Pound-Australian Dollar Week Ahead Forecast: Suppressed Near 1.7539

- GBP/AUD supported at 1.7539 but fall to 1.7411 possible

- If outperforming AUD/USD attempts reclamation of 0.70

- GBP/AUD recoveries may fizzle on any approach of 1.78

- China reopening supports AUD/USD into Australian CPI

- U.S. CPI & risk of USD rebound supportive of GBP/AUD

Image © Adobe Images

The Pound to Australian Dollar exchange rate entered the new week multi-month lows but would risk falling to some of its softest levels since late September if the currently outperforming antipodean currency remains ascendant in the days ahead.

Australia's Dollar was bought widely on Monday in price action that has helped the antipodean unit to cement its grip on the top spot in the major currency league table for the fledgling year owing in part to optimism in the market about what China's reopening could mean for the Australian economy.

"The rapid reopening in China has benefitted AUD over the last few weeks, making the currency one of the best relative performers in G10 ex. USD, apart from CAD," says Michael Cahill, a G10 FX strategist at Goldman Sachs.

"Going forward, we think that the reopening will continue to be a positive impulse for AUD, though some of the reopening news has already been priced," Cahill and colleagues write in a Friday research briefing in which they tipped AUD/NZD as a buy with a target of 1.12.

Monday saw the last restrictions on travel into and out of China removed following the abandonment of a three-year bid by the government to eradicate the coronavirus.

Above: Pound to Australian Dollar rate shown at daily intervals with Fibonacci retracements of late September and early October recoveries indicating possible areas of technical support for Sterling. Selected moving averages indicate possible support and resistance. Click image for closer inspection.

Hopes are that lifting the restrictions will drive a recovery in the world's second largest economy with positive spillovers for others in the region including the resource-exporting Australian economy, hence the antipodean currency's outperformance since late December.

"AUD has been the G10 outperformer through the first day of the week and notably on the first day that the majority of domestic desks returned to full numbers," says Patrick Bennett, an Asia FX strategist at CIBC Capital Markets.

"Support for AUD/USD comes from a weaker USD, but importantly so from a positive outlook on China’s emergence from zero-COVID, and on signs of easing tensions between China and Australia. The next major upside level in AUD/USD is 0.7000-10," Bennett says in Monday market commentary.

The reopening Chinese economy and continuing retreat of the U.S. Dollar have driven a five percent rally in AUD/USD in during recent weeks and pulled the Pound to Australian Dollar rate lower from above 1.82 in late December to 1.7565 by Monday this week.

But Wednesday's Australian inflation figures for December and Thursday's publication of equivalent data in the U.S. will also now have significant sway over how and where AUD/USD and GBP/AUD finish up the week.

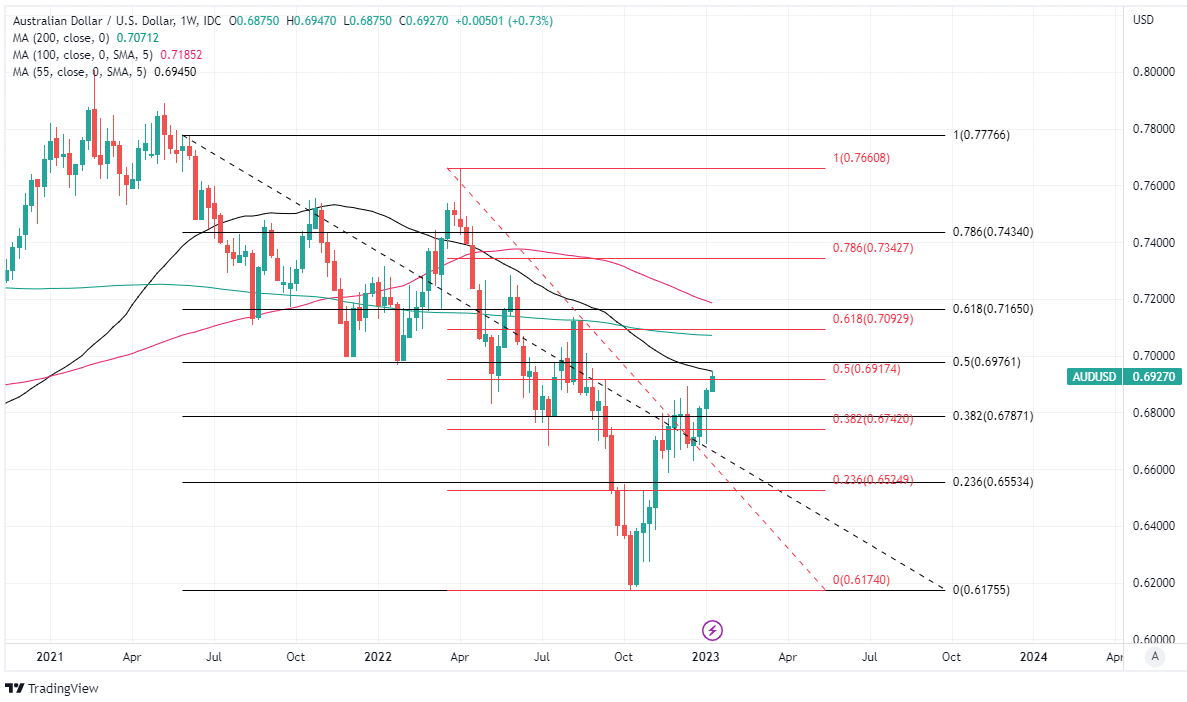

Above: AUD/USD shown at weekly intervals with selected moving averages and Fibonacci retracements of June 2021 and April 2022 declines indicating possible areas of technical resistance for the Aussie. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: AUD/USD shown at weekly intervals with selected moving averages and Fibonacci retracements of June 2021 and April 2022 declines indicating possible areas of technical resistance for the Aussie. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

"RBC Economics forecasts 0.8% m/m headline and 0.5% core readings in November CPI inflation (Wednesday). This implies y/y inflation picking up to 7.4% (headline) and 5.5% (core), both of which would be fresh cycle highs," says Alvin Tan, Asia head of FX strategy at RBC Capital Markets.

"However, the monthly CPI report do not yet incorporate some important quarterly categories such as utility prices, so the full quarterly report remains more important for the RBA," Tan writes in a Monday research briefing.

Consensus suggests Australian inflation rose from 6.9% to 7.2%, which would be its highest level since the early 1990s and one that could place the quarterly inflation reading on track to exceed the Reserve Bank of Australia's (RBA) 8% forecast for the year to end of December.

This could support the Australian Dollar and burden GBP/AUD if the market reads it as making the RBA more likely to raise its interest rate above the 4% level recently priced-in as the likely peak for borrowing costs next year.

However, commentary from Federal Reserve officials and Thursday's U.S. inflation figures are the highlight of the week for global markets and would potentially be supportive of GBP/AUD if it transpires that expectations of a third successive decline in inflation have been misplaced.

Above: Pound to Australian Dollar rate shown at weekly intervals with selected moving averages. Click image for closer inspection. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

"We're expecting Fed speakers — including JP tomorrow — to lean against froth in risk appetite, but with limited success amidst solid resistance in the FX market to sustained dollar appreciation," says Stephen Gallo, European head of FX strategy at BMO Capital Markets.

"A surprisingly strong reading on December US inflation is needed for the current dynamic in the FX market to flip, but the BMO call for core MoM has been parked at 0.3%," Gallo writes in Monday market commentary.

Financial markets have recently marked down expectations for U.S. interest rates this year but could be forced to revise them higher by any upside inflation surprise on Thursday in what would typically be a headwind for AUD/USD and a supportive outcome for GBP/AUD.

GBP/AUD benefits from technical support around 1.7539 on the charts, meanwhile, but would risk falling near to the round number of 1.74 this week if Monday's rally in AUD/USD extends further and takes it closer toward the 0.70 handle last seen in the summer.

The Pound to Australian Dollar exchange rate may also be sensitive to any indications in Friday's November GDP data of the UK's descent into recession late last year having been heavier than economists expect.

"The consensus estimate amongst professional forecasters compiled by Bloomberg is -0.3% MoM, which would follow a surprisingly strong +0.5% print for October. Given the latest readings on activity in the services sector, the property market, and other anecdotes (Figure 1), we think there is a slight downside risk to the consensus view," BMO's Gallo says.