/USD. Click image for closer inspection.

Above: GBP/NZD at daily intervals alongside NZD/USD. Click image for closer inspection.