GBP/AUD Week Ahead Forecast: Gravity Constrains

- GBP/AUD finding foothold around 1.86 short-term

- Upside potentially limited as downside risk lingers

- AU inflation expectations, & U.S. CPI & BoE eyed

Above: King Charles III coronation procession, The Mall, London. Image © John-Parnell, Flickr,

The Pound to Australian Dollar rate edged higher in the opening session of a holiday-shortened week but any further gains could be limited with GBP/AUD potentially listing to the downside in the wake of Thursday's Bank of England (BoE) forecast update and interest rate decision.

Australia's Dollar gave way to many other major currencies on Tuesday when underperforming alongside counterparts in Europe as the Dollar rose broadly and risky assets fell in many parts of the world amid signs of risk aversion in international markets.

Modest losses in Australian exchange rates helped a slightly more resilient Sterling to steady around 1.86 following a week of declines since the turn of the month and might partially reflect the implications of Chinese trade figures released overnight and concerns about the U.S. debt ceiling.

"China’s export growth slowed in April amid weakening external demand. The drop in import growth also quickened, reflecting subdued domestic demand and weaker commodity prices," says Carol Kong, an economist and currency strategist at Commonwealth Bank of Australia.

Multi-decade highs for interest rates are headwinds first and foremost for economies in the U.S. and Europe but may also be impacting the recovery in China with possible implications for the Australian economy further down the line.

Above: GBP/AUD shown at daily intervals with Fibonacci retracements of February rally indicating possible areas of technical support for Sterling. Click image for closer inspection.

Above: GBP/AUD shown at daily intervals with Fibonacci retracements of February rally indicating possible areas of technical support for Sterling. Click image for closer inspection.

Australia's economy was already widely projected to slow this year but retail sales figures for March and the first quarter appeared to confirm a slowdown already underway on Tuesday with nominal retail sales up 0.4% in March but down on the quarter for a second time running, suggesting a softer real economy,

"The back to back falls mark the biggest six-month contraction in retail sales volumes since 1986 (excluding the COVID and GST introduction periods)," says Matthew Hassan, an economist at Westpac.

"Annual growth slowed to 0.3%yr – stalling speed, and a material 1.3%yr contraction in per capita terms. The detail shows weakness in the quarter centred on household goods and was more pronounced in Qld," Hassan writes in a Tuesday research briefing.

This might also have contributed to gains in GBP/AUD but price action through the rest of the week is likely to reflect the outcomes and implications of Wednesday's U.S. inflation data as well as Thursday's Melbourne Institute inflation expectations figures and Bank of England (BoE) policy decision.

Any signs of an increase in inflation expectations might be positive for the Australian Dollar if enough to impact the outlook for Reserve Bank of Australia (RBA) interest rate policy but the antipodean currency might be likely to benefit more if the U.S. disinflation trend extends further in the midweek session.

Further declines in U.S. inflation might encourage further selling of the U.S. Dollar and an uplift in AUD/USD, which is often negatively correlated with GBP/AUD, although much about the outlook for the Pound also depends on Thursday's BoE decision and Friday's economic growth data.

"In the UK, both the inflation figures and the wage increases have recently been much stronger than hoped for - the issue of fighting inflation is therefore not yet over," writes Katin Lohken, an economist for the UK & Japan at DWS Group, in a Tuesday research briefing.

"It still expects its previous rate hikes to significantly slow the economy. At present, however, it is obviously still too early for that. The British economy has held up better than expected and has probably even made it through the winter without a recession," she adds.

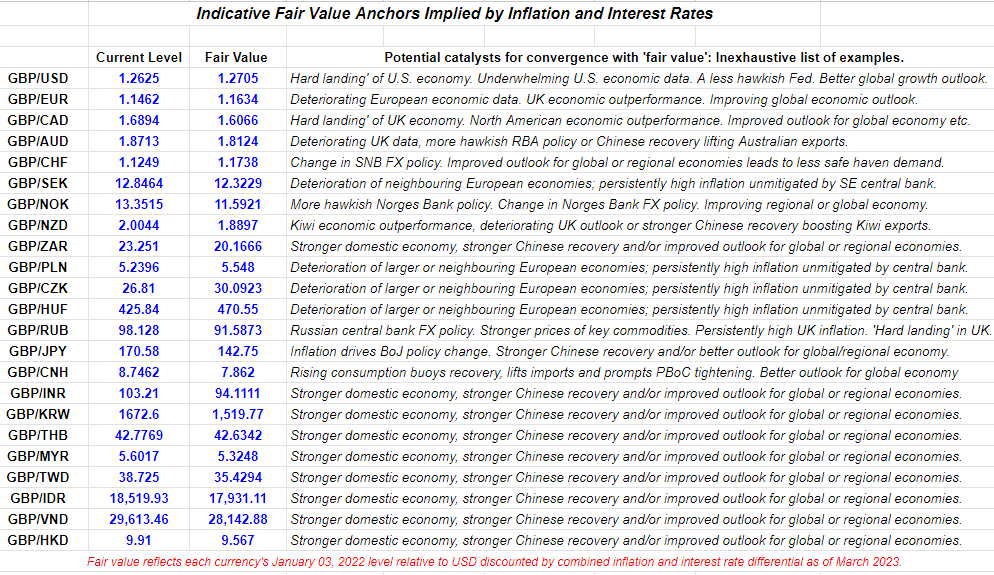

Above: Pound Sterling Live estimates of 'fair value.' Click the image for closer inspection.

There is uncertainty over what the BoE will say and do in response to recent inflation figures after prices pressures proved slower in dissipating than many economists had expected for the first quarter, and given the BoE has itself been looking to see a rapid decline in the second quarter.

"The MPC is likely to exhibit a relatively hawkish tone and retain optionality over the direction of policy going forward, including avoiding any reference, explicit or otherwise, to pausing its tightening cycle," says Elsa Lignos, global head of FX strategy at RBC Capital Markets.

"Data wise, monthly GDP prints of 0.4% m/m and 0.0% in January and February mean that Q1 GDP is likely to be positive overall (Friday)," she adds.

Economists and markets expect Bank Rate to be lifted from 4.25% to 4.5% and have also been betting on it rising as far as 5% later this year so it's far from clear the BoE could say or do anything much to lift Sterling on Thursday.

Any further boost in GBP/AUD might be more likely to follow a continuation of Tuesday's risk aversion in global markets or Friday's UK GDP data, although the latter would likely require the economy to have outperformed expectations for another month of 0% growth in March.

Above: Pound to Australian Dollar rate shown at weekly intervals with Fibonacci retracements of 2020 fall indicating possible areas of technical resistance for Sterling while selected moving averages indicate possible medium-term technical supports. Click image for closer inspection.

Above: Pound to Australian Dollar rate shown at weekly intervals with Fibonacci retracements of 2020 fall indicating possible areas of technical resistance for Sterling while selected moving averages indicate possible medium-term technical supports. Click image for closer inspection.