Surprise Labour Market Revision & Fed Minutes Send USD to Fresh Lows

Image © Adobe Images

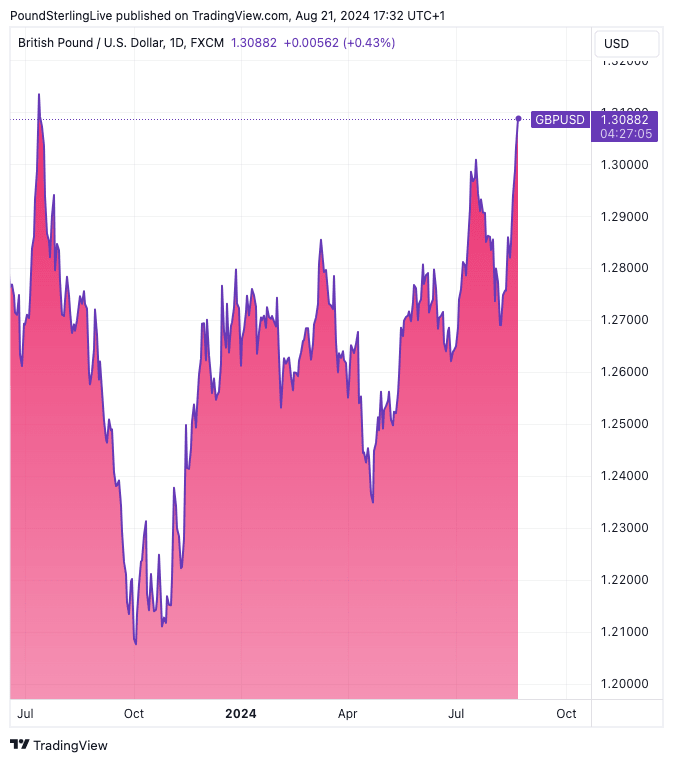

The British Pound powered to a new 2024 high against the U.S. Dollar after data showed the U.S. labour market was weaker than previously expected, which will push the Federal Reserve into action.

The Pound to Dollar exchange rate rose to 1.31 after the Bureau for Labor Statistics said it had overestimated the number of jobs created in the 12 months to March 2024 by 818K.

The move took the best rate on international transfers to above 1.3050, giving the UK's dollar buyers their strongest hand since July 2023.

The Bureau compared their initial estimate of 2.9M against tax records, which gave a conclusive, albeit long-delayed, figure of 2.1M for the year to March.

The Dollar fell across the board following the release as market bets for Federal Reserve rate hikes rose. This is because the Fed has said it is closely watching the labour market for signs of weakness when considering cutting interest rates.

"Later on in the session, we then received some dovish-leaning minutes from the Fed’s July meeting, which along with the payrolls revisions helped to cement expectations that the Fed would cut rates pretty rapidly over the coming months, with over 100bps of cuts priced in by year-end again," says Henry Allen, an analyst at Deutsche Bank.

The Fed's minutes said several members of the Committee "observed that the recent progress on inflation and increases in the unemployment rate had provided a plausible case" for a 25bps cut as early as the July meeting. A “vast majority” saw a September rate cut as appropriate if data came in as expected.

The labour market revision will only add fresh impetus to the odds of a cut. "The greenback has been penalised by the more aggressive rate cuts now expected by investors," says Jimmy Jean, Chief Economist and Strategist at Desjardin Bank.

GBP/USD investment bank consensus forecasts: The end-2024 and 2025 guide from Corpay has been released. It shows a sizeable uplift was made to the consensus forecasts for GBP/USD. Please request a copy here.

Pound-Dollar had been struggling at a technical resistance point near 1.30-1.3040 ahead of the release. These data and the subsequent market reaction could result in a more conclusive break higher in the exchange rate.

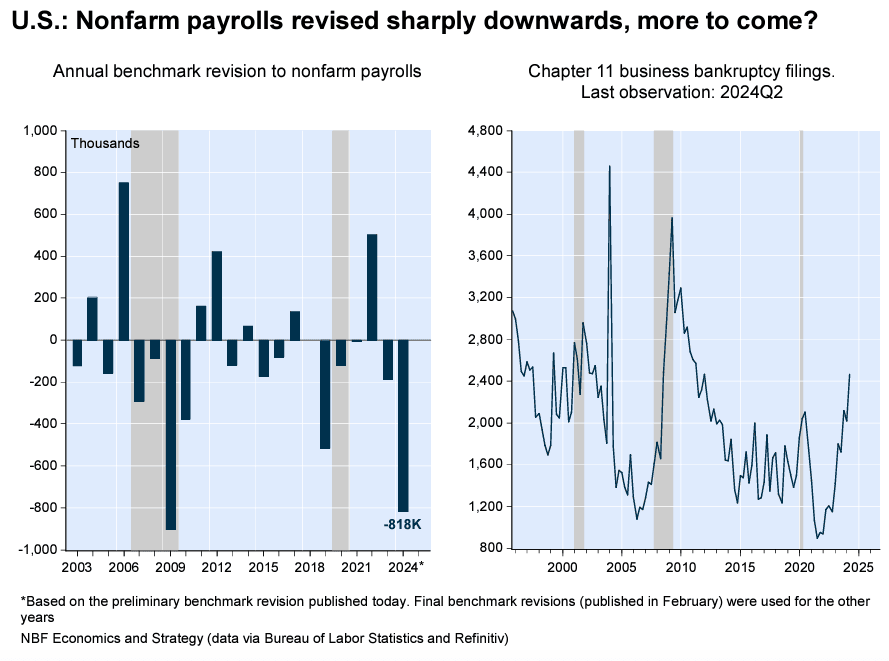

The market reaction to the BLS revision of payrolls will surprise many market participants who thought it would pass by without notice, as has been the case in recent years. But, James Knightley, Chief International Economist for the U.S. at ING Bank, says this was an unusually big miss by the Bureau, which typically revises its estimates vs. the tax data by a respectable 0.1 percentage point.

Last year, they were out by 0.2pp, requiring a 306k downward revision, "so today’s announced change is a big error," says Knightley.

"This downward revision would be the largest recorded since 2009," says Jocelyn Paquet, an economist at National Bank of Canada. "While job creation remained solid over this period, even taking this revision into account, it was much less than initially forecast."

Knightley offers further insights into the matter:

"The BLS has a good handle on what is going on amongst large employers but has less visibility on the small business sector and has a “births-death” model.

"In steady times, their assumptions are accurate, but at turning points in the cycle they can be significanty wrong – so in the early stages of a downturn they tend to overestimate the jobs created by new start-ups – 'births' – and underestimate the number of jobs lost by the 'death' of failing small businesses."

Paquet agrees; "Historically, this model has failed to reflect increases in business bankruptcies and has therefore tended to overestimate job creation at the end of business cycles. Such an overestimation is probably taking place now, as high interest rates weigh increasingly heavily on businesses."

Financial markets are now primed for the Fed to deliver a 25bp interest rate cut on September 18 and are pricing close to 100bp of cuts in total for 2024.

The Dollar's downtrend looks set to remain intact.