New Zealand Dollar's Inflation Win Boosts GBP/NZD, but Outlook Uncertain

"We have broken the back of the inflation beast. And we should see the last RBNZ rate hike in May," Kiwibank.

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate rose to its highest since October in the midweek session after Statistics New Zealand figures showed Kiwi inflation falling to its lowest level for more than a year but some analysts are wary of the outlook for Sterling.

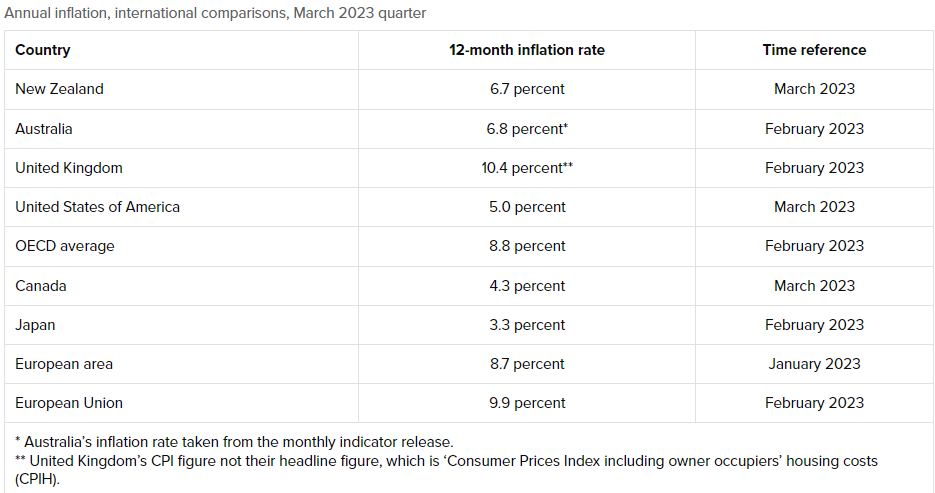

New Zealand inflation fell to 6.7% last quarter, from 7.2% previously, surprising on the low side of the economist consensus and the latest forecasts from the Reserve Bank of New Zealand (RBNZ).

"The most notable event today was a miss in NZ CPI, which sent NZD plunging," says Naveen Nair, Markets Analyst at Citi. "This trims the odds for a May 24 hike."

Economists had looked on average for prices to merely edge lower to 7.1% while the RBNZ projected in February that inflation would dip only as far as 7.2%.

"We need to take this report for what it is – good news," says Jarrod Kerr, chief economist at Kiwibank. "We have broken the back of the inflation beast. And we should see the last RBNZ rate hike in May."

Above: Pound to New Zealand Dollar rate shown at daily intervals with selected moving averages and featured alongside NZD/USD.

Above: Pound to New Zealand Dollar rate shown at daily intervals with selected moving averages and featured alongside NZD/USD.

The Kiwibank team says the RBNZ is likely to raise its cash rate from 5.25% to 5.5% next month before beginning to cut the benchmark in November.

It's possible that financial markets were contemplating the timing of interest rate cuts when selling the New Zealand Dollar.

"NZD/USD dropped by about ½ cent following the New Zealand CPI. New Zealand swap rates fell up to 10bp along the curve. NZD is likely to fall modestly further in the London, and possibly New York sessions," says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

"We agree with market pricing that the RBNZ will increase the cash rate once more by 25bp to 5.50%. However, we disagree with market pricing that rate cuts could start in November 2023," he adds in Thursday market commentary.

New Zealand Dollar losses lifted GBP/NZD to some of its best levels since last September's UK government budget on Thursday although the pair had help previously from a rally in Sterling, which followed Wednesday's release of March inflation figures in the UK.

Source: Statistics New Zealand.

Source: Statistics New Zealand.

UK inflation fell from 10.4% to 10.1% when economists had looked for it to fall back into the single digits last month while the more important core inflation rate remained unchanged at 6.2% for a second month running.

"Markets are fully priced for a 25bp hike by the BoE in May and are also now discounting some further increases over the summer months," says Hann-Ju Ho, an economist at Lloyds Commercial Banking.

The UK data is potentially a source of apprehension for the Bank of England (BoE) after it forecast in February that price growth would decelerate rapidly over the second quarter to reach around 4% by year-end.

Prices in interest rate derivative markets have shifted since Wednesday to imply some probability of the Bank of England (BoE) raising Bank Rate as far as 5% over the coming months, although the CBA team is sceptical that this would be necessary of whether this will be necessary.

"We expect one, possibly two, more rate hikes by the BoE. Therefore, there is some downside to GBP from here in our view," Capurso says.