GBP/USD Week Ahead Forecast: Balanced Risk and Scope for Volatility

- GBP/USD underpinned by firm support at 1.2620 short-term

- Minor technical resistances at 1.2794 & further up at 1.2821

- RMB loss & index management potentially also offer support

- Jackson Hole Symposium, central banker speeches in focus

Image © Adobe Images

The Pound to Dollar exchange rate was trading buoyantly above its recent lows on Tuesday after entering the new week on the front foot and could have scope to edge higher in the days ahead in the absence of any upset from central bank speeches in the U.S. or foreign exchange policy developments in China.

Sterling has been one of only few currencies to hold up well in the face of a strong Dollar over recent days following an outperformance that many analysts attribute to official figures out last week suggesting inflation fell less than expected in July and that average wage packets grew at an accelerated pace.

“Wage gains could prove less persistent if recent labour market loosening continues. The unemployment rate has risen from a cycle low of 3.5% to 4.2% – one of the biggest jumps in the G10 space – while redundancy rates continue to rise and vacancies fall,” says Dominic Bunning, European head of FX research at HSBC.

“We have been bullish on GBP since November last year, with a forecast that GBP-USD would hit 1.30. Having breached that level – briefly – last month, risks are building that it may now represent the peak in the currency rather than a more sustainable level beyond the end of the drizzly summer,” he adds.

Financial markets have reengaged earlier bets on the Bank of England (BoE) Bank Rate being raised from 5.25% to 6% as a result, which could partly account for the recent resilience of the Pound to Dollar rate but the sparsely populated UK economic calendar means offshore events will be more influential for Sterling this week.

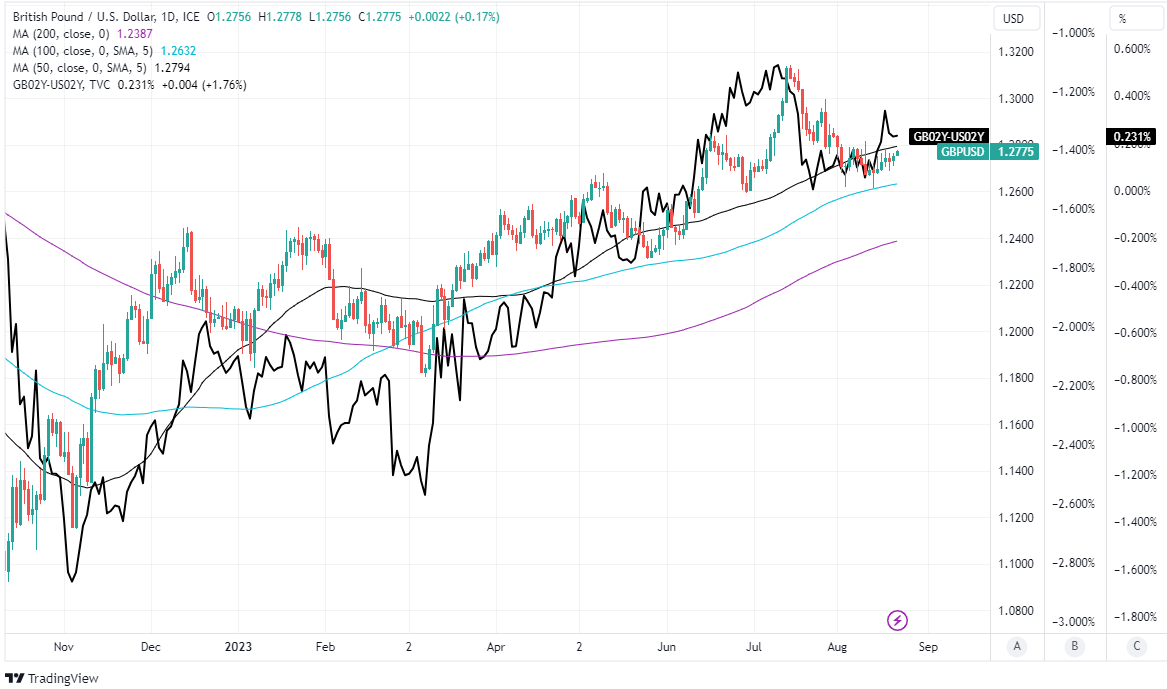

Above: Pound to Dollar rate shown at daily intervals with Fibonacci retracements of November recovery indicating possible areas of technical support for Sterling while selected moving averages denote prospective support and/or resistance levels.

Wednesday’s release of S&P Global PMI surveys is the sole highlight of the UK economic calendar for the week ahead and while positive readings could help prop up the Pound to Dollar rate for a period, this week’s performance likely hinges much more significantly on developments in the U.S. and China.

The annual Federal Reserve (Fed) Jackson Hole Symposium for economists and central bankers gets underway on Thursday and will be watched closely for clues on whether the Fed is likely to raise interest rates any further while also garnering attention for geopolitical reasons connected with this week’s BRICS group summit.

The latter group is aspiring to create an international financial architecture to compete with that overseen by the U.S. and one of the main themes at this year’s symposium concerns structural shifts in the global economy, though China’s Renminbi exchange rate policy might also be important for numerous currencies including Sterling.

“Intraday losses so far are putting something of a negative spin on the charts for the index which may be a “tell” that markets are leaning towards some reduction in USD exposure ahead of Jackson Hole in the event that Powell dials back the inflation rhetoric somewhat,” says Shaun Osborne, chief FX strategist at Scotiabank.

“Sterling is flat on the session but is still edging a little above the mid-point of its broader range, defined by support at 1.2620 (double bottom) and resistance at 1.2820 (double bottom trigger). A clear break above 1.2820 targets a move to the low 1.30s,” he adds.

Above: GBP/USD at daily intervals with selected moving averages denoting prospective support and/or resistance levels, alongside spread or gap between UK and U.S. government bond yields of 02-year maturity.

Any suggestion from Fed policymakers that further increases in interest rates are likely could see the Pound to Dollar rate come under pressure in the latter half of the week though the scale of any losses is likely to depend in part on how much of a stronger Renminbi Chinese monetary authorities actually want to see.

The Renminbi is managed loosely in relation to a basket of developed and emerging market currencies with the objective of keeping it “basically stable” at an adaptive equilibrium level, which has implications for other currencies whenever the Dollar-Renminbi pair is rising in the way that it has done in recent months.

A strong USD/CNH weighs on currencies of Asia Pacific and emerging market trade partners or competitors while exerting an upward influence on the trade-weighted or overall Renminbi index, which in turn necessitates an offsetting calibration of other currencies in the index for the barometer to be kept “basically stable”.

In short, counterbalancing any depreciation of the Renminbi and other regional currencies - such as KRW/USD, AUD/USD, NZD/USD, JPY/USD and MYR/USD - can only be achieved with efforts to lift or otherwise support the likes of the U.S. Dollar, Euro, Pound, Swiss Franc, Canadian Dollar, Mexican Peso and some others.

The upshot is Sterling might be likely to remain well supported at or above current levels against the Dollar unless and until the Renminbi and other positively correlated counterparts are either able or willing to stage a recovery from their recent and ongoing losses.

Above: GBP/USD at daily intervals alongside Renminbi-Dollar rate and Sterling-Renminbi rate.