GBP/AUD Rate Week Ahead Forecast: Under Strain as Wage Data Eyed

- GBP/AUD under pressure & risking further losses short-term

- Upside risk for AU wage index a downside risk for GBP/AUD

- Scope for dip below 1.73 if wage data lifts RBA expectations

Image © Adobe Images

The Pound to Australian Dollar exchange rate (GBP/AUD) entered the new week on the back foot and risks falling further if Australia's Wednesday wage data vindicates the Reserve Bank of Australia (RBA) for its hawkish interest rate stance.

GBP/AUD dipped briefly below the 1.74 handle on Monday but would risk falling further and potentially below 1.73 later this week if the latest wage price index eggs on the Reserve Bank of Australia.

"The Australian wage price index for Q4 2022 may give AUD some support on Wednesday. The RBA’s business liaison and our wage tracker based on customer transactions suggests wage growth accelerated," says Carol Kong, an economist and currency strategist at Commonwealth Bank of Australia.

"Our internal wages tracker indicates growth of 1.0%/qtr (3.4%/yr). Given Governor Lowe’s testimony last week, the minutes of the 7 February meeting is likely to be hawkish and may give AUD/USD some intraday support (12:30am London time)," she adds.

Above: Pound to Australian Dollar rate shown at hourly intervals alongside AUD/USD. Click image for closer inspection.

GBP/AUD is often negatively correlated with AUD/USD so typically anything that supports the latter is likely to act as a headwind for the Sterling pair, which is one reason why Tuesday's release of minutes from February's RBA meeting and Wednesday's publication of final quarter wages data are risks for the Pound.

The RBA raised its cash rate to 3.35% earlier this February in its ninth increase since May 2022 and warned that "further increases in interest rates will be needed over the months ahead to ensure that inflation returns to target."

"The RBA minutes could have a hawkish tilt given the decision to strengthen forward guidance in February (and the quarterly wage price index will be important too)," says Sid Bhushan, an economist at Goldman Sachs.

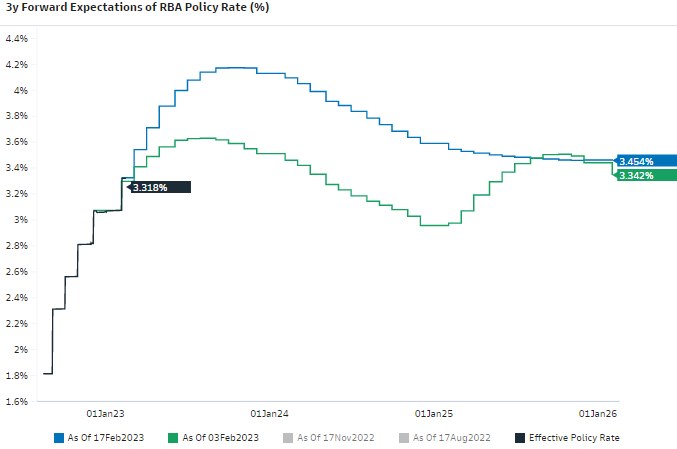

February's RBA statement prompted market-implied expectations for the cash rate to rise notably but was followed by data revealing a second consecutive contraction of employment for January

Above: Market-implied expectations for RBA cash rate. Source: Goldman Sachs Marquee. Click image for closer inspection.

"Our overall assessment is the labour market is still very tight. When we talk to firms, they tell us they're still hiring. It's a bit easier to hirer than it was three months ago," RBA Governor Philip Lowe told the House of Representatives Standing Committee on Economics last week.

"They're still hiring and they still want to hire, and the number of job ads and job vacancies are still extraordinarily high. It's hard to interpret the last two month's employment data because there are some seasonable issues," he added.

Governor Lowe also told the committee "when we speak to businesses a fair number are giving wage increases of more than five per cent this year," which potentially implies upside risks to consensus expectations for Wednesday's wage price index.

A stronger-than-expected number is potentially an upside risk for the Australian inflation outlook and so also for market views about the outlook for the cash rate, which would mean downside risk for the Pound to Australian Dollar rate.

"We're expecting that inflation will start now declining. It didn't decline in the December quarter. It did elsewhere in the world, but it didn't in Australia. The main reason for that is demand here has been strong, national income is strong, people have got jobs and they've got savings," Governor Lowe said last week.

Above: Pound to Australian Dollar rate shown at daily intervals with selected moving averages. Click image for closer inspection. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)