New Zealand Dollar Forecasts Warn of Losses Ahead in AUD/NZD and Gains for EUR/NZD

"That hike is more or less priced into markets" - Commonwealth Bank of Australia.

Image © Adobe Images

The New Zealand Dollar has lagged behind many other major currencies thus far in the year but updated forecasts from Commonwealth Bank of Australia suggest the Kiwi could underperform further in the short-term while warning of divergence between AUD/NZD and EUR/NZD from here.

New Zealand's Dollar was a middling performer among major currencies on Friday but remained close to the back of the pack for the week and one of the bigger fallers for the year-to-date.

Reserve Bank of New Zealand (RBNZ) interest rate policy and dimming prospects for some economies around the world have been widely cited as prominent internal and external headwinds for New Zealand, and a likely driver of the Kiwi Dollar's underperformance.

"The Reserve Bank of New Zealand remains concerned that demand is expanding faster than supply. Our ASB colleagues predict one more 25bp increase in the cash rate to 5.5%. That hike is more or less priced into markets," says Joseph Capurso, head of international economics at Commonwealth Bank of Australia, in a Thursday review of CBA's currency forecasts.

"New Zealand's current account deficit is very large at 9% of GDP. Financing current account deficits can become more difficult when the world economy slows and is therefore a downside risk to NZD," he adds.

CBA's latest forecasts suggest the bottom is not quite in for the Kiwi in NZD/USD with levels as low as 0.58 seen as likely later this year, reflecting a downgrade of the short-term outlook for the pair.

Projections for year-end and next year have been upgraded, however, with NZD/USD now seen recovering to 0.61 by year-end before rising to 0.65 in 2024.

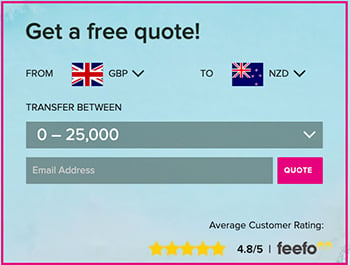

Meanwhile, the outlook for the Kiwi in GBP/NZD is similar with Sterling seen in the 1.9836 to 2.00 range until late September before falling back to 1.9077 in 2024.

But the New Zealand Dollar is seen as likely to rise against the Australian Dollar through much of this year and next, while falling persistently against the Euro.

"We expect EUR/USD to recover in late 2023 as inflation in advanced economies falls closer to central bank targets and the outlook for the world economy improves," Capurso says in reference to the Euro.

"We expect a recovery in AUD to emerge later this year as market participants price an eventual recovery in the global economy," he adds.

Above: GBP/NZD shown at weekly intervals alongside NZD/USD, EUR/NZD and AUD/NZD. Click image for closer inspection. (To optimise the timing of international payments you could consider setting a free FX rate alert here.)

The reopening of China's economy from a year of coronavirus-related closures was widely expected to benefit the New Zealand economy but exports of Kiwi commodities like meat and dairy have been soft while rising interest rates are leaning against demand from elsewhere in the world.

Pressure on the export sector has been a driver of the deepening New Zealand trade deficit, alongside elevated demand for imports, while both have helped to deepen a current account deficit that is now the largest in the developed world.

These factors are all short-term headwinds for the New Zealand economy and Dollar, although both could eventually benefit and perhaps more than most others when global economic growth eventually picks up if the repair and rebuild following February's weather events is slow to play out.

"Chinese demand for milk remains soft. In addition, Chinese milk supply and inventories are high. The forecast lower milk price will weigh on NZD," Capurso says.

"The recent natural disasters disrupted New Zealand's economy. The rebuild and renovation will take time amid a tight labour market," he adds.