GBP/NZD Week Ahead Forecast: Buoyant Below Recent High

- GBP/NZD supported by key averages just below 1.93

- Still remains buoyant but below recent high up ahead

- With BoE & RBNZ policy stances reflecting similarity

- NZ card spending, BoE speech & UK GDP data eyed

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate has climbed above the top of a five-month range over last week and could remain buoyant in the days ahead, albeit at levels that are likely to remain below the recent highs.

New Zealand's Dollar spent much of the Monday session on the back foot but it remained one of the best-performing major currencies in the G10 basket for the recent week after halting a rally in Sterling at the five-month highs that were seen in GBP/NZD last Tuesday.

"We remain attuned to the possibility of ongoing NZD volatility as markets weigh the pros and cons of post-flood rebuilding/sticky inflation/higher rates against the prospect of exports being disrupted and the USD benefitting from higher rates there," says David Croy, a strategist at ANZ.

"NZD/GBP is holding in the high-0.51s for now [near low 1.96s for GBP/NZD]. Like NZD/EUR, not much contrasting each leg," Croy and colleagues write in a Monday market commentary.

While the Kiwi has remained both buoyant and volatile in recent trade, Sterling has also been likewise after last Tuesday's S&P Global PMI surveys lifted the Pound broadly only for it to then come undone in the wake of midweek remarks from Bank of England (BoE) policymakers.

Above: Pound to New Zealand Dollar rate shown at hourly intervals alongside NZD/USD. Click image for closer inspection.

Above: Pound to New Zealand Dollar rate shown at hourly intervals alongside NZD/USD. Click image for closer inspection.

"CPI inflation is projected to fall to below the 2% target by the end of the forecast horizon, as increased economic slack reduces domestic inflationary pressure. However, there are considerable uncertainties around this outlook, and the MPC continues to judge that the risks to inflation are skewed significantly to the upside," the BoE's chief economist Huw Pill told the Institute of Directors at Wales Week in London last Thursday.

"That said, some high-frequency indicators of wages have fallen quite sharply recently, such as the KPMG/REC permanent staff salaries index. The MPC will continue to monitor indications of persistence in domestic inflationary pressures closely, with a focus on developments in the labour market, in wage dynamics, in services price inflation and in measures of underlying inflation and inflation expectations," he added.

Commentary from the BoE's chief economist was broadly neutral in its indications about the outlook for Bank Rate last week while the Wednesday words of Governor Andrew Bailey were also unequivocal in their non-committal tone about the likely trajectory of borrowing costs.

"Inflation has been slightly weaker, and activity and wages slightly stronger, though I would emphasise ‘slightly’ in both cases. A further set of data will be coming in before our next monetary policy decision later this month," Governor Bailey told a Brunswick Group conference last Wednesday.

"At this stage, I would caution against suggesting either that we are done with increasing Bank Rate, or that we will inevitably need to do more," he added.

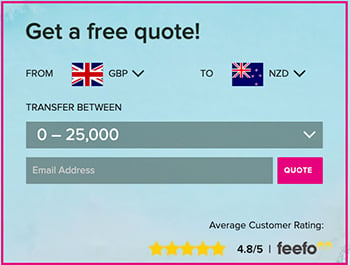

Above: Financial model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

There is a similarity between the tone, policy stance and present policy positions of the BoE and Reserve Bank of New Zealand (RBNZ) that would not be inconsistent with a GBP/NZD exchange rate that remains buoyant but below last week's highs in the days ahead.

"We are tacking into the inflation headwinds right now by raising interest rates at times of severe capacity constraints in the economy and high inflation. We continued to do that last week. We continued to do that last week," says RBNZ Governor Adrian Orr, in a Friday speech.

"While there are early signs of price pressures easing, core consumer price inflation remains too high, employment is still beyond its maximum sustainable level, and near-term inflation expectations remain elevated," he later added in an address to the NZ Economics Forum at Waikato University.

While Governor Orr noted tentative progress in the RBNZ's effort to return Kiwi inflation to within the one-to-three percent target band last week there was also an acknowledgment of upside risks stemming from the aftermath of recent natural disasters and the rebuilding process that follows.

There is significant repair and reconstruction work ahead in New Zealand after the severe flooding, the Gabriel cyclone and the subsequent earthquakes that blighted the North Island or Aotearoa part of the country before migrating south toward the capital and the Te Waipounamu part throughout February.

Above: NZD/USD shown at daily intervals with selected moving averages. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: NZD/USD shown at daily intervals with selected moving averages. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

This repair and reconstruction work would be taking place against the backdrop of a tight labour market in which wages and future inflation risks are rising, which keeps open-ended questions about the RBNZ policy outlook in prominent consideration for the market.

Meanwhile, minor data covering retail card spending in February are also likely to garner attention on the Kiwi side of the GBP/NZD equation on Wednesday.

"NZD/USD can be supported by a softer USD. But the disappointment from China’s Two Sessions will likely weigh on NZD early in the week," says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

"There is upside resistance at 0.6338 (50 day moving average). Domestic economic data includes some partial indicators of NZ Q4 GDP and card spending data for February. This data is unlikely to be market moving," Capurso and colleagues write in a Monday research briefing.

For Sterling, on the other hand, Wednesday's speech from the BoE's Swati Dhingra is the highlight ahead of this Friday's January GDP data, which the consensus suggests will show a 0.1% rebound doing very little to reverse the steep -0.5% fall seen in December.

Above: Pound to New Zealand Dollar rate shown at daily intervals with selected moving averages. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: Pound to New Zealand Dollar rate shown at daily intervals with selected moving averages. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.