GBP/NZD Week Ahead: Rally Curbed

- GBP/NZD stalls in possible exhaustion of six week rally

- Scope for holding 2.0209 to 2.0325 range in short-term

- Continued NZ job growth could reinforce GBP/NZD top

- But Fed decision, U.S. data & USD each wild card risks

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate entered the new month near one-year highs following six weeks of unbroken gains but could now struggle for further traction as attention turns to Kiwi job figures due out on Tuesday and May's Bank of England (BoE) interest rate decision next week.

New Zealand's Dollar gave ground to its Canadian, U.S. and Australian counterparts on Monday but otherwise outperformed many advanced economy counterparts including the Pound as markets contemplated mixed messages coming from economic data out in China and the U.S.

Agricultural commodity prices fell with precious metals and U.S. government bonds on Monday while industrial metals and stocks climbed after China Federation of Logistics and Purchasing (CFLP) PMI survey warned that China's economic recovery may have lost steam last month.

"In addition, the unexpected contraction in manufacturing while services held up better indicates that the country’s recovery remains disjointed and is not broad-based," writes Clive Wardle, a senior EM FX strategist at HSBC.

Wardle said on Monday that China's data indicates "more policy support will be needed," in what is a potentially bullish prognosis for the Australian Dollar but less supportive of the agriculturally-oriented Kiwi economy and currency.

Above: Pound to New Zealand Dollar rate shown at 2-hour intervals alongside NZD/USD.

Above: Pound to New Zealand Dollar rate shown at 2-hour intervals alongside NZD/USD.

Meanwhile, the latest Institute for Supply Management Manufacturing PMI indicated a possible bottoming out of the U.S. industrial sector last month but also warned of renewed inflation building within supply chains ahead of Wednesday's Federal Reserve (Fed) interest rate decision.

"Picking how markets will react to a Fed hike this late in the cycle is nuanced: a hawkish hike has potential to stoke recession fears, but a dovish hike has the potential to fan inflation fears, so expect volatility," says David Croy, a senior currency strategist at ANZ.

"But we do think we’ll see decent employment growth and a dip in unemployment here; that might help the Kiwi on Wednesday," he adds.

Wednesday's Fed decision and U.S. economic data will be important determinants of how the week pans out for exchange rates like NZD/USD and GBP/NZD also but before then both of those pairs will also likely be responsive to Tuesday's release of Kiwi employment figures for the opening quarter.

The consensus among economists suggests employment grew by a further 0.4% in New Zealand while unemployment edged higher from 3.4% to 3.5% in a first-quarter outcome that could be supportive of the Kiwi currency and a headwind to further gains in GBP/NZD.

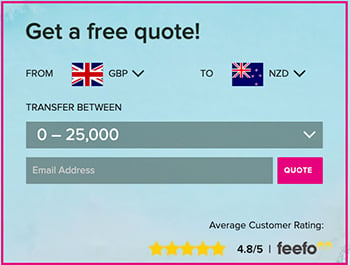

Above: Quantitative model estimates of ranges for selected pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

"AUD, CAD and NZD have made their home in the oversold category, and are approaching extreme levels," writes Mazen Issa, a senior FX strategist at TD Securities, in a Monday market research briefing. "NZD has seen one of the biggest drawdowns in growth expectations."

While Tuesday's employment data could help the Kiwi to recover from "oversold" levels against the Pound and other currencies, the risks stemming from Wednesday's Fed decision and U.S. economic figures due out later in the week are more nuanced.

On the one hand, GBP/NZD's often-negative correlation with NZD/USD suggests it would fall this week if the latter rallies in response to either Wednesday's interest rate decision or data suggesting the U.S. economy will avoid an all-out recession in the months ahead.

However, on the other side of the same coin, GBP/NZD could benefit if the Fed remains unapologetically hawkish in its interest rate stance or if the market responds to either Thursday's U.S. Services PMI or Friday's non-farm payrolls report by bidding the U.S. Dollar higher.

"NZD/GBP looks to be in range-trade mode ahead of the BoE," ANZ's Croy says.

Above: Pound to New Zealand Dollar rate shown at daily intervals with selected moving averages and Fibonacci retracements of 2023 rally indicating possible areas of technical support.

Above: Pound to New Zealand Dollar rate shown at daily intervals with selected moving averages and Fibonacci retracements of 2023 rally indicating possible areas of technical support.

Beyond the current week, much about the outlook for GBP/NZD is likely to be decided by the Bank of England next Thursday when economists and analysts widely expect Bank Rate to be raised from 4.25% to 4.5% in response to stubbornly high inflation in the UK.

Inflation held in the double-digits in March if measured on a consumer price index basis while the economy has so far proven to be more resilient than many including forecasters at the BoE had anticipated, leading financial markets to price-in as many as three further increases in Bank Rate.

What, if anything, the BoE says about those implied expectations next week will be important for determining how much of its recent gain GBP/NZD can cling to.

"Within G10 FX, GBP stands out as overbought due to seasonals and BoE expectations; we like to fade recent strength," says Adarsh Sinha, head of Asia-Pacific G10 foreign exchange strategy at BofA Global Research.

"Meanwhile, commodity currencies (ex CAD) generally look oversold, especially NZD – while we are bearish, this suggests caution on near-term NZD shorts," Sinha and colleagues write in a Friday research briefing.