Australian Dollar Needs Help of Sterling to Drive Deeper Correction in GBP/AUD

"And our judgement, at least at the moment, is that the benefits we would get from getting inflation back to three per cent six months earlier at the cost of a lot of job losses isn’t worth it" - Reserve Bank of Australia Governor Philip Lowe.

Image © Adobe Stock

The Australian Dollar softened in midweek trade after pulling a previously-rallying Pound lower from one-year highs in prior sessions but the antipodean currency might need the help of its currently-resilient UK counterpart if the correction in GBP/AUD is to be sustained over the days ahead.

Australian Dollar exchange rates ebbed in early European trade on Wednesday as many currencies relinquished gains made briefly after data from the National Bureau of Statistics of China hinted at a modest pick-up in the world's second largest economy during February.

Wednesday' price action appeared to have stalled a rally underway since last week when funding pressures at some U.S. financial firms snowballed into the failures of Silicon Valley Bank and others, leading to a federal intervention on Sunday aimed at preventing panic among depositors elsewhere.

"They took imprudent duration risk, ignored objections, and it blew them up. I think that answer is fine," writes Matt Levine for Bloomberg Opinion.

"A more complicated answer would be that they took duration risk, as banks generally do, but their real sin was having a concentrated set of depositors who were uninsured, quick-moving, well-informed, herd-like and very rates-sensitive in their own businesses," he adds.

Above: GBP/AUD shown at hourly intervals alongside GBP/USD and AUD/USD. Click image for closer inspection.

Above: GBP/AUD shown at hourly intervals alongside GBP/USD and AUD/USD. Click image for closer inspection.

Earlier financial upset has prompted a market reappraisal of the outlook for Federal Reserve (Fed) policy, calling into question whether the interest rates will even be raised at all at next week's meeting while seeing investors and traders bet again that borrowing costs will be cut before year-end.

Concerns were that psychological shock from recent events would stifle bank lending and the broader economy, reducing the workload of the Federal Reserve for the months ahead while weighing heavily on U.S. exchange rates to the benefit of AUD/USD and others this last week.

"In our view, the actions by US regulators to address financial stability risks will enable the FOMC to continue its fight against inflation. We continue to expect the FOMC to raise interest rates by 25bps next week," says Carol Kong, an economist and currency strategist at Commonwealth Bank of Australia.

"AUD/USD is trading near around 0.6685. Australian government bond yields were little changed in the absence of local economic data. The next domestic economic highlight is the Australian labour force report (12:30am London time)," Kong and colleagues write in Wednesday market commentary.

The CBA team is looking for Australian employment to have risen by 45k when data for February are released in the early hours of Thursday, which would draw a line under a two-month contraction that has called the Reserve Bank of Australia (RBA) cash rate outlook into question over recent months.

Above: Pound to Australian Dollar rate shown at daily intervals alongside GBP/USD and AUD/USD. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: Pound to Australian Dollar rate shown at daily intervals alongside GBP/USD and AUD/USD. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Australian economic growth also softened into year-end while a moderation of inflation in January led the RBA to suggest this month that it may have peaked, reopening the door to a pause in its interest rate cycle as soon as April.

"We’ve discussed the case for being even more aggressive with interest rates and trying to get inflation back to three per cent before the end of ‘25*. It would be possible to do that," Governor Philip Lowe told reporters at the Financial Review Business Summit 2023 in early March.

"But it would come at the cost of forgoing many of those gains in the labour force that I talked about before. And our judgement, at least at the moment, is that the benefits we would get from getting inflation back to three per cent six months earlier at the cost of a lot of job losses isn’t worth it," he added.

The RBA's underlying strategy is to "preserve the gains in the labour market as much as we can," and keep "the economy on an even keel" while allowing time for inflation to come down to within the 2% to 3% target band, which imposes a 2.5% inflation target for the medium term.

Australia's inflation target is slightly higher than in other advanced economies and for years before the pandemic, the RBA had struggled to meet it even after multiple interest rate cuts, which is one set of prospective reasons for its relatively more laid-back stance in relation to recent inflation.

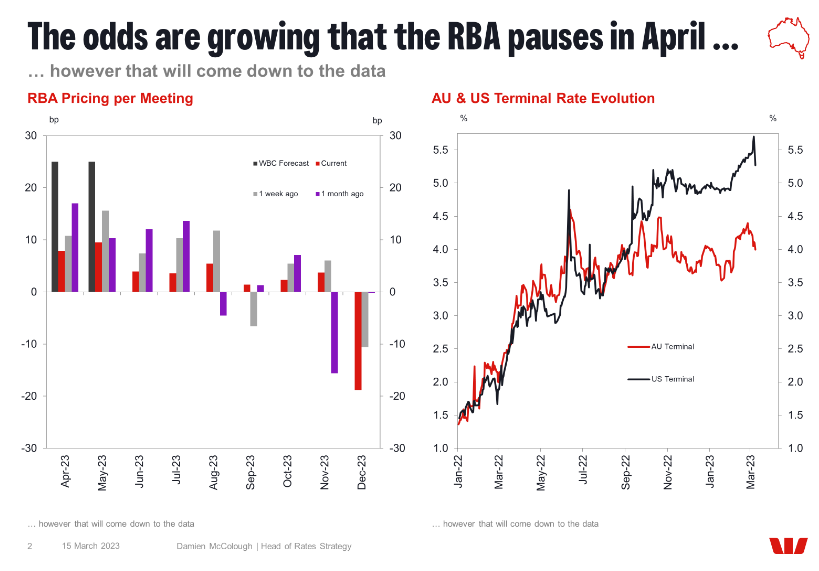

Source: Westpac. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Source: Westpac. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Governor Lowe also told reporters that Thursday's job data and subsequent readings on inflation and retail sales will decide April's cash rate decision.

"While some of the current pricing is clouded by the SVB backdrop, we assess risk rewards around the data as skewed. That is, confirmation of a weaker labour market or that business confidence has peaked, will have a greater impact than the alternative," says Jessica Ren, a rates strategist at Westpac.

The RBA interest rate stance is in turn an important reason for why this week's correction lower in GBP/AUD might ultimately prove to be shallow and short-lived without a burdensome contribution from the Sterling side of the equation.

This could come from either Wednesday's annual budget or next Thursday's Bank of England (BoE) interest rate decision, which is widely seen as a toss-up between a 0.25% increase in Bank Rate to 4.25% or no change at all.

"We suspect that Chancellor Hunt may be saving more overt fiscal stimulus for the Autumn Statement or the Budget this time next year ahead of elections later in 2024," says Chris Turner, global head of markets and regional head of research for UK & CEE at ING.

"We doubt anything in the Budget will be sterling negative - after all taxation levels are near the limit - but equally we do not see it as especially sterling positive either," Turner writes in a Wednesday market commentary.