Pound-Australian Dollar Week Ahead Forecast: Scope for Short-term Volatility

Copyright Adobe Images

- GBP/AUD on back foot near multi-month low

- Wide 1.7223 to 1.7624 range possible ahead

- Dual job reports ahead as CPI eyed for GBP

The Pound to Australian Dollar exchange rate entered the new week near multi-month lows and could be volatile within a wide 1.7223 to 1.7624 range up ahead as it digests employment reports from the UK and Australia as well as public remarks from Reserve Bank of Australia (RBA) Governor Philip Lowe.

Australia's Dollar outperformed most other major currencies in the week to Monday with the aid of a hawkish monetary policy statement in which the RBA warned that further increases in the cash rate are likely to be necessary to ensure inflation returns to within the 2% to 3% target band.

Updated forecasts and analysis suggest the 7.8% inflation rate seen last quarter is likely to be the peak for this cycle but that annual price growth is unlikely to return to within the target band until late in 2025 even if the cash rate is lifted to 3.8% or so in the interim.

Since then pricing in interest rate derivative markets has lifted to imply a likely peak somewhere between 4% and 4.25% by September this year, leading to gains for many Australian Dollar exchange rates while pushing GBP/AUD back to some of its lowest levels since early October.

"The Australian labour force report on Thursday may add some volatility to AUD/USD if it moves the market’s expectations for increases in the Reserve Bank of Australia’s cash rate," says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

Above: Pound to Australian Dollar rate at daily intervals with selected moving averages. Click image for closer inspection.

"GBP/USD can head towards upside resistance at 1.2386 (61.8% Fibbo) if the growth in weekly earnings or the core CPI does not slow. AUD/GBP can continue to trade in its recent 0.5674-0.5806 [GBP/AUD: 1.7223 to 1.7624] range this week," Capurso and colleagues write in a Monday research briefing.

Australian Dollar exchange rates are likely to be sensitive to any remarks about the cash rate outlook when RBA Governor Philip Lowe appears before the Senate Economics Legislation Committee on Wednesday and the House Economics Committee late on Thursday.

However, before then Australian employment figures will be watched closely for clues about the extent to which a 'tight labour market' and building wage pressures can be expected to help sustain higher-than-usual inflation pressures in the months and quarters ahead.

Capurso and colleagues say the risk is of a weak rebound from December's surprise decline in employment, which would potentially support GBP/AUD, although much about price action here also depends this week on the outcome and implications of employment and inflation figures due from the UK.

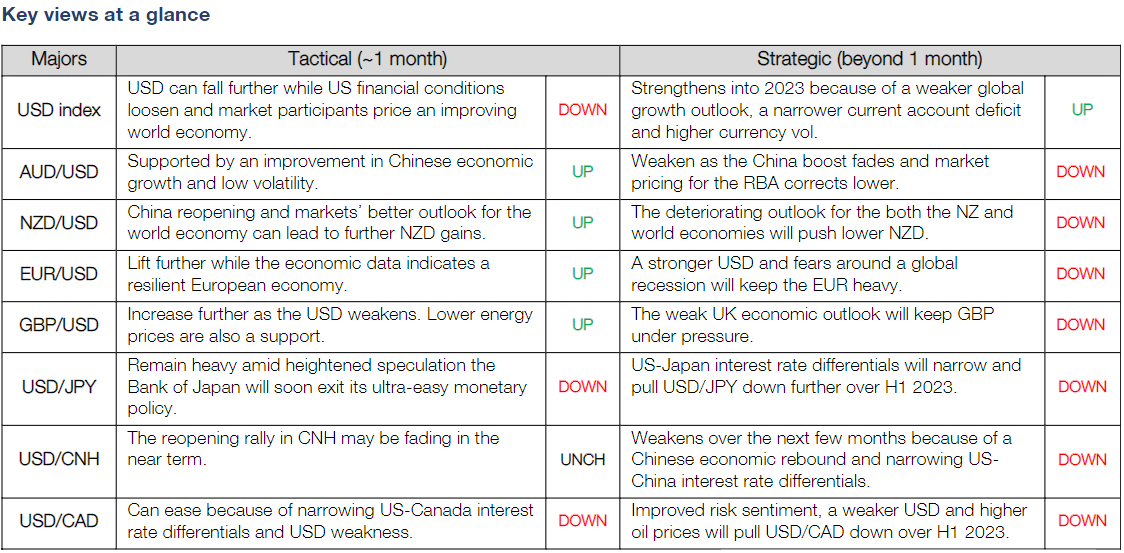

Source: Commonwealth Bank of Australia. Click image for closer inspection.

"We will be watching the labour market results closely next week to confirm that the 15,000 drop in employment in December was a one-off. Our labour market outlook is still very strong," says Adelaide Timbrell, an economist at ANZ.

"The RBA’s liaison program shows a sharp increase in the share of firms reporting wage growth of over 5% in the December quarter. RBA wage growth forecasts now peak at 4.2% y/y to December 2023 versus a previous peak of 3.9%," Timbrell and colleagues write in a Friday research briefing.

Tuesday's speech from Governor Lowe is followed by UK employment data for January in the European trading session after and Sterling is likely to be sensitive to any positive or negative surprise in the wage growth number.

Consensus or the average of professional forecaster estimates suggests UK wages grew at a modestly reduced annualised pace of 6.2% in the three months to the end of December, down from 6.4% previously, while both of the UK's inflation rates are expected to have ebbed in January.

Above: Financial model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

The overall UK inflation rate is seen falling from 10.5% to 10.3% and the more important core inflation rate is expected to have fallen from 6.3% to 6.2% in January, while positive or negative surprises in these could also be expected to impact the Pound.

"Unfilled job vacancies are falling but for now remain uncomfortably high. Moreover, we expect the latest release to show a further fall in the unemployment rate and another rise in employment," says Rhys Herbert, an economist at Lloyds Commercial Banking.

"While total pay growth may have slowed modestly, we project regular (ex-bonus) pay to have picked up further to 6.6%. In all, we expect it to do little to relieve Bank of England policymakers’ concerns about domestic inflationary pressures," he adds.

The Pound to Australian Dollar rate would likely benefit from an above-consensus UK wage number on Tuesday, but might have difficulty sustaining any attempted recovery if a robust Aussie labour market continues to foment expectations of further increases in the RBA cash rate.

Above: Pound to Australian Dollar rate shown at weekly intervals with selected moving averages. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.