GBP/NZD Rally at Risk from Any Hawkish RBNZ Surprise

"Consensus is overwhelmingly looking for a downshift in the hiking pace to 25bp, leaving us as the only one in the 50bp camp among the 18 analysts surveyed by Bloomberg" - BofA Global Research.

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate has rallied strongly over recent weeks but will risk being stopped in its tracks this week if BofA Global Research economists are on the money with their forecast for Wednesday's Reserve Bank of New Zealand (RBNZ) interest rate decision.

New Zealand's Dollar was close to being an underperformer on Tuesday when it appeared to follow the Australian Dollar toward the bottom of the major currency bucket after the Reserve Bank of Australia (RBA) left its cash rate unchanged for the first time in more than a year.

Kiwi losses came alongside an outperformance that helped lift the Pound to its highest level since October on Tuesday but the rally in GBP/NZD would potentially be liable for a partial reversal if BofA Global Research is right to anticipate a hawkish surprise from the RBNZ on Wednesday.

"Consensus is overwhelmingly looking for a downshift in the hiking pace to 25bp, leaving us as the only one in the 50bp camp among the 18 analysts surveyed by Bloomberg (16 expect a 25bp hike and oneexpects a pause)," says Devika Shivadekar, an economist at BofA Global Research.

"We think the central bank would be wary of being seen as going soft on inflation before price data have moved decisively lower. Unlike the RBA, which has been prioritizing a soft landing, the RBNZ has been resolutely focused on stamping out inflation," she adds in a Tuesday research briefing.

Above: Pound to New Zealand Dollar rate shown at daily intervals with Fibonacci retracements of late 2022 downtrend indicating possible areas of technical resistance, while selected moving averages denote possible support for Sterling.

Above: Pound to New Zealand Dollar rate shown at daily intervals with Fibonacci retracements of late 2022 downtrend indicating possible areas of technical resistance, while selected moving averages denote possible support for Sterling.

Shivadekar and colleagues have tipped the RBNZ to raise its cash rate from 4.75% to 5.25% on Wednesday in what would be a hawkish surprise for the market consensus and a potentially favourable development for the New Zealand Dollar.

Underlying the forecast are the latest inflation developments in New Zealand and the RBNZ's "least regrets" approach to bringing inflation back to within the 1% to 3% target band, which has emphasised the high costs of doing too little, too late in order to restore price stability.

All other professional forecasters tip the RBNZ as likely to begin drawing its interest rate cycle to a close by lifting the cash rate from 4.75% to 5% in what would be the smallest increase for borrowing costs since November 2021 and shortly after the RBNZ first began raising interest rates.

"Economic surprises have been much more negative in New Zealand lately, culminating in a big miss for Q4 GDP. Housing is also contracting, and business confidence is not far from the lows," says Jayati Bharadwaj, an FX and macro strategist at Barclays.

"The RBNZ, on the other hand, is priced in line with their published rate path for the next few meetings, including a 25bp hike this week," Bharadwaj adds.

Above: NZD/USD shown at daily intervals alongside GBP/USD. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: NZD/USD shown at daily intervals alongside GBP/USD. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

New Zealand inflation remained unchanged at 7.2% in the final quarter and the RBNZ projected in February that its cash rate will likely need to rise to 5.5% later this year and remain there for a period of time in order to return inflation to the target.

Whether the RBNZ sticks with that stance in light of recent turbulence in the U.S. and European banking sectors potentially matters as much for the New Zealand Dollar outlook as the size of any interest rate change announced on Wednesday.

Local analysts and economists see little chance of offshore financial volatility or risk dislodging the RBNZ from its earlier established policy course, however, suggesting that Sterling might need to do any heavy lifting involved in order to further extend the rally in GBP/NZD over the second half of the week.

"The Reserve Bank is nearing the point at which it can 'watch and wait' as higher interest rates do their work, but for now it will leave the door open for further hikes," writes Michael Gordon, a senior economist at Westpac, in a late March research briefing.

"Monetary policy is now actively working to slow the economy. But it will still be a long and uncomfortable wait until we get back to low and stable inflation," Gordon adds.

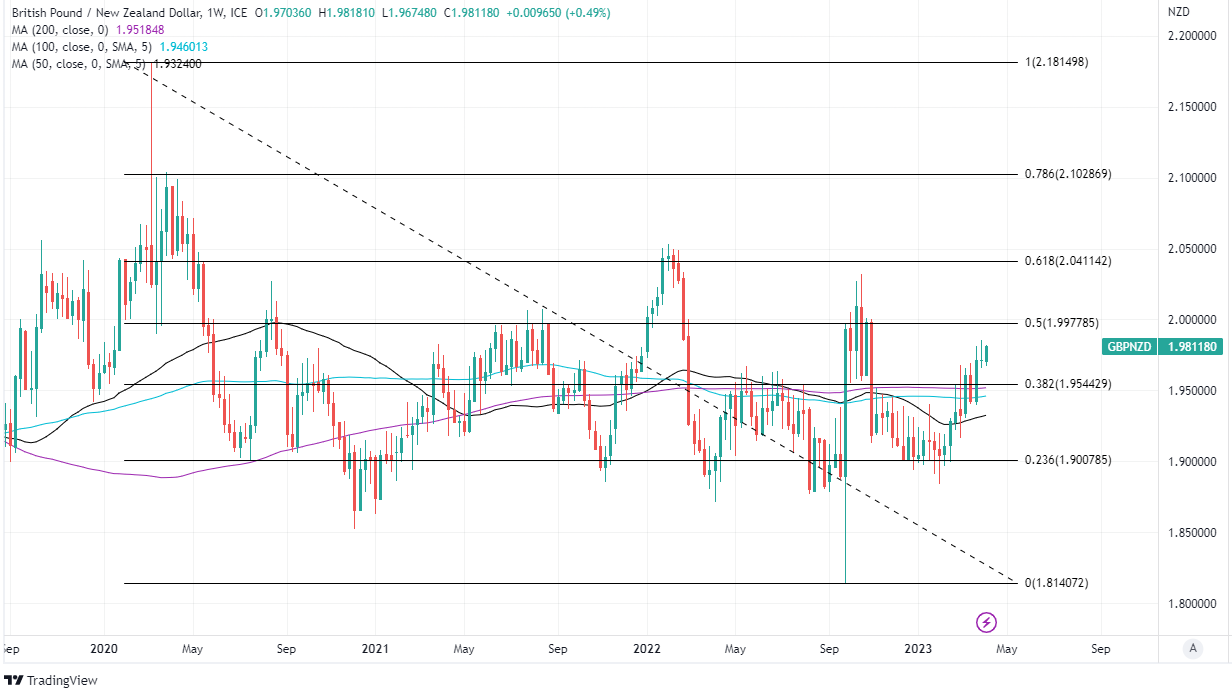

Above: Pound to New Zealand Dollar rate shown at weekly intervals with Fibonacci retracements of 2020 downtrend indicating possible areas of technical resistance, while selected moving averages denote possible support.

Above: Pound to New Zealand Dollar rate shown at weekly intervals with Fibonacci retracements of 2020 downtrend indicating possible areas of technical resistance, while selected moving averages denote possible support.