GBP/NZD: Resistance Could Stymie Rally

- Risk of GBP/NZD rally extending further in short-term

- But resistance could stymie around 1.9751 on charts

- NZ trade figures & Kiwi recovery could stall GBP/NZD

- But outlook also hinged on Fed, BoE policy decisions

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate extended a six-week rally in the opening session of the week and could yet rise further in the days ahead but such an outcome would bring Sterling into contact with a Fibonacci resistance at 1.9751, which could frustrate the ascent.

New Zealand's Dollar was close to the worst-performing major currency in Monday's trading session when it counted Switzerland's Franc and South Africa's Rand for company at the bottom of the G20 league table even as stock indices found their feet and the U.S. Dollar turned lower.

U.S. Dollar rates fell from the North American open while stocks and commodities turned higher but the Pound to Kiwi exchange rate continued to climb in price action that could be indicative of further gains being in store for Sterling in the middle and later stage of the week.

"We are not reading too much into it given how volatile markets have been of late, and given that all major crosses are within their respective 5-day trading ranges," says David Croy, a senior FX strategist at ANZ.

"NZ trade data today might pique the market’s interest after last week’s shocker current account deficit – this data is for February, so it is far more current – but it is only goods trade, so is only part of the picture," Croy adds.

Above: Pound to New Zealand Dollar rate shown at hourly intervals alongside NZD/USD. Click image for closer inspection.

Above: Pound to New Zealand Dollar rate shown at hourly intervals alongside NZD/USD. Click image for closer inspection.

New Zealand's trade in goods balance is the highlight of the domestic calendar for the Kiwi and the consensus among economists suggests the NZ$1.95BN deficit of January likely narrowed to around NZ$1.45BN in February, which might be a supportive outcome at the margins for the currency.

Much about the Pound to Kiwi Dollar performance this week is also heavily contingent on Wednesday and Thursday interest rate decisions from the Federal Reserve (Fed) and Bank of England (BoE), however.

"Despite the market turmoil, the European Central Bank stayed the course. Another 50bp hike was delivered as expected, taking its key deposit facility rate to 3%," says Mary Jo Vergara, a senior economist at Kiwibank.

"All eyes now turn to the US Federal Reserve. The March meeting will be a real test of the Fed’s resolve in bringing down inflation. We expect the Fed will take its cue from the ECB," Vergara adds in Monday market commentary.

Financial markets have revised down their implied expectations for the Fed's interest rate this year owing to the recent bonfire of banking stocks and a small number of bank failures in the U.S. and the UBS takeover of Credit Suisse that was organised by Swiss authorities at the weekend.

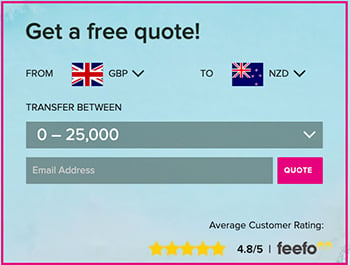

Above: Pound to New Zealand Dollar rate shown at daily intervals with selected moving averages indicating possible areas of technical support for Sterling and Fibonacci retracements of October downtrend indicating possible levels of technical resistance. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: Pound to New Zealand Dollar rate shown at daily intervals with selected moving averages indicating possible areas of technical support for Sterling and Fibonacci retracements of October downtrend indicating possible levels of technical resistance. To optimise the timing of international payments you could consider setting a free FX rate alert here.

These events and the resulting market volatility mean that Wednesday's decision is seen as being a close call in relation to whether the Federal Reserve will even raise borrowing costs at all, meaning the Dollar could rise with implications for other currencies if interest rates are lifted.

"Looking ahead much further, by mid-year, we would expect to see a more NZD-supportive environment, as Fed pricing passes a peak and US economic performance is assessed. NZD/USD could start a multi-month rise toward the high 0.60s," says Imre Speizer, head of NZ strategy at Westpac.

There are reasons for why the Fed might yet raise interest rates again including inflation data released last week, which showed both of the main measures of inflation falling in annual terms but only just so after the month-on-month measure of core inflation surprised on the strong side of expectations.

The consensus among economists still favours an increase to between 4.75% and 5% for the Fed Funds rate and the last set of Federal Open Market Committee forecasts indicated in December that the benchmark could rise to anywhere between 5% and 5.5% this year.

Sterling would potentially benefit if the Fed raises interest rates on Wednesday because GBP/NZD tends to have a negative correlation with NZD/USD and an often-positive correlation with other measures of the U.S. Dollar, which might be likely to rise if the Fed pushes ahead this week.

Above: NZD/USD shown at daily intervals with selected moving averages. Click image for closer inspection.

Above: NZD/USD shown at daily intervals with selected moving averages. Click image for closer inspection.

Much about the outlook for GBP/NZD is also hinged on the outcome and implications of Thursday's interest rate decision from the Bank of England, which is even more of a close call than the Fed decision on Wednesday.

"On Thursday,we expect the BoE to lift interest rates by 25bp. With 12bp priced, GBP may lift modestly," writes Joseph Capurso, head of international economics at Commonwealth Bank of Australia, in a Monday research briefing.

"There is some evidence UK inflation and the labour market is cooling. Alongside uncertainties in US and European banks, slower growth in demand supports the case for a smaller increase in interest rates," Capurso adds.

The BoE turned non-committal in its guidance on the outlook for Bank Rate last month and most Monetary Policy Committee members speaking since then have stopped short of endorsing another increase in interest rates for March.

This potentially leaves a lot to be determined by Wednesday's UK inflation figures and whatever the BoE makes of last week's budget, which led the Debt Management Office (DMO) to estimate a 2023/24 borrowing requirement higher than that expected following September's 'mini budget.'

Above: Financial model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)