GBP/AUD Rate Could Reach for the Sky if CPI Invites New High

"AUD/GBP can remain heavy this week because interest rate differentials have moved against this currency pair." - Commonwealth Bank of Australia.

Image © Adobe Images

The Pound to Australian Dollar exchange rate opened the holiday-shortened week near the month's highs and some of its best levels for more than a year but it could reach toward the sky if inflation recedes further in the direction of the Reserve Bank of Australia (RBA) target this Wednesday.

Australia's Dollar edged higher against some counterparts during early trade in Europe on Tuesday while holding in the middle of the major currency rankings for the recent week but it lagged behind higher-yielding alternatives like the Pound, Canadian Dollar and U.S. Dollar for both periods.

Sterling was an outperformer on Tuesday when it remained buoyant above 1.89 against its antipodean counterpart but it could get an opportunity to rise above 1.90 from midweek if Australia's monthly inflation indicator records a fourth successive decline on Wednesday.

"We expect the RBA to leave the cash rate on hold at its June meeting unless there is a big upside surprise to the monthly CPI. Current market pricing implies the RBA is more likely to pause rather than increase rates," says Carol Kong, an economist and strategist at Commonwealth Bank of Australia.

Above: Pound to Australian Dollar rate shown at daily intervals with selected moving averages and Fibonacci retracements of September 2022 recovery indicating possible areas of technical support for Sterling. Click for closer inspection.

The potential rub for Sterling, however, is the economist consensus suggesting last month likely saw Australian inflation tick higher from 6.3% to 6.4% in an April outcome that would be consistent with data emerging from other advanced economies for that month.

That would interrupt a hat-trick of declines that has pulled the annual pace of inflation down from 8.4% in December but whether that's enough on its own to meaningfully alter the balance of market-implied expectations for the Reserve Bank of Australia cash rate next month remains to be seen.

"With Aussie rates pricing 6bp of hikes in the June RBA meeting (a 25% chance of a hike), a number above 6.6% could see that pricing closer to 10bp with the market sensing a hike could be very much on the table," says Chris Weston, chief market analyst at Pepperstone.

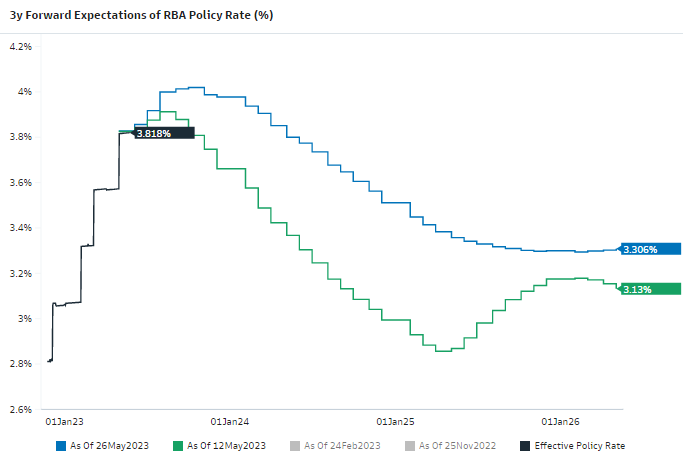

Above: Change in market-implied expectations for RBA cash rate between selected dates. Source: Goldman Sachs Marquee. Click for closer inspection.

The RBA lifted its cash rate to 3.85% on May 02 but expectations have shifted since then to suggest a high probability of an August increase taking the benchmark to 4% or more, despite official figures suggesting a softer labour market and moderating wage growth in the interim.

But the bank also warned this month of a limited margin for error in relation to its forecasts for inflation, given the length of time it's expected to take in returning to within the two-to-three percent target band, while Governor Philip Lowe said further increases in the cash rate shouldn't be ruled out.

"Australia’s Fair Work Commission (FWC) will announce its annual decision for minimum and award wage rates over the coming weeks. While there is significant uncertainty around the outcome, we expect to see a weighted-average increase of 5¼%. The increase will directly boost the wages of the ~20% of workers on these contracts," says Andrew Boak, chief economist for Australia & New Zealand at Goldman Sachs.

Source: Goldman Sachs Marquee. Click for closer inspection.

"Our baseline wage forecasts remain consistent with our expectation for one more +25bp hike in July to 4.1%. That said, if the Fair Work Commission increases minimum and award wages by more than our base case of 5¼% – for example by 7% as requested by unions – we expect the RBA to respond with an additional 25bp hike to 4.35% sometime in 2H2023," Boak adds.

The limited margin for error around the RBA's inflation forecasts and the risk of further stimulus for price pressures including from things like wage bargaining agreements within the unionised parts of the workforce are why any meaningful increase in inflation this Wednesday would be potentially significant.

Such an outcome could prompt an upward revision to expectations for the cash rate and a rally in the Australian Dollar with bearish implications for GBP/AUD, although conversely, a downside surprise and fourth consecutive decline in inflation would likely have the opposite effect.

Above: GBP/AUD at weekly intervals with Fibonacci retracements of 2020 fall indicating possible areas of technical resistance for Sterling. Selected moving averages denote prospective support and/or resistance. Click for closer inspection.

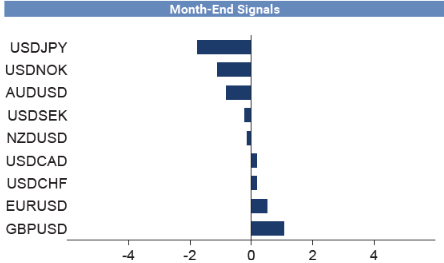

"AUD/GBP can remain heavy this week because interest rate differentials have moved against this currency pair. The next level of downside support is at 0.5145 (23.6% Fibbo) [GBP/AUD 1.9436]," CBA's Kong says.

"We remain confident AUD/USD will fall to 0.64 by the end of June, though the risk is sooner rather than later," Kong and colleagues add in reference to the effect that fading market optimism about the Chinese economic outlook could be likely to have on Australian Dollar rates up ahead.

Official figures have suggested in recent weeks that China's recovery from the economic closures of the pandemic may be losing momentum, leading to pressure on prices of many commodities including those underpinning the Australian economy's trade surplus.

The above factors are a further headwind for the Australian Dollar, and could remain an additional source of support for GBP/AUD in the absence of any upward revision to market pricing of the RBA cash rate outlook on Wednesday.

Above: AUD/USD at daily intervals alongside copper price as well as upside down Dollar-Renminbi rate and upside down U.S. Dollar Index. Click for closer inspection.