GBP/AUD Rate Supported by RBA Interest Rate Hold

Image © Adobe Images

The Australian Dollar was broadly softer following a decision by the Reserve Bank of Australia (RBA) to once again pause its interest rate hiking cycle.

The RBA left the cash rate at 4.10% and said, "higher interest rates are working to establish a more sustainable balance between supply and demand in the economy and will continue to do so."

The market was split 50/50 on whether or not the central bank would raise interest rates again following the June hike, but analysts were wary of a stop-start tendency to policy resulting in another pause.

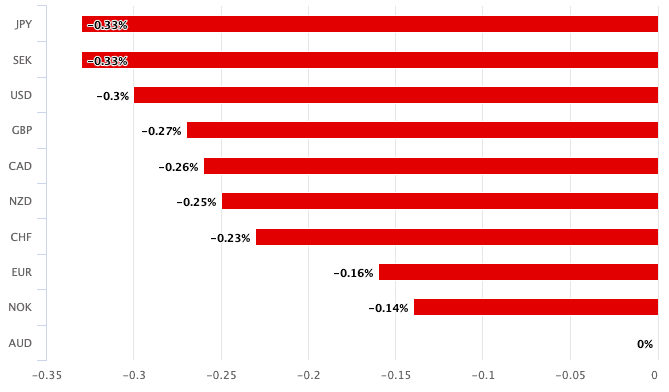

The result of the decision to halt interest rates was a broadly weaker Australian Dollar:

Above: AUD was lower right across the board on July 04 in the wake of the RBA decision.

The Pound to Australian Dollar exchange rate (GBPAUD) is seen a quarter of a per cent higher at 1.0960 at the time of writing amidst a broader weakness in the Aussie Dollar.

The Australian Dollar to U.S. Dollar exchange rate (AUDUSD) was 0.20% lower at 0.6660 and the Euro to Australian Dollar rate (EURAUD) was more contained at 1.6371.

Looking ahead, the RBA said there remains "uncertainty" as to how supply and demand would evolve and the decision to hold "provides the Board with more time to assess the state of the economy and the economic outlook and associated risks."

Analysis from RBC Capital Markets says the prospect of further rate hikes at the RBA looks more remote following July's pause and associated guidance.

"The onus remains on the data to weaken and probably more materially (given the global inflation trends) to keep the RBA on hold. The bar to hike looks a little higher from this statement," says Elsa Lignos, Global Head FX Strategy at RBC Capital Markets.

Australian Dollar weakness would reflect a suspicion amongst market participants that Australian interest rates are unlikely to rise much further.

This matters in a currency market currently driven by interest rate differentials, with those currencies benefiting from higher domestic rates tending to outperform, for example, the Pound.

Analysts are not yet fully discounting the prospect of a further interest rate, although for the Aussie Dollar, it remains clear the peak is close at hand.

"Our base case remains the RBA will increase its cash rate to 4.35% in August so long as the Australian economic data (employment, inflation and retail) evolves in line with our view. AUD/USD can drop a little further in the London session as investors digest the RBA’s decision," says Joseph Capurso, an analyst at Commonwealth Bank of Australia.

However, currency strategists at UniCredit Bank say they are looking for the Aussie Dollar to be supported amidst the prospect of further interest rate hikes.

"We favour buying this pair on dips as the RBA warned that some further tightening may be required," says Roberto Mialich, strategist at UniCredit Bank in Milan.