GBP/USD Week Ahead Forecast: Eyes Retest 1.30 but Risks Losses Below 1.28

- GBP/USD supported near 1.2825, 1.2727 & 1.2631

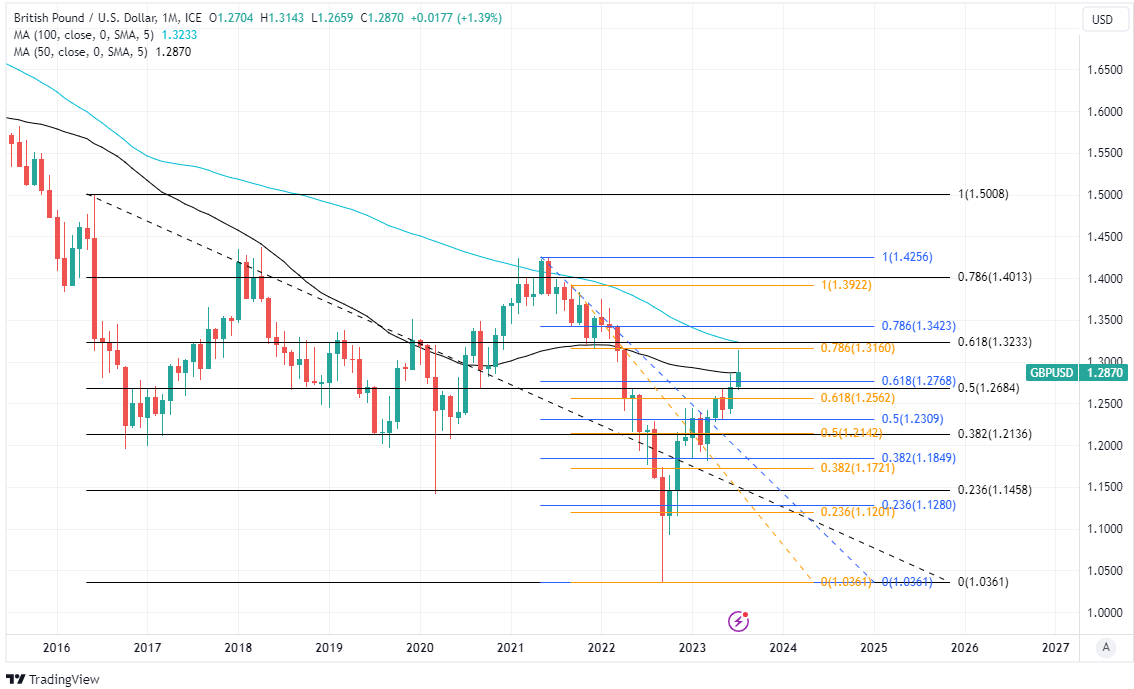

- Rallies meet resistance at 1.3025, 1.3160 & 1.3233

- Fed decision could aid GBP into wild card BoJ risk

Image © Adobe Images

The Pound to Dollar exchange rate entered the new week with a chance of increased volatility and a possible retest of 1.30 or more if the Federal Reserve (Fed) takes a rain cheque this Wednesday or otherwise moderates its hawkish policy stance, though the bigger danger is of losses leading Sterling back below 1.28.

Falling UK inflation led Sterling to underperform many other currencies last week including a rebounding Dollar while leaving it testing a duo of technical supports near 1.2825 as the Pound entered a gauntlet of fundamental risk on Monday.

“This is the first layer of support. An initial bounce is expected however,” says Kenneth Broux, a strategist at Societe Generale.

“1.3025, the 61.8% retracement of the recent down move, is likely to contain. In case the pair fails to defend 1.2850/1.2790, a retest of the lower band of the channel at 1.2600 can’t be ruled out,” he adds in a Friday research briefing.

S&P Global PMI survey results warned of a sharp deceleration of the manufacturing and services sectors for July on Monday and placed the Pound ate under pressure but policy decisions from the Federal Reserve and Bank of Japan on Wednesday and Thursday are likely to be much more decisive of how it ends the week.

Above: Pound to Dollar rate shown at daily intervals with Fibonacci retracements of March and May rallies indicating possible areas of short-term technical support for Sterling.

“We expect the Federal Open Market Committee to raise interest rates by 25bp when it meets this week, taking the federal funds rate target range to 5.25-5.50%. That would leave it in line with our terminal rate forecast,” says Tom Kenny, an economist at ANZ.

“There are encouraging signs price pressures are moderating, but it’s not clear it’s enough to get inflation back to 2% sustainably. As such there is a risk the Federal Reserve’s work is not yet done,” he adds in a Monday research briefing.

Economists, analysts and financial markets all expect the Fed to raise its interest rate from 5.25% to 5.5% on Wednesday so would be unprepared for any surprise decision to hold off for a while longer before raising borrowing costs again, while the Pound could also be sensitive to any second-guessing of the forecasts released in June.

Live GBP/EUR Money Transfer Exchange Rate Checker | ||

Live Market Rate: | get quick quote | |

Corpay: | ||

Banks: Median Low | ||

Banks: Median High | ||

These data are based on the spread surveyed in a recent survey conducted for Pound Sterling Live by The Money Cloud. | ||

Last month's forecast update suggested the Fed Funds rate would likely peak at 5.75% by year-end and close to the level that triggered the collapse of some small and medium-sized banks in March when the financial markets first began to price-in such a prospect.

“Given the deceleration in underlying inflation, we think the risk is Powell cools on another hike by describing the FOMC as ‘data dependent’. US interest rates and the USD can fall in response,” says Kristina Clifton, an economist and currency strategist at Commonwealth Bank of Australia.

Interest rate markets have stopped short of fully pricing in the new forecasts since they were released last month and since then U.S. inflation was reported to have fallen back to 3% in June, leaving it close to the 2% target and potentially creating room for the Fed to be patient before raising borrowing costs again.

Above: Pound to Dollar rate shown at weekly intervals with Fibonacci retracements of selected downtrends indicating possible areas of short-term technical resistance for Sterling.

"First, the Fed is unlikely to encourage a further dovish shift in expectations. While our US economics team thinks the FOMC will deliver its last hike of the cycle this week, they also expect the messaging to be crafted to avoid prematurely loosening financial conditions," says Alexander Jekov, an FX strategist at BNP Paribas.

GBP/USD could benefit meaningfully on Wednesday if the Fed elects to leave its interest rate unchanged for a second month running or otherwise signals that June's forecasts are less sure now than at the time, but risk-aversion in global markets and heavy losses for Sterling might be seen instead if the bank stays June's course this week.

Any rally could also be encouraged further on Thursday if the Bank of Japan surprises the market with another unexpected adjustment to its Yield Curve Control program parameters and the upper limit it imposes on 10-year government bond yields, and some say the risk of this is underappreciated.

"We believe the odds of a YCC revision this week are quite high. The BoJ has lowered the bar for such an adjustment by arguing that it would not equate to monetary tightening, while it remains a necessary step towards an eventual rise in the policy rate," Jekov and colleagues write in a Monday research briefing.

GBP/USD could benefit from a BoJ policy change if the positive correlation between Sterling and the Yen holds after but this is far from assured due to the Yen's use as a ‘funding currency’ for investment in higher-yielding assets and Pound's recent popularity as exactly that, which might mean there could be a risk of losses for Sterling on Thursday.

Above: Pound to Dollar rate shown at monthly intervals with selected moving averages and Fibonacci retracements of selected downtrends indicating possible areas of technical resistance for Sterling.

Live GBP/EUR Money Transfer Exchange Rate Checker | ||

Live Market Rate: | get quick quote | |

Corpay: | ||

Banks: Median Low | ||

Banks: Median High | ||

These data are based on the spread surveyed in a recent survey conducted for Pound Sterling Live by The Money Cloud. | ||