GBP/NZD Rate Correction Seen Ahead

"We now await the Government’s budget in May, flanked by the RBNZ’s next rate decision. It is a big month for policymakers" - Kiwibank.

Pine timber being exported from Wellington, New Zealand. Photo by James Anderson, World Resources Institute.

The Pound to New Zealand Dollar rate fell from near six-month highs in ANZAC Day trade but could be in line for further losses in the days ahead if BofA Global Research is right about Sterling being overbought, and even more so once the May month gets underway.

New Zealand's Dollar gave further ground to the Japanese Yen and U.S. Dollar on Monday and Tuesday but rose against the remainder of the G10 basket while also performing well against G20 counterparts and some say it could be likely to remain something of an outperformer in the short term.

Meanwhile, Sterling is said to be overbought against many currencies and susceptible to a corrective setback.

"NZD underperformance stands out and while this is consistent with our fundamental view (restrictive RBNZ policy adds to downside growth risk), it suggests caution against selling at current levels," says Adarsh Sinha, head of Asia Pacific G10 foreign exchange strategy at BofA Global Research.

"GBP stands out as overbought due to seasonals and BoE expectations; we like to fade recent strength," Sinha writes in a Tuesday research briefing.

Above: Pound to New Zealand Dollar rate shown at daily intervals with Fibonacci retracements of March rally indicating possible areas of short-term technical resistance for Sterling.

Above: Pound to New Zealand Dollar rate shown at daily intervals with Fibonacci retracements of March rally indicating possible areas of short-term technical resistance for Sterling.

Sinha and the BofA team suggested on Tuesday that clients consider selling Sterling after it and other European currencies were bought almost across the board last week including when the Office for National Statistics announced said inflation fell to only 10.1% in March.

The inflation decline was slightly smaller than economists had expected and contributed to a sharp uplift in market-implied expectations of the Bank of England (BoE) Bank Rate later this year, one that BofA Global Research and others are somewhat sceptical about.

"The sharp jump in UK interest rates since December 2021 – already the biggest tightening cycle since the late 1980s – is now pretty much over," says Michael Saunders, a senior economic adviser at Oxford Economics and former member of the BoE Monetary Policy Committee.

"At this stage, we expect a further, final 25bp hike at the May meeting. But the actual decision will depend on upcoming data and market rate expectations at the time," Saunders writes in a Tuesday research briefing.

The implied endpoint for Bank Rate came close to 5% and could be the subject of a downward revision that would likely see Sterling coming under pressure if either UK economic data or the BoE itself begs to differ with that kind of level over the coming weeks.

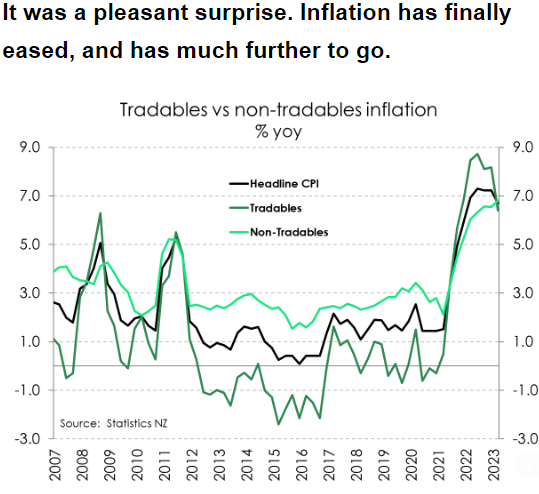

Meanwhile, New Zealand inflation fell by half a percentage point to a lower level of 6.7% last quarter in what may have been an aggravator of the Kiwi Dollar's recent losses but there are appointments in the local economic calendar that could pose added downside risk to GBP/NZD in the weeks ahead.

Source: Kiwibank. (To optimise the timing of international payments you could consider setting a free FX rate alert here.)

"Aotearoa’s inflation rate has eased to 6.7%, from 7.2%. It’s still far too high, but it’s moving in the right direction. Most importantly, inflation is running below the RBNZ’s 7.3% forecast," says Jarrod Kerr, chief economist at Kiwibank.

"We now await the Government’s budget in May, flanked by the RBNZ’s next rate decision. It is a big month for policymakers," he adds.

Notably, and just like in many other places around the G10 currency universe, the non-tradable or domestic component of inflation has not actually fallen by much in New Zealand.

However, unlike in many other places, there is also a risk of policy announcements in next month's budget that could lead the Reserve Bank of New Zealand (RBNZ) to worry about inflation persisting at above-target levels for longer than was previously assumed.

That might have 'hawkish' implications for RBNZ interest rate policy beyond those already priced into the market, which would be an added risk for GBP/NZD.

Above: NZD/USD shown at daily intervals alongside GBP/USD. Click image for closer inspection.

Above: NZD/USD shown at daily intervals alongside GBP/USD. Click image for closer inspection.