GBP/USD Week Ahead Forecast: A Go Big or Go Home Moment for BoE

- GBP/USD testing cluster of resistances at 1.2867 & 1.2877 on chart

- As more inflation data & torturous monetary policy test loom for BoE

- Wages & UK inflation dynamics pose risk to 'fair value' for GBP/USD

- Bottom of range could fall from 1.2515 to 1.2014 by late September

© Bank of England

The Pound to Dollar exchange rate has rallied to fresh one-year highs but uncertainty over how the Bank of England (BoE) will handle a torturously testing and inescapably difficult policy decision on Thursday means the short-term prospects for Sterling are as moggy and murky as the medium-term outlook is crystal clear.

Recent data covering pay growth and inflation have left the Bank of England Monetary Policy Committee in a bind where it has to decide how far to go to ensure inflation returns to the 2% target rather than becoming self-sustaining at a higher level.

But lofty market expectations mean the Pound could struggle to rise much further whatever the BoE does while the risk is that inflation figures out beforehand on Wednesday provide the market with motivation and appetite for bets against Sterling.

"We think that the MPC will play it safe and opt for a 25bp increase in Bank Rate this week, and will not up-the-ante with its rhetoric on bringing down CPI inflation," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

"The lags in the transmission mechanism and the sensitivity of the economy to further increases in Bank Rate suggest that it won’t tie its hands even more closely to near-term inflation outturns," Tombs and colleagues write in a Monday research briefing.

Above: Pound to Dollar rate shown at daily intervals with Fibonacci retracements of February 2022 decline indicating one possible areas of technical resistance for Sterling. Click for closer inspection.

The consensus is for inflation to fall from 8.7% to 8.4% this week but with the more important core rate remaining at 6.8% after rising from 6.2% previously, which is the sort of thing that could have bearish implications for the value of Sterling.

So far, the BoE has raised rates in increments of 0.25%, 0.5% and 0.75% but with little obvious effect on the homegrown side of the inflation picture where the core inflation rate appeared to be on the cusp of a fresh upturn in the April data released this time last month: Much of its increase in Bank Rate is yet to be reflected in mortgage costs, however.

"Our economists expect to get a 7% core inflation print for May next week. And, even though the April number was boosted in part by indexation, that is no reason to be relaxed about it," writes Michael Cahill, an FX strategist at Goldman Sachs.

"It is instead precisely the sort of dynamics that can cause inflation to become more persistent. And, even outside of these special factors in April, it appears that underlying inflation was still quite firm," he and colleagues write in a Friday research briefing while reiterating a bullish medium-term outlook for the Pound.

A rising core rate reflects an acceleration of inflation within the domestic economy following the commodity price shocks of the last two years and this is a bearish influence on the Pound's theoretical value unless the BoE becomes able and willing to offset it through a higher Bank Rate.

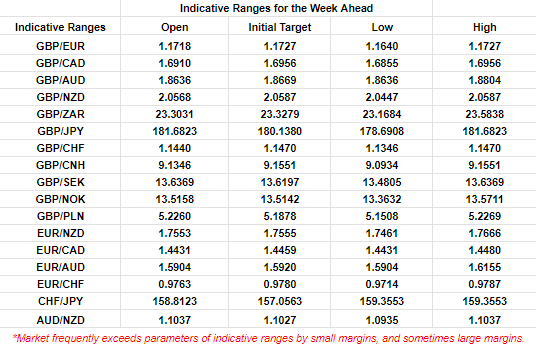

Above: Quantitative model estimates of ranges for this week. Source Pound Sterling Live.

The author's largely uneducated and back-of-an-envelope estimation is that inflation is on course to reduce the lower end of GBP/USD's 'fair value' range from 1.2515 to around 1.2014 by October (currently 1.2515 to 1.2853), which might matter given that Sterling fell out the bottom of this range in last year's inflation acceleration.

"GBP reaction will be determined by both the size of the rate hike and the tone of the policy statement. In a scenario of a high inflation report and a 50bp increase, GBP could jump above 1.30," says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

Economists and market-implied expectations suggest the BoE is likely to raise Bank Rate in increments of 0.25% on Thursday and in the months afterward, taking it from 4.5% to something like 5.75% by year-end, but it's not clear if this would keep the Pound-Dollar rate from falling in the interim.

This might be particularly true if the kind of wage growth revealed by the ONS employment figures out last week ultimately leads to a dreaded 'wage-price-inflation' spiral that leads the market to question whether the BoE will be able to bring inflation back to the 2% target with writing off the economy and financial system.

"Either way, higher realised inflation is likely. Faced with adverse supply shocks and armed mainly with a severely lagging tool in policy rates, policymakers have a near impossible task to fully offset the second-round impacts," says Innes McFee, chief global economist at Oxford Economics, in a research briefing last week.

Above: Pound to Dollar rate shown at weekly intervals with selected moving averages indicating possible areas of technical support and/or resistance for Sterling and spread or gap between 02-year UK and U.S. government bond yields. Click for closer inspection.

"This often prompts the question: is inflation targeting by central banks still appropriate in a world of more common adverse supply shocks? This is understandable during the largest and what is likely to be the most persistent inflation overshoot of the inflation-targeting era," McFee writes in a recent research briefing.

Last Tuesday's wage figures showed permanent pay packets growing more than 7% in the year to May following an almost 10% uplift in the national minimum wage, which could have implications for company profit margins, prices, wage expectations among mortgaged workers further up the income pyramid, and inflation in the months ahead.

There is also the possibility or risk of wage expectations among mortgaged workers rising notably with Bank Rate, given how the rise from 0.1% to 4.5% since December 2021 has added more than £9k in annual interest to the new purchase cost of buying an average-priced home with a 25% loan-to-value mortgage.

This far exceeds the uplift in the £31,200 average wage and is just one among many factors like making Thursday's policy decision torturously difficult for BoE policymakers, though things might become difficult for the Pound-Dollar rate too if there is any further divergence between the UK's two inflation rates beforehand.

This is because the overall and core U.S. inflation rates at 4% and 5.3% respectively and the last week's forecast update from the Federal Reserve (Fed) suggested up to two further increases could lift the Fed Funds rate from 5.25% to 5.75% by year-end, meaning the U.S. Dollar is close to offering investors a 'real yield.'

Above: Pound to Dollar rate shown at monthly intervals with selected moving averages indicating possible areas of technical support and/or resistance for Sterling. Includes spread or gap between 02-year UK and U.S. government bond yields. Click for closer inspection.