GBP/NZD Rate Week Ahead Forecast: Risking Slippage Near to 1.90

- GBP/NZD could test 1.93 if RBNZ cuts cash rate forecasts

- Nears 1.90 if RBNZ looks past disasters to stay its course

- Effects of reconstruction could see RBNZ remain hawkish

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate (GBP/NZD) entered the new week within a short distance of 2023 highs but would risk falling near to the round number of 1.90 if the Reserve Bank of New Zealand (RBNZ) stays the hawkish interest rate course set out in November's forecasts.

New Zealand's Dollar edged higher against most major currencies while Sterling featured as an underperformer to open the new week with the net effect pulling GBP/NZD down from February highs near 1.93 in Monday trade.

So far efforts to reclaim that level have fallen afoul of 200-day and 100-day moving averages at 1.9293 and 1.9318 respectively but it might be likely to make another attempt at overcoming them if recent Kiwi inflation developments lead the RBNZ to reduce its forecasts for the cash rate on Wednesday.

"Market pricing has reduced to a high probability of a 50bp hike following the impact of cyclone Gabrielle in the country, but we think the scope for the RBNZ to downshift its OCR forecast is limited," writes John Kalamaras, a global macro strategist at Morgan Stanley, in a Monday market commentary.

"While CPI came in marginally below the RBNZ's forecasts, headline and core inflation have remained elevated in absolute terms and consumer spending has slowed only marginally. This contrasts with RBNZ comments that it wants to see "sufficient restraint on spending" before dialling back policy," he adds.

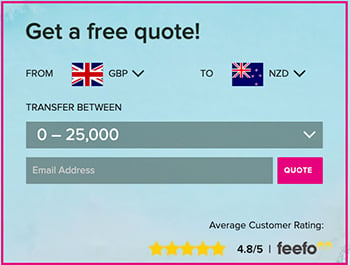

Above: Pound to New Zealand Dollar rate shown at daily intervals with selected moving averages. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

New Zealand's inflation rate held steady at 7.2% in the final quarter last year when the RBNZ had assumed that it would rise to 7.5% while the central bank's latest survey suggested recently that business' expectations for inflation had fallen at most time horizons early in the new year.

Inflation expectations for this year ticked higher from 5.08% to 5.11% but they dipped notably from 3.62% to 3.30% when businesses were asked where they see price growth in two years' time while survey responses to questions about inflation some five years out were also lower.

"Our colleagues at ASB expect the RBNZ to lift the cash rate by 50bp on Wednesday. The RBNZ is also likely to signal more tightening is likely. By comparison, financial markets are currently pricing around 43bp," says Carol Kong, an economist and strategist at Commonwealth Bank of Australia.

"The RBNZ is likely to mention the recent storms in the post-meeting communication but we do not expect these events to alter the path of monetary policy," Kong and colleagues write in a Monday research briefing.

Economists widely expect the RBNZ to lift its cash rate by half a percentage point to 4.75% on Wednesday while market-implied expectations suggest investors view the balance of risk as being on the downside if anything, which could have implications for GBP/NZD if the bank stays its hawkish course.

The RBNZ indicated in the last set of forecasts released in November that New Zealand's cash rate would be likely to rise to 5.5% in the months ahead if the economy performs and inflation behaves in line with its other forecasts.

Above: Financial model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

But while inflation came in lower than was anticipated for the final quarter, there are reasons for why the RBNZ might want to maintain November's hawkish policy stance regardless, which is an outcome that would potentially lead GBP/NZD back toward the 1.90 level.

"Although local analysts still overwhelmingly expect a 50bp hike by the RBNZ this week, the market is pricing in a small chance of a lesser move due to the devastation wrought by Cyclone Gabrielle. That’s fair – it certainly can’t be ruled out," writes Sharon Zollner, chief economist at ANZ, in a Monday note.

"But in our view, monetary policy is not the right tool for the job, and could do more harm than good. It is slow-acting and broad-brush, whereas fiscal policy can be fast and targeted. And with inflation so high (and this an inflationary shock at the end of the day), not staying the course could mean even higher interest rates are required down the track," Zollner and colleagues add.

While New Zealand's inflation rates came in lower than was anticipated by the RBNZ for the final quarter, many local analysts say the repair and rebuilding work necessitated by February's flooding and the destruction caused by Cyclone Gabrielle is likely to have inflationary implications.

This is because it will boost demand for construction workers and materials at a time when labour resources are scarce and the RBNZ is attempting to restrain spending so as constrain and ultimately reduce the inflation rate to levels consistent with the 1% to 3% target band.

Above: Pound to New Zealand Dollar rate at weekly intervals with selected moving averages. Click for closer inspection.

Above: Pound to New Zealand Dollar rate at weekly intervals with selected moving averages. Click for closer inspection.