GBP/NZD Volatility Ahead as China's Renminbi Treks South

"While it appears undeniable that the pace of de-dollarisation has gathered pace, it also appears as if the impact on the dollar’s dominance so far is little more than a dent - Rabobank.

Above: Pine timber being exported from Wellington, New Zealand. Photo by James Anderson, World Resources Institute.

The Pound to New Zealand Dollar rate could be volatile near the 2.0 level in the days ahead and vulnerable to losses thereafter as China's Renminbi migrates south amid growing concerns in the market about the outlook for the world's second largest economy.

New Zealand's Dollar climbed against an underperforming Pound on Wednesday as GBP/NZD dipped below 2.00 in a partial reversal of last week's gains and amid further widespread signs of risk aversion in broader financial markets.

"Strong retail sales, manufacturing data, and labour demand will make it difficult to achieve inflation targets indicating the Federal Reserve may have more work to come," says David Croy, a strategist at ANZ.

"So far there is no agreement on increasing the debt ceiling in the US but it is widely expected an agreement will be negotiated before the 1 June deadline," he adds in Wednesday remarks.

While some U.S. data has continued to indicate a resilient economy and risk of higher interest rates, a series of important barometers of Chinese economic activity underwhelmed forecasts for the month of April on Tuesday.

Above: Pound to New Zealand Dollar rate shown at hourly intervals with NZD/USD. Click image for closer inspection.

Above: Pound to New Zealand Dollar rate shown at hourly intervals with NZD/USD. Click image for closer inspection.

"I still don’t think the market has fully internalized or come to appreciate how much of a zilch the China reopening has become and how fast it has gone from 1⁄2 pound bacon, cheese, and mushroom burger to nothingburger," says Brent Donnelly, CEO at Spectra Markets and a veteran currency trader with a career spent at global banks including Lehman Brothers, Nomura and HSBC.

"In other words, the prices of the second order China proxies (like NZD and AUD) are too high relative to the first order proxies like copper, and the fast-evaporating narrative," Donnelly writes in Tuesday's am/FX daily macro diary.

The weakening data saw the Renminbi break below an important technical resistance level on the charts before making a beeline for the round number of 7.00 when measured against the Dollar.

It's not clear if the Tuesday data reflects just the fading economic recovery or a political directive coveting self-sufficiency in the economic image of the hermit kingdom North Korea as part of the government's "dual circulation" strategy.

But the always variable correlation between the USD/CNH, USD/NZD and USD/GBP is weakening on the above chart and a divergence is opening up.

Above: Dollar-Renminbi exchange rate shown alongside upside-down NZD/USD and GBP/USD. Click image for closer inspection.

Above: Dollar-Renminbi exchange rate shown alongside upside-down NZD/USD and GBP/USD. Click image for closer inspection.

This divergence is potentially significant because it could be the beginning of a controlled depreciation carried out by the Peoples' Bank of China (PBoC).

"The Chinese data dump was less than impressive also with nearly every reading missing relative to expectations but improving relative to the prior month's report," writes Brad Bechtel, global head of FX at Jefferies, in a Tuesday commentary.

"It is worth keeping an eye on South Korean trade figures month to month, as an early warning sign for the health of Chinese demand, global growth more broadly, and the tech sector more specifically," he adds.

A falling Renminbi and its typical correlation with other assets might lead many forecasters to infer a bearish outlook for the New Zealand Dollar, there is the possibility of a Renminbi depreciation supporting the Kiwi and some other currencies if it's aimed at stimulating the Chinese economy.

This is partly because of geopolitical circumstances, which are widely said to have reduced China's appetite for dependency on trade with the U.S and the Dollar.

"Last week Reuters reported that nearly all of its [China's} purchases of oil, coal and some metals are now settled in the yuan, rather than USDs. It also reported that Chinese imports of major commodities from Russia rose last year by 52% y/y," says Jane Foley, head of FX strategy at Rabobank.

"While it appears undeniable that the pace of de-dollarisation has gathered pace, it also appears as if the impact on the dollar’s dominance so far is little more than a dent," Foley writes in a Tuesday forecast review.

A U.S. Dollar aversion would imply a preference for other parts of the world in any forthcoming attempt to stimulate exports, meaning currencies in the emerging markets and elsewhere might be more likely to benefit which, by definition, would be supportive of other currencies.

The above chart shows how Sterling has an often-negative but sometimes-imperfect correlation with the likes of NZD/USD, GBP/USD, and the Renminbi-Dollar rate, which is why there could be short-term volatility in GBP/NZD if there is a further Renminbi depreciation.

But beyond the shortest horizon, the implications for Sterling are less clear.

Above: Pound to New Zealand Dollar rate shown at daily intervals with NZD/USD and GBP/USD.

Above: Pound to New Zealand Dollar rate shown at daily intervals with NZD/USD and GBP/USD.

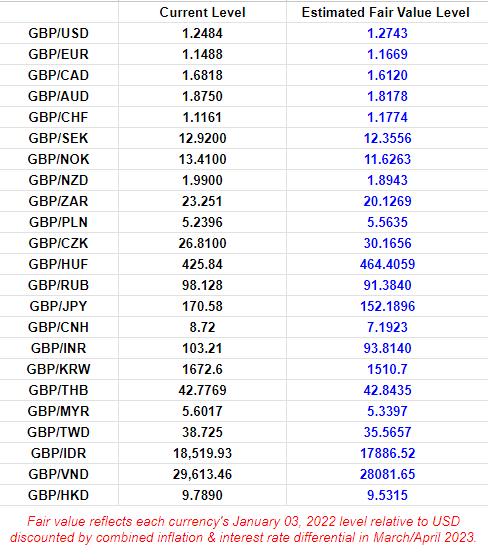

Uncertainty about the outlook for GBP/NZD results from the risks ahead of the UK economy and the possibility that many Sterling exchange rates have been left overvalued by the inflation and interest rate changes of the last year.

This, and the risk of a deterioration of the UK economy leading markets to revise down expectations for the Bank of England (BoE) Bank Rate in the months ahead, is just one set of reasons why GBP/NZD and Sterling more broadly might both sooner or later find themselves under pressure.

"The number is so bad that one can’t help but imagine there might be a revision, but many job categories saw weakness, so their revision would have to be extreme to erase the concerning signal," says John Hardy, head of FX strategy at Saxo Bank, in reference UK job figures out on Tuesday

"I am putting sterling on negative watch after this data point, but EURGBP certainly not cooperating yet on that account," he adds.

Conversely, other currencies are undervalued if measured by the same measure referenced above and below including the Renminbi.

Source: Pound Sterling Live.