Pound-Dollar Boosted by PCE Inflation Drop

"There is some evidence that such extreme positioning points to a reversal in GBP-USD...There is no overall link between the data. But at the extremes, we can see some patterns," - HSBC.

Image © Adobe Images

The Pound to Dollar exchange rate stalled in an earlier rally in the final session of the week after data suggested the Federal Reserve (Fed) is close to reaching its inflation target and that consumer spending continues to outpace income growth in the U.S. against the backdrop of a seemingly brightening picture in Europe.

Dollar exchange rates were a mixed bag of performances on Friday while the Pound topped the board in the G20 grouping alongside the Mexican Peso and South African Rand after the preferred inflation measure of the Federal Reserve edged further toward the target level for the month of June.

The more closely monitored Core Personal Consumption Expenditures Price Index fell from 4.6% to 4.1%, further than the 4.2% anticipated by economists, while the overall PCE inflation rate mimicked the official measure when dropping to 3% in response to reported declines in the cost of food and energy items.

Meanwhile, employment costs rose by one percent for the second quarter and less than the 1.1% economists had forecast after falling from 1.2% in the opening quarter, and with both sets of data doing little to address the question of whether or not the Federal Reserve will raise its interest rate again in September.

"The main risk here is a sudden jump in healthcare services inflation, lagging last year’s explosion in wage growth. If this is avoided, though, and the downshift in core services ex-housing inflation continues, it will be hard for the Fed to justify another hike in September," says Ian Shepherdson, chief U.S. economist at Pantheon Macroeconomics.

Above: Pound to Dollar rate shown at 15-minute intervals with Fibonacci retracements of recent fall indicating possible areas of technical resistance for Sterling and shown alongside EUR/USD.

The data came against a mixed backdrop for stock markets including in Europe where data was brighter on the surface in France and Spain but less so in Germany after economic growth came in at zero for the second quarter and was revised lower for the prior period, while inflation ebbed from 6.4% to 6.2%.

"First details for Germany’s national CPI inflation measure show that core inflation is also on the way down," says Salamon Fiedler, an economist at Berenberg,

"So far, the data is in line with our call that Eurozone inflation will recede to 5.3% yoy in July from 5.5% in June," he adds.

Fiedler says Friday's data "suit the call that the ECB will not hike rates much further," but also that "the probability that the ECB will keep rates on hold now is almost as high."

However, the better data came from France and Spain on Friday with economic growth and consumer spending reported to have jumped in France last quarter.

Meanwhile, the Spanish economic expansion moderated only slightly to 0.4% in Spain but with inflation climbing from 1.7% to 2.4% to take it back above the 2% target.

Above: Pound to Dollar rate shown at daily intervals alongside EUR/USD. Click image for closer inspection.

"Indications so far point to a return to Eurozone growth in Q2 but business surveys indicate weakening demand," says Hann-Ju Ho at Lloyds Commercial Banking.

There was no economic data of note out in the UK on Friday though previously on Thursday the Confederation of British Industry indicator of realised sales at retailers and wholesalers fell to its lowest level since April 2022 and soon after the onset of the Russian invasion of Ukraine.

Prior to that S&P Global surveys suggested on Monday that a deepening recession drove one measure of combined activity in the manufacturing industry to its lowest level since the onset of the coronavirus pandemic while pushing the same barometer of services sector activity back to its weakest since January this year.

Sterling pairs rallied broadly, meanwhile, and though the precise driver is unclear it's possible that the outperformance reflects bidding by the speculative market where positioning has recently reached its highest since just before the 2008 financial crisis.

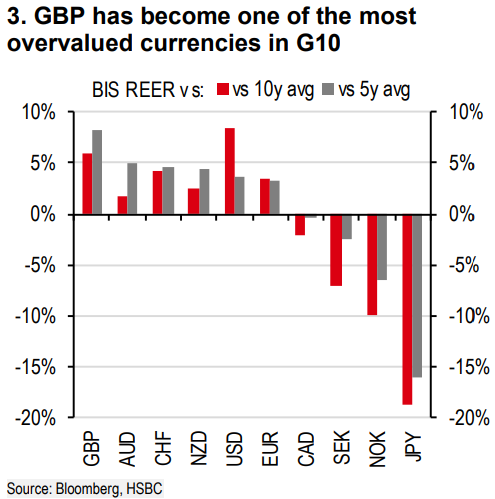

"There is some evidence that such extreme positioning points to a reversal in GBP-USD," says Dominic Bunning, European head of FX research at HSBC.

"There is no overall link between the data. But at the extremes, we can see some patterns," he adds in a Thursday research briefing.

Source: HSBC.