GBP/AUD Week Ahead Forecast: Supported Above 1.9315

Image © Newtown Grafitti, Reproduced under CC Licensing.

The Pound to Australian Dollar exchange rate has receded from early August highs but economic data on both sides of the GBP/AUD equation could help the pair to steady above 1.9315 in the week ahead.

GBP/AUD fell sharply from early August highs around 2.0042 last week as an improvement in global market risk appetite helped stock markets and highly correlated currencies to rebound from prior losses.

The pair has tested and found support around the 50% Fibonacci retracement of its 2024 uptrend around 1.9315 in recent trade, though some local strategists see scope for a move below here up ahead.

“AUD/GBP could have a bumpy week with important economic data scheduled for release in both Australia and the UK. The next level of resistance is at 0.5192 (50% fibbo) [support for GBP/AUD at 1.9260],” Commonwealth Bank of Australia strategists said in a Monday research briefing.

Above: Pound to Australian Dollar rate shown at daily intervals with Fibonacci retracements of 2024 uptrend and selected moving averages indicating possible areas of technical support.

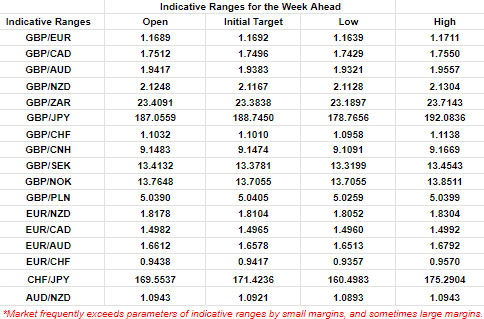

The author’s model suggests a 1.9321 to 1.9556 range is likely in the week ahead but an action-packed economic calendar on both sides of the GBP/AUD equation could threaten a breakout on the downside.

Any break lower would lead GBP/AUD to further close the gap with fair value, which is currently down around 1.9171, according to the author’s fair value model. The model uses inflation, interest rates and the cross-currency differentials between both to estimate where currencies should trade as inflation rises and falls.

A break beneath support at 1.9315 would be more likely if either of this week’s key economic numbers from UK surprises on the downside of expectations, as this would weigh on Sterling, or if US inflation data for July is softer than expected as that could boost AUD/USD at the expense of the negatively-correlated GBP/AUD.

“AUD/NZD can test resistance at 1.1015 (76.4% fibbo) if the Reserve Bank of New Zealand (RBNZ) cuts interest rates this week as our ASB colleagues expect,” CBA strategists also said.

Above: Quantitative model estimates of possible ranges for the week. Source: Pound Sterling Live.

One factor on the Aussie dollar side that could help steady GBP/AUD up ahead would be if the Reserve Bank of New Zealand surprises CBA’s ASB colleagues by leaving its cash rate unchanged on Wednesday, as this could lead profit-taking on AUD/NZD, which would weigh on AUD/USD and support GBP/AUD.

Another factor that could support GBP/AUD would be any softer-than-expected reading of the second quarter wage price index in Australia as this could, at the margins, lead the Reserve Bank of Australia to become less worried about the risk of persistent inflation, which it flagged as a concern last Tuesday.

“US recession fears have subsided quickly and the widespread view is that markets had an overly pessimistic read of the weak June payrolls report. But the week ahead is full of key US data and markets can still be easily rattled. AUD/USD looks set to remain choppy and challenging,” Westpac economists said on Monday.

“The risk of a more abrupt slowing in the US economy is the overriding global macro focus and markets are ultra-sensitive to any and all US data. Even smallish surprises on CPI and retail sales could ignite outsized market swings,” they added.