GBP/NZD Week Ahead Forecast: Rally Runs Short of Road

- GBP/NZD rally risks being stalled by any rebound in AUD

- AU retail sales & CPI pose upside risk to RBA rate pricing

- Better prospect of April rate rise may turn GBP/NZD lower

- BoE speak key for GBP; NZD eyes Oz data, RBA outlook

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate opened the new week with a rally to fresh five-month highs but would likely be susceptible to any mid-week rebound by the Australian Dollar and might also struggle if a tenative recovery in global markets continues through the coming days.

New Zealand's Dollar notched up losses against all major counterparts barring the Australian Dollar on Monday, enabling GBP/NZD to rise more than half a percent with the help of an outperforming Pound while making the Kiwi the second worst-performer in the G10 contingent for the recent week.

Kiwi Dollars were sold even as banking and finance shares pare earlier losses amid a rebound in global markets that may have overlooked New Zealand following the sharp double-digit fall in industrial profits announced by the National Bureau of Statistics previously.

"The laggards are AUD, NZD and CAD as the China re-opening story has struggled for confirmation in markets and as oil prices remain mired near 1-year lows," says John Hardy, head of FX strategy at Saxo Bank.

Above: Pound to New Zealand Dollar rate shown at 2-hour intervals alongside NZD/USD. Click image for closer inspection.

Above: Pound to New Zealand Dollar rate shown at 2-hour intervals alongside NZD/USD. Click image for closer inspection.

Currencies of many Chinese trade partners were underperformers on Monday after factory profits fell -22.9% for the year to the end of February but it's the details and implications of Australian economic figures out Tuesday and Wednesday that might be likely to have most effect on GBP/NZD this week.

GBP/NZD tends to have a negative correlation with NZD/USD and so would likely struggle if Australian retail sales and inflation figures lead the AUD/USD pair to attempt a recovery from recent losses, which have also appeared to weigh on the New Zealand Dollar.

An Australian Dollar rebound and setback for GBP/NZD would be particularly likely if economists and financial markets were to assign better odds to the idea of the Reserve Bank of Australia (RBA) announcing an increase in its currently 3.6% cash rate next week.

"Local economic data includes the business outlook survey (Thursday) and consumer confidence (Friday). Our colleagues at ASB expect the results of both surveys to be downbeat," says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

Above: GBP/NZD at daily intervals with selected moving averages indicating possible technical support and Fibonacci retracements of 2020 downtrend denoting prospective areas of resistance. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: GBP/NZD at daily intervals with selected moving averages indicating possible technical support and Fibonacci retracements of 2020 downtrend denoting prospective areas of resistance. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

"However, the outcomes are unlikely to impact market pricing for the RBNZ, or the NZD," Capurso and colleagues write in a Monday research briefing.

There is little by way of major appointments in the calendar for each of the Kiwi and Sterling this week, although the New Zealand Dollar could benefit to detriment of the Pound if early selling of China-linked assets peters out and the nascent improvement in global market risk appetite endures.

Meanwhile, however, the Pound is likely to pay close attention to public remarks from Bank of England (BoE) Governor Andrew Bailey and colleagues when as they appear before the Treasury Select Committee on Tuesday where questions about recent turbulence in the banking sector are expected.

This is all after the BoE raised Bank Rate from 4% to 4.25% last week, citing an economy that has been less weak than expected in recent months, but left financial markets guessing about the outlook when pegging future decisions to the data emerging from the UK economy up ahead.

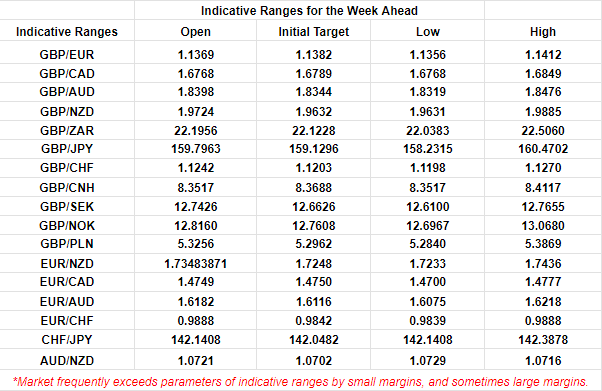

Above: Quantitative model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

"The risk to banking systems offshore, has led to a lowering of Kiwi wholesale rates onshore. The RBNZ’s proposed hiking path to 5.5% is becoming increasingly unlikely," writes Jarrod Kerr, chief economist at Kiwibank, in a Monday economics commentary.

"We have always said a move beyond 5% would be a step too far. And we believe the RBNZ will come around to this view. Market traders agree. The 2-year swap rate has fallen fast, dropping from 5.5% earlier in the month to 4.85% at time of writing," Kerr adds.

Banking stocks, other shares and risky assets more generally had been sold heavily last week as financial markets asked questions about the stability of a large German bank barely a week after similar questions led the Swiss government to force a merger between Credit Suisse and UBS.

Turbulence in the European banking sector followed the mid-to-late-March failures of Silicon Valley Bank and others, which are threatening to stifle lending to companies and households and have been widely seen as truncating the interest rate cycles in the U.S., Australia, New Zealand and other parts.

Above: GBP/NZD at weekly intervals with Fibonacci retracements of 2020 downtrend indicating possible areas of technical resistance for Sterling and selected moving averages denoting prospective support. Click image for closer inspection.

Above: GBP/NZD at weekly intervals with Fibonacci retracements of 2020 downtrend indicating possible areas of technical resistance for Sterling and selected moving averages denoting prospective support. Click image for closer inspection.