Pound to Dollar Forecast Survey Shows the Big Investment Banks Have Raised Targets for Year-end

Image © Adobe Images

The big banks have raised their forecasts for the Pound against the Dollar into year-end.

An exclusive analysis of the predictions made by all the major investment banks for year-end 2024 shows the median point has risen by 200 pips since March.

The findings are contained in Corpay's GBP/USD forecast guide, which is available to readers of Pound Sterling Live as a free discretionary download.

The mean forecast of over 40 investment bank analysts, all of which utilise their own bespoke models, has also risen by 200 pips.

Analysts at even the biggest institutions can get currency predictions wrong, and sometimes by a significant margin.

This is where a survey is useful, as it establishes a consensus forecast based on the mean and median views of all the analysts.

We think this gives the best possible projection for businesses and individuals with significant payment requirements to assess their risk/reward dynamics.

GBP/USD investment bank consensus forecasts: The end-2024 and 2025 guide from Corpay has been released. It shows a sizeable uplift was made to the consensus forecasts for GBP/USD. Please request a copy here.

The survey shows the highest forecast by any single institution remains unchanged, albeit some 700 pips above current levels in the spot.

The lowest forecast has also been lifted, and no single institution now thinks the Pound to Dollar exchange rate will fall below 1.20 in the outlook, as was the case in the second quarter.

The forecast guide also reveals what a select few well-known investment bank names are expecting.

Bank of America Merrill Lynch remains amongst the more bullish, seeing spot headed to 1.35 by the time 2024 ends.

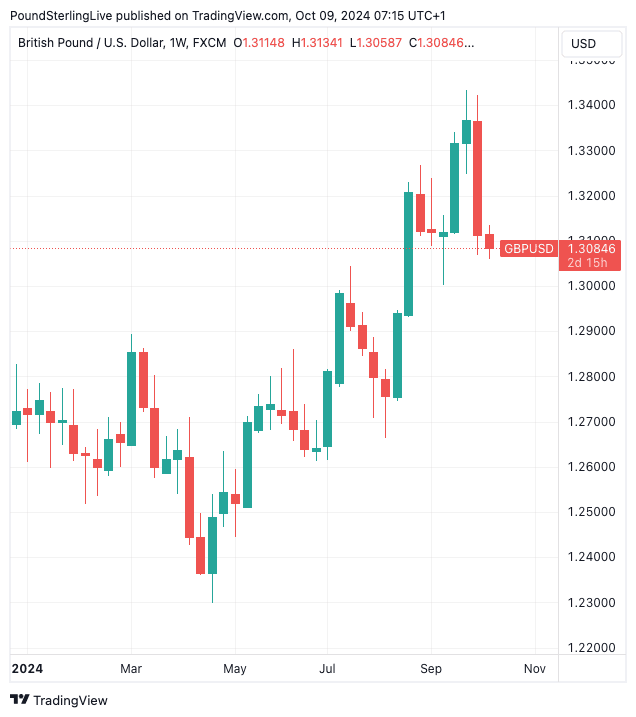

Above: GBP/USD in 2024.

Recently, Bank of America wrote the Pound will remain supported by a slow pace of interest rate cuts at the Bank of England.

"We continue to expect a slow cutting cycle with one more cut in November this year, four cuts in 2025 and two cuts in 2026 such that Bank Rate reaches a terminal rate of 3.25% by mid-2026," says a note from Bank of America.

The Pound hit fresh 2024 highs against the Dollar in September but has since relinquished the highs, thanks to a reassessment of Federal Reserve interest rate policy.

Investors expect the Fed no longer has a window to cut rates by 50 basis points owing to a strong economy, instead it will have to opt for 25bp moves.

The Pound was meanwhile hampered by comments from the Bank of England's Governor Andrew Bailey that the Bank could afford to be more "activist" when it comes to cutting interest rates.

"The perception that the BoE may cut interest rates more cautiously than the Fed and potentially the ECB have been a source of support for the pound. This view has been deeply shaken by comments made by BoE Governor Bailey in an interview with the Guardian newspaper," says Jane Foley, Senior FX Strategist at Rabobank.

The next major event for the Sterling is the release of September's inflation numbers in mid-October. This will determine whether the Bank cuts again in early November or waits until December.