GBP/USD Week Ahead Forecast: Topping and Possibly Dropping

- GBP/USD rallying into formidable chart resistances

- Could struggle near 1.3240 on any break of 1.3108

- May struggle to hold 1.30 if USD recovers a footing

- Risk from UK inflation but retail sales could support

Image © Adobe Images

The Pound to Dollar exchange rate has rallied to its highest since April 2022 but it now faces headwinds in the form of formidable technical resistances around 1.3108 and 1.3240 and might be lucky if it holds 1.30 this week in the event of any rebound from the greenback over the coming days.

Dollars were sold widely late last week, lifting the Pound to a 15-month high above 1.31 while rendering the greenback the worst performer in the advanced economy bucket for the period after U.S. inflation fell back to 3% for June, leaving it close to the 2% average target of the Federal Reserve (Fed).

"The pound’s powerful rally has stalled against resistance at 1.3145 (tested four times in the past 24 hours). This does not appear to be a major technical point for Cable, according to my read of the charts, however," writes Shaun Osborne, chief FX strategist at Scotiabank, in a Friday market commentary.

"There is little—obvious—resistance to GBP gains extending until the 1.33 area at this point. Some consolidation in this week’s strong gains should perhaps be expected in the short run. Pullbacks to the 1.29/1.30 range are likely to be well-supported," he adds.

Above: Pound to Dollar rate at daily intervals with selected moving averages and Fibonacci retracements of mid-June rally indicating possible technical support for Sterling.

Live GBP/EUR Money Transfer Exchange Rate Checker | ||

Live Market Rate: | get quick quote | |

Corpay: | ||

Banks: Median Low | ||

Banks: Median High | ||

These data are based on the spread surveyed in a recent survey conducted for Pound Sterling Live by The Money Cloud. | ||

Falling inflation has boosted the real or inflation-adjusted offering of U.S. government bonds but done little to keep the Dollar from falling in recent trade, although Sterling's rally has also been encouraged by the high level of market expectations for the Bank of England (BoE) Bank Rate.

This was after UK employment figures suggested last Tuesday that workforce wage growth persisted at a high single-digit percentage for the year to the end of May in a labour market outcome that is only likely to encourage Bank of England concerns about upside risks to its inflation outlook.

“GBP/USD can rise this week and head towards upside resistance at 1.3328 (5 year 76.4% Fibbo). The UK CPI for June will be important for UK interest rates and GBP,” says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

“The headline CPI is expected to fall as energy prices decline. However, we expect the core CPI to lift further. A lift in the core CPI can encourage financial markets to price in even more tightening from the Bank of England and support GDP/USD,” he adds.

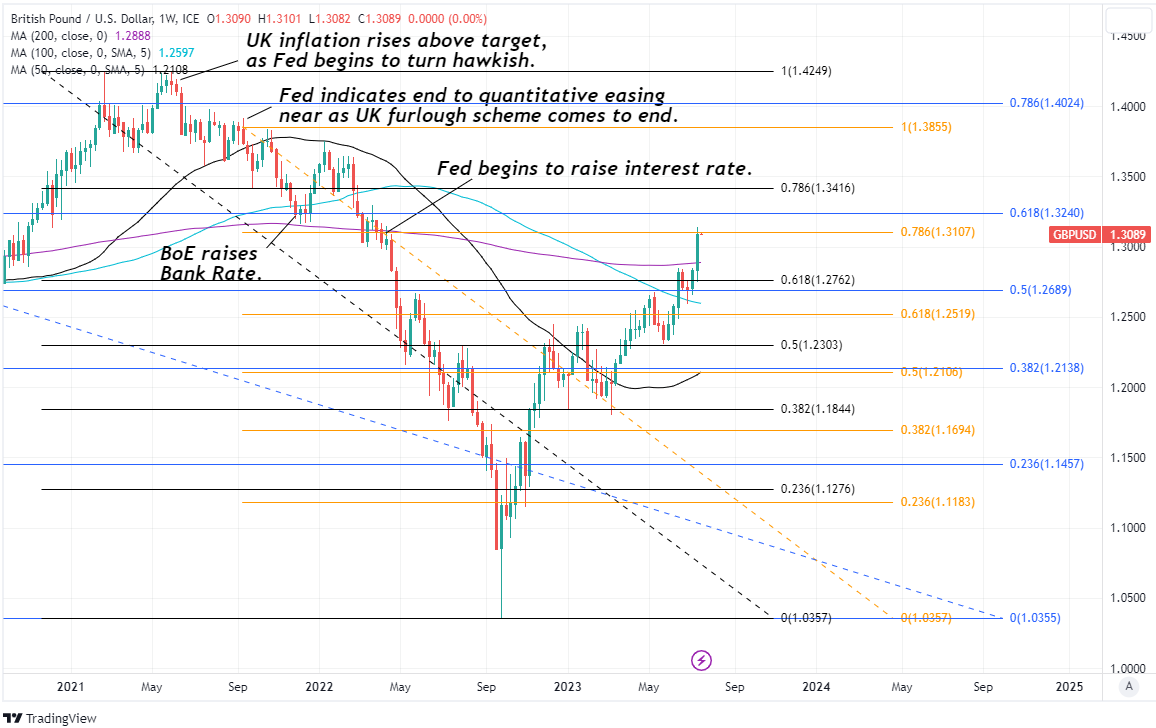

Above: Pound to Dollar rate shown at weekly daily intervals with Fibonacci retracements of selected downtrends indicating possible areas of technical resistance while selected moving averages denote prospective support and/or resistance.

High pay growth has kept market concerns about a protracted battle to wrestle inflation back to the 2% target alive and played a role in sustaining widespread wagers on the BoE Bank Rate being raised from 5% currently to around 6.25% by early next year.

“The BoE will likely have to raise its wage growth forecasts markedly in the next set of forecasts. That would boost inflation on 1-year and perhaps 2-year horizons,” says Robert Wood, a UK economist at BofA Global Research.

“This is a key risk to our BoE call of a peak rate of 5.5%, and there is a non-negligible probability the BoE may have to deliver a hard landing to force down wage growth and inflation,” he adds in a Friday research briefing.

Expectations for Bank Rate have made Sterling a popular ‘carry trade’ in recent months while encouraging its rally against the Dollar but some analysts say it would be shortsighted to expect GBP/USD to rise much further from current levels.

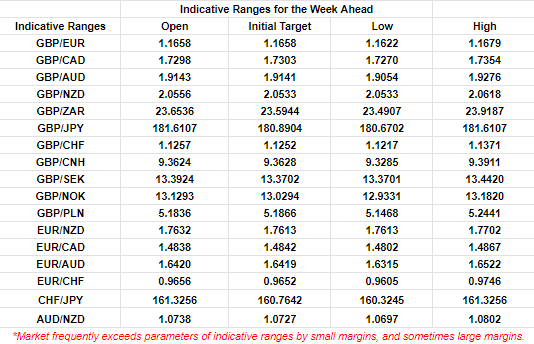

Above: Quantitative model estimates of ranges for this week. Source Pound Sterling Live.

Live GBP/EUR Money Transfer Exchange Rate Checker | ||

Live Market Rate: | get quick quote | |

Corpay: | ||

Banks: Median Low | ||

Banks: Median High | ||

These data are based on the spread surveyed in a recent survey conducted for Pound Sterling Live by The Money Cloud. | ||

“At the moment the UK does not have a growth story, and significant medium-term fiscal and political risks are apparent. The fact that GBPUSD is trading above 1.30 against this backdrop demonstrates the myopic nature of some FX carry trades,” writes Stephen Gallo, a global FX strategist at BMO Capital Markets, in a Friday research briefing.

While the almost record amount of monetary tightening announced by the BoE over the last year could yet lead the economy to sink into a deep recession over the coming months, its Wednesday's release of UK inflation figures for June that are most likely to test market appetite for Sterling this week.

Economist surveys suggest inflation is likely to fall from 8.7% to 8.2% while remaining at 7.1% once energy and food price changes are set aside, though market assumptions about the Bank Rate outlook might be challenged by any downside surprise.

"Markets currently price in 45bp for August, so the downside risks likely exceed the upside for the pound," says Francesco Pesole, an FX strategist at ING.

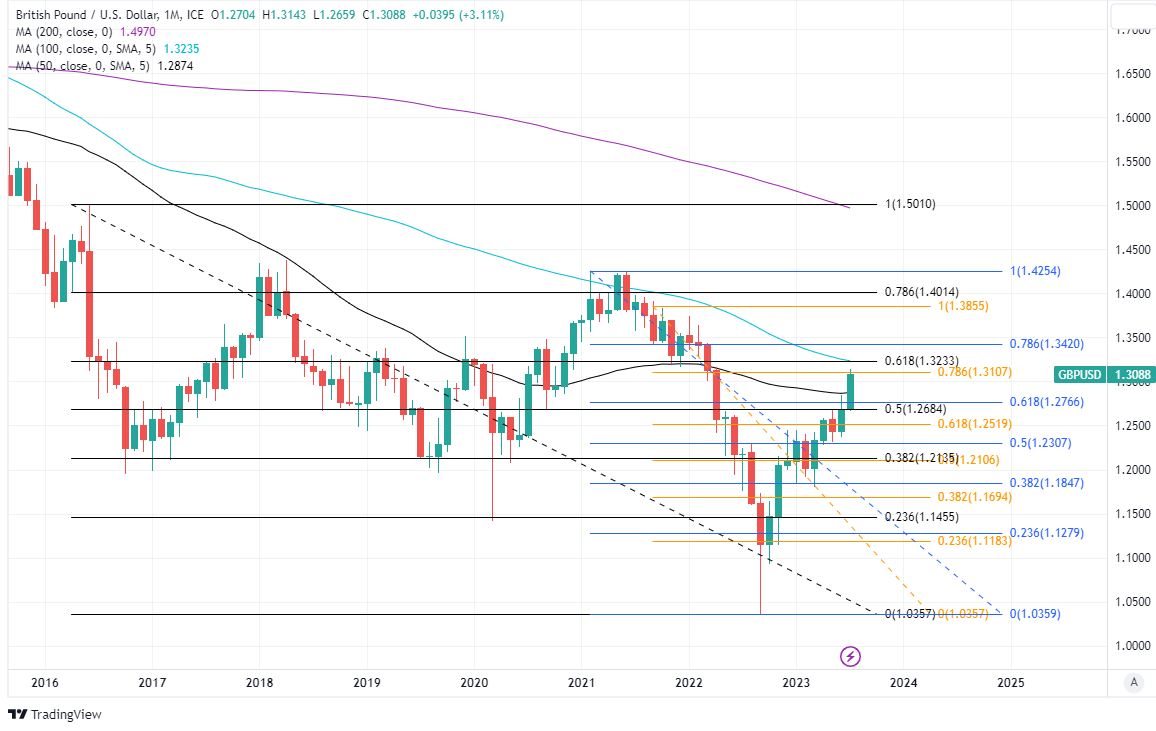

Above: Pound to Dollar rate shown at monthly intervals with Fibonacci retracements of selected downtrends indicating possible areas of technical resistance while selected moving averages denote prospective support and/or resistance.

It could undermine the Pound to Dollar rate from Wednesday if any weaker-than-expected inflation number forces financial markets to reconsider the expected peak for Bank Rate but Sterling's losses would potentially also be tempered if the recently positive trend in retail sales is seen to persist for the month of June on Friday.

But with a thicket of major long-term technical resistances now obstructing the path higher from around 1.3240 on the charts, the upside for Sterling is likely to be limited in most scenarios during what is set to be a quieter week for U.S. data with only Thursday's release of June retail sales numbers offering the market something to chew on.

"Retail sales have recently displayed a surprising degree of resilience, and we think growth probably continued in June, aided by the return to a normal complement of working days after May's extra public holiday," says Andrew Goodwin, chief UK economist at Oxford Economics.

"Retailers' performance should have been aided by evidence of a further rebound in consumer confidence, which reached an 18-month high on the GfK measure, and the unseasonably warm weather," he adds.