Dollar Sold After U.S. Inflation & Retail Sales Undershoot

Image © Adobe Images

Pound Sterling rallied against the Dollar after a key U.S. inflation print undershot expectations and retail sales showed a notable retracement in spending during April.

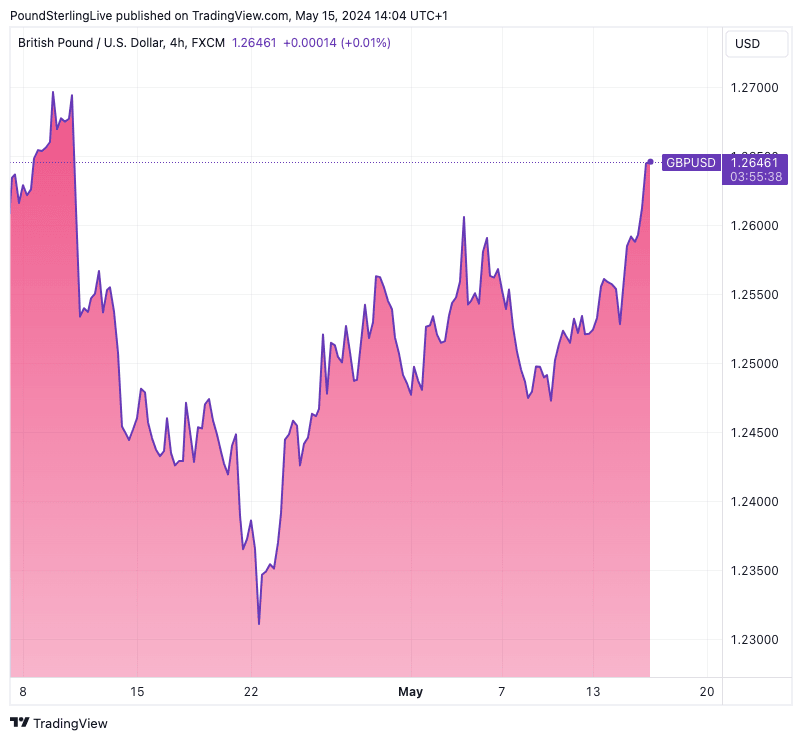

The Pound to Dollar exchange rate jumped to 1.2645 and could be en route back to 1.27 after official data showed U.S. CPI inflation rose 0.3% month-on-month in April, down on March (0.4%) and below expectations (0.4%).

After three months of uncomfortably hot upside surprises, the softer-than-expected reading will renew hopes that the rise in inflation in the first three months of the year was a counter-trend blip.

Money market pricing shows investors are now pricing around 50bp of easing this year (two 25bps cuts), from one cut just a week ago. This puts the market in line with the Federal Reserve's own projections that envisage two rate cuts this year. "Financial markets are now fully pricing a September rate cut compared to about a 75% chance before the data," says Carol Kong, a strategist at CBA.

This repricing has weighed on the Dollar and opened the door to further short-term losses. "If the softness in US growth surprises continues, the USD could be hit even harder from a combination of softening yields compared to elsewhere, firm risk appetite and improving global growth signals," says Charlotte Ong, European FX Strategist at HSBC.

Live GBP/EUR Money Transfer Exchange Rate Checker | ||

Live Market Rate: | get quick quote | |

Corpay: | ||

Banks: Median Low | ||

Banks: Median High | ||

These data are based on the spread surveyed in a recent survey conducted for Pound Sterling Live by The Money Cloud. | ||

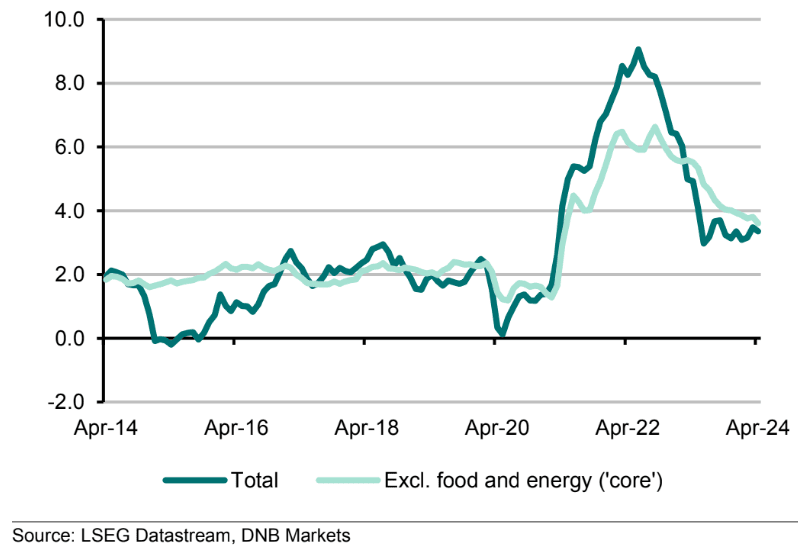

The year-on-year inflation rates read at 3.4%, as expected, down from 3.5% last month. The important core CPI measures all met expectations, rising 0.3% m/m (down from 0.4%) and 3/6% y/y (down from 3.8%).

"The slightly more modest 0.3% m/m increase in core CPI in April was even better than it looked, particularly given that we already know the PPI components that feed into the Fed’s preferred PCE deflator measure came in, on balance, weaker than expected. As a rough guide, we estimate that core PCE increased by around 0.20% m/m," says Paul Ashworth, Chief North America Economist at Capital Economics.

"All things considered, this is consistent with the Fed cutting interest rates in September," he adds.

Above: GBP/USD has hit a one-month best for USD buyers. Track GBP/USD with your own custom rate alerts. Set Up Here

U.S. retail sales were arguably more Dollar-negative, as the surprise was more noticeable. Headline retail sales were flat at 0% m/m vs. 0.4% expected and 0.7% prior.

Excluding automobile sales, retail sales fell sharply from 1.1% m/m to 0.2% (which was as expected). The control group retail sales number was -0.3% m/m, which was below 1.1% prior and 0.1% expected.

"The overdone slide in Treasury yields and the dollar is telling of the market’s keenness to jump on encouraging data, and to ramp up their optimism on rate cuts. There is a distinctively risk-on mood permeating through financial markets, and there is a sense that traders are bracing themselves for further disinflation over the next few months," says Kyle Chapman, FX Markets Analyst at Ballinger Group.

Above: U.S. inflation. Image courtesy of DNB Markets.

September Rate Cut Certainty Grows

The prospect of an interest rate cut at the Fed next month remains a remote prospect, which can limit the extent to which the Dollar can weaken.

Instead, it could be the case that markets settle on a consensus for the Fed to cut interest rates in September.

"We believe today’s reading will not change the outlook for rate cuts in the autumn if coming inflation data remains moderate and the labour market continues to ease. The market is pricing in the first rate cut in September, in line with our forecast," says Knut A. Magnussen, Senior Economist at DNB Markets.

Ian Shepherdson, Chief Economist at Pantheon Macroeconomics says the case for expecting a further slowdown in core CPI inflation remains compelling.

"Supply chains have normalised, wage growth is weakening, and corporate margins are flat but still hugely elevated, indicating clear scope to fall ahead," he explains.

At the same time, he sees no threat from global food and energy prices, and rent inflation for new tenants remains subdued. Falling vehicle prices suggest that auto insurance inflation will slow sharply soon from its recent rapid pace.

"The foundations, therefore, are in place for a further deceleration in the core CPI this summer, enabling the Fed to start easing in September," says Shepherdson.